- 20 Marks

PSAF – Dec 2023 – L2 – Q2a – Preparation and presentation of financial statements for covered entities

Prepare a Statement of Financial Performance and a Statement of Financial Position for Danke State University as at 31 December 2021, along with the accounting policies.

Question

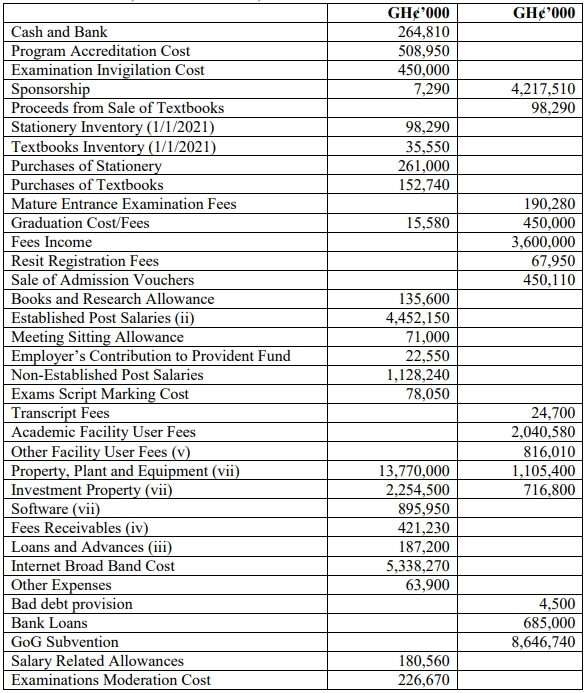

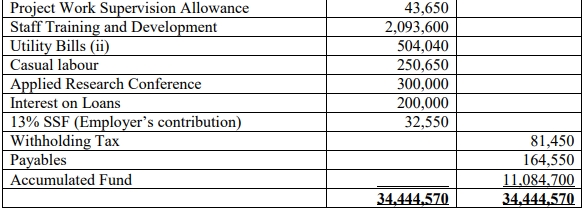

The following Trial Balance relates to Danke State University, a public tertiary educational institution in Ghana, as at 31 December 2021:

Additional Information:

- It is the policy of the University to prepare Financial Statements on an accrual basis in compliance with Public Financial Management Act, 2016 (Act 921), Public Financial Management Regulation 2019 (L.I 2378), and the International Public Sector Accounting Standards (IPSAS).

- Utility Bills outstanding during the year amounted to GH¢15,500,000 whilst that of Established Post Salaries amounted to GH¢120,000,000. These have been omitted from the trial balance.

- Loans and Advances represent Salary Loans given to some Staff of the University. These loans were granted at a concessionary interest rate of 2%. Provision is to be made for interest on Loans and Advances.

- The Fees Receivables represent outstanding school fees for 870 students. Out of this, 90 students were expelled from the school for poor academic performance. As a result, it is very unlikely the University would recover the amount of School Fees owed by the expelled students. This amount constitutes 5% of Fees Receivables. The University from experience also considers that it is very unlikely to recover all the outstanding fees and they intend to set a provision of unrecoverable debt against the remaining school fees at the rate of 7%.

- Included in the Other Facility User Fees is hostel fees amounting to GH¢1,050,000 paid in respect of the 2022/2023 Academic year.

- Inventory of Textbooks as at 31 December 2021 amounted to GH¢ 142,500,000 at cost and having a Net Realisable Value of GH¢165,000,000, but its Replacement Cost is GH¢78,000,000. In addition, stationery inventory as at 31 December 2021 amounted to GH¢17,000,000 and having a Replacement Cost of GH¢18,000,000 with an estimated Net Realisable Value of GH¢25,000,000.

- The University uses the Straight Line method of depreciation for Non-Current Assets. Details of Non-Current Assets and their respective useful lives are stated below:

| Non-Current Assets | Useful Life |

|---|---|

| Property, Plant, and Machinery | 20 years |

| Investment Property | 10 years |

| Software | 10 years |

Required: a) Prepare a Statement of Financial Performance for Danke State University for the year ended 31 December 2021. (8 marks)

b) Prepare a Statement of Financial Position for Danke State University as at 31 December 2021. (8 marks)

c) State FOUR (4) accounting policies applied in preparing the financial statement. (4 marks)

Find Related Questions by Tags, levels, etc.

Report an error