- 3 Marks

CR – May 2018 – L3 – Q4b – Presentation of financial statements

Explain three problems that arise when using ratios to compare the performance of two companies.

Question

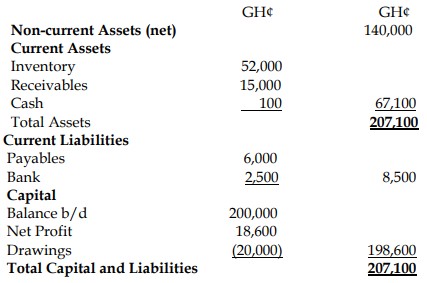

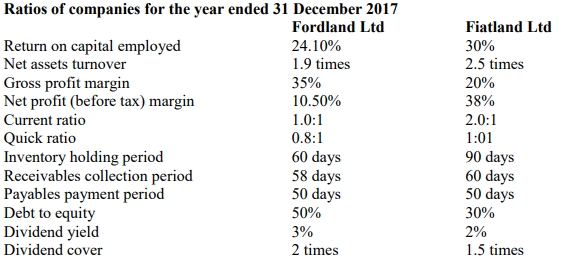

Fordland Ltd and Fiatland Ltd are two companies in the garment industry. The following are financial ratios computed by the Research Department of ICAG as part of analyzing companies’ performance industry by industry.

Required:

Explain THREE problems that are inherent when ratios are used to compare the performance of two companies, even in the same industry.

Find Related Questions by Tags, levels, etc.

Report an error