- 20 Marks

FM – May 2019 – L3 – Q3 – Corporate Restructuring

Evaluate three strategic proposals for Pinko Ltd., including immediate liquidation, a take-over offer, and reorganization, to determine Able Bank's financial outcome.

Question

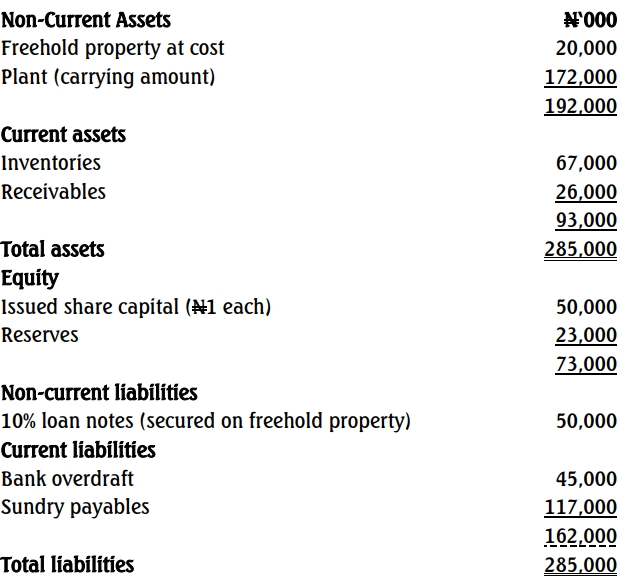

ble Bank, on April 24, 2019, received the following statement of financial position prepared for its customers, Pinko Limited (PL):

Statement of financial position as at April 20, 2019

PL is a long-established company which traded profitably until a few years ago. Following the expiration of exclusive patent rights on a particularly profitable product line, results declined dramatically. Over the last twelve months, the company’s cash flow problems have steadily increased. The overdraft facility at present stands at N45m and carries a second charge on the company’s freehold property.

A meeting has been arranged to consider the company’s future. The above statement of financial position will be presented at the meeting and the following proposals will be discussed:

Proposals:

(a) Immediate liquidation of the company

In these circumstances, it is estimated that the freehold property would realize N65,000,000, the plant N21,000,000, the inventory N40,000,000, and the receivables would pay up in full. Preferential payables, included in the statement of financial position figure for payables, amounted to N27,000,000.

(b) Tayo Limited (TL) has made an offer to take over the entire business activities of PL

Under the terms of the offer, Able Bank would receive 80% of the balance due, but repayment would not be made until exactly one year from the date of the creditors’ meeting. No further interest would be considered to accrue on the balance due to Able Bank (AB) during the twelve-month period.

(c) Reorganization and capital reconstruction

The management of PL is planning a reorganization of the company’s activities which will restore profitability to reasonable levels almost immediately. The reorganization will be linked with a capital reconstruction scheme. Under this scheme:

- The existing shareholders will be asked to accept two ₦1 shares in exchange for every five shares currently held.

- The bank will be asked to accept 10,000,000 ₦1 shares as consideration for one-half of the present overdraft.

- If this proposal is acceptable to creditors, the shareholders have indicated their willingness to take up a further 30,000,000 ₦1 shares for cash, and the balance remaining outstanding to the bank would be repaid from the proceeds of this issue.

- The directors are confident that if this proposal is put into effect, profits of ₦40,500,000 per annum will be earned for the foreseeable future, of which two-thirds will be paid out as dividends and the remainder reinvested.

Notes:

- Assume that the bank earns 15% per annum on all its lending and that the amounts in the statement of financial position include interest that accrued to date.

- Assume, for convenience, that any adopted proposal would be implemented immediately with payments received immediately unless otherwise stated.

- Ignore expenses of realization and liquidation, and assume that no changes have occurred between April 20 and April 24, 2019.

Required:

a. Calculate the amounts which Able Bank would receive under each of the three proposals. (10 Marks)

b. Examine the relative financial merits of the proposals from the viewpoint of Able Bank. (10 Marks)

(Total: 20 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Capital Reconstruction, Debt Recovery, Liquidation

- Level: Level 3

- Topic: Corporate Restructuring