- 20 Marks

FR – Mar 2025 – L2 – Q4 – Financial Statement Analysis

Compute adjusted financial ratios for 2022 and 2023, excluding business unit sale, and assess Ben Garzy LTD’s financial performance post-sale and IT system deployment.

Question

Ben Garzy LTD has recently undertaken significant strategic initiatives, including the sale of a key business unit and the implementation of a new information technology (IT) system aimed at enhancing operational efficiency.

Below are excerpts from the company’s most recent financial statements:

Income Statements for the Year ended 31 December

| 2023 GH¢’000 | 2022 GH¢’000 | |

|---|---|---|

| Revenue | 45,000 | 60,000 |

| Cost of Sales | (27,000) | (36,000) |

| Gross Profit | 18,000 | 24,000 |

| Gain on Sale of Business Unit | 2,000 | – |

| Distribution Expenses | (4,000) | (6,000) |

| Administrative Costs | (5,500) | (3,800) |

| Finance Costs | (600) | (1,200) |

| Profit Before Tax | 9,900 | 13,000 |

| Tax Expense | (2,500) | (3,900) |

| Net Profit | 7,400 | 9,100 |

Additional Information:

- On 1 January 2023, Ben Garzy LTD completed the sale of a business unit for GH¢10 million, resulting in a gain of GH¢2 million. This sale was approved by shareholders, who received a special dividend of GH¢0.50 per share from the proceeds. The business unit’s financial performance included in the 2022 income statement was as follows:

- Revenue: GH¢20,000

- Cost of Sales: GH¢12,000

- Gross Profit: GH¢8,000

- Distribution Costs: GH¢1,500

- Administrative Expenses: GH¢2,000

- Profit Before Interest and Tax: GH¢4,500

- During 2023, Ben Garzy LTD deployed an advanced IT system across its operations to enhance efficiency, reduce costs and improve financial reporting accuracy. This development is expected to influence the company’s financial metrics and operational outcomes.

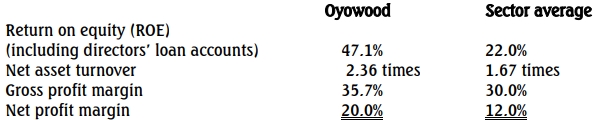

- The following financial ratios were calculated for Ben Garzy LTD for the year ended 31 December 2022:

Gross Profit Margin: 40.0%

Operating Profit Margin: 21.7%

Return on Capital Employed (ROCE): 44.38%

Net Asset Turnover: 2.73 times

Required:

a) Compute the comparable financial ratios for Ben Garzy LTD;

i) For the year ended 31 December 2022, excluding the financial contribution of the sold business unit.

(6 marks)

ii) For the year ended 31 December 2023, excluding the gain on the sale of the business unit.

(6 marks)

b) Assess the financial performance and position of Ben Garzy LTD as at 31 December 2023, taking into consideration the effects of the business unit sale and the implementation of the new IT system on the company’s operational efficiency and overall financial health.

Find Related Questions by Tags, levels, etc.