- 20 Marks

FRPA – APRIL 2024 – L3 – Q4 – Potco PLC Ratios and Performance Report

Compute six ratios for Potco PLC and write a report assessing its financial performance and position relative to the industry.

Question

Potco PLC is a listed Ghanaian company that produces textile prints for both local and African markets. As at the year ended 31 March 2023, the company made a Gross Profit of GH$12,150. Cost of Sales for the year was GH$77,850 and Operating Profit Before Interest and Tax was GH$47,130. Finance Cost for the year was GH$920 and Tax Charged to Profit or Loss was GH$1,400.

The Inventory Turnover was 3.6 times. Dividend Paid Per Share was GH$0. 36 resulting in a Dividend Yield of 6 %. Current Assets consist of Inventory, Cash and Trade Receivables.

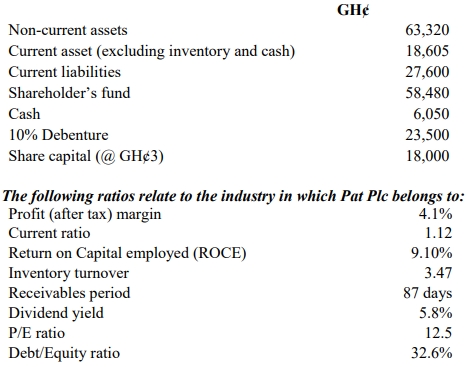

Extracts from the Statement of Financial Position as at 31 March 2023 were as follows: GH$

| Non-Current Assets | 63,320 | | Current Asset (excluding Inventory and Cash) | 18,605 | | Current Liabilities | 27,600 | | Shareholder’s Fund | 58,480 | | Cash | 6,000 | | 10% Debenture | 23,500 | | Share Capital (@ GH63) | 18,000 |

The following ratios relate to the industry in which Potco Plc belongs to:

| Profit (after Tax) Margin | 4.1% | | Current Ratio | 1.12 | | Return on Capital Employed (ROCE) | 10.0% | | Inventory Turnover | 3.47 | | Receivables Period | 87 days | | Dividend Yield | 5.8% | | EPS Ratio | 12.0 | | Debt/Equity Ratio | 32.6% |

You are required to: a) As far as the above information permits, compute the following ratios for Potco PLC. i. Profit (after Tax) Margin ii. Current Ratio iii. Return on Capital Employed (ROCE) iv. Receivables Period v. Price/Earnings Ratio vi. Debt/Equity Ratio (12 marks) b) Using the ratios above, write a report to the Board of Potco PLC to assess the Financial Performance and Financial Position of the entity, relative to its industry. (8 marks) [Total: 20 marks]

Find Related Questions by Tags, levels, etc.