- 20 Marks

PSAF – Mar 2025 – L2 – Q1- Preparation and presentation of financial statements for covered entities

Prepare the Statement of Financial Performance for Hamile Teaching Hospital for 2023 per IPSAS and related regulations.

Question

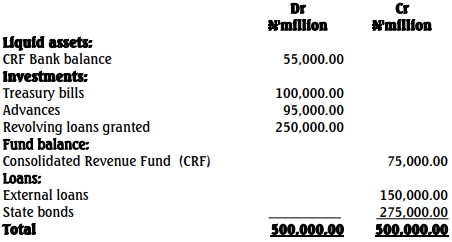

The Trial Balance below relates to Hamile Teaching Hospital, a public hospital.

| Trial Balance for the year ended 31 December 2023 | ||

|---|---|---|

| Debit | Credit | |

| GHc’000 | GHc’000 | |

| Government subvention | 100,750 | |

| Out-patient services fees | 35,000 | |

| In-patient services fees | 40,000 | |

| Development Partner grants (ii) | 16,000 | |

| Established position salaries | 62,000 | |

| Casual Labour | 5,600 | |

| Contract appointment (local and foreign) | 1,400 | |

| Limited engagements | 200 | |

| Rent (iii) | 500 | 150 |

| Insurance | 340 | |

| Consultancy services | 120 | |

| Conferences, workshops and training | 4,500 | |

| Purchase of drugs | 60,000 | |

| Purchase of medical consumables | 80,000 | |

| Office expenses | 20,000 | |

| Repairs and maintenance | 6,000 | |

| Interest on loan | 10,000 | |

| Pharmacy sales | 180,000 | |

| Diagnostic | 85,000 | |

| Mortuary Services | 9,400 | |

| Cafeteria and Canteen | 4,650 | |

| Extension services | 14,500 | |

| Furniture and office equipment (iv) | 200,000 | 40,000 |

| Medical equipment & accessories (iv & v) | 420,000 | 120,000 |

| Motor vehicles (iv) | 120,000 | 20,000 |

| Land and buildings (iv) | 300,000 | 70,000 |

| Bank and Cash | 30,000 | |

| Receivable from National Health Insurance Scheme (vi) | 65,000 | |

| Receivable from patients | 15,000 | |

| Payables | 26,000 | |

| Loan from foreign Institution (2028) (vii) | 350,000 | |

| Inventory of drugs | 22,000 | |

| Inventory of medical consumables | 12,000 | |

| Accumulated Fund | 336,210 | |

| Other expenses | 13,000 | |

| 1,447,660 | 1,447,660 |

Additional Information:

i) The hospital prepares its financial statements in accordance with the International Public Sector Accounting Standards (IPSAS), the Public Financial Management Act 2016, (Act 921), the Public Financial Management Regulation 2019, L.I 2378, and the current Chart of Accounts of the Government of Ghana.

ii) The Development Partner grants received from the Health Care Fund, an international organization that provides free medical care to the rural poor and vulnerable individuals, are typically unconditional. However, 40% of this year’s grant is subject to certain conditions, which had not been met as of December 31, 2023.

iii) Rent received in advance during the year amounted to GH¢20,000 while rent owed by the hospital for the year amounts to GH¢300,000.

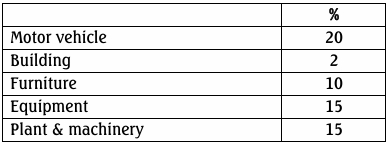

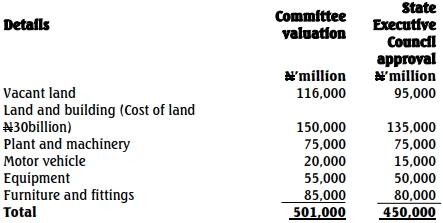

iv) The hospital charges consumption of fixed assets on straight line basis as follows

| Non-current Assets | Estimated Useful Life |

|---|---|

| Furniture and office equipment | 5 years |

| Medical equipment and accessories | 4 years |

| Motor vehicles | 5 years |

| Buildings | 10 years |

Land constitutes 30% of the amount of land and building shown in the trial balance.

v) A medical equipment valued at GH¢20,000,000 which is included in the medical equipment and accessories listed on the trial balance, was completely damaged due to consistent power fluctuations. The value of this equipment should be written off.

vi) The hospital submitted a claim of GH¢11,000,000 to the National Health Insurance Scheme for services provided to patients in the last quarter of 2023, but the payment has not yet been received. This transaction has not yet been reflected in the trial balance.

vii) The hospital took a loan of $100,000,000 from Health World Bank on January 1, 2023, when the exchange rate was $1 to GH¢3.50. The exchange rate on 31 December 2023 is $1 to GH¢5.

viii) The inventories on 31 December 2023 were as follows:

| Inventory type | Cost | Net Realizable Value | Current Replacement |

|---|---|---|---|

| GHc’000 | GHc’000 | GHc’000 | |

| Drugs | 15,000 | 16,000 | 14,000 |

| Medical consumables | 10,000 | 11,000 | 9,000 |

Required:

Prepare for Hamile Teaching Hospital:

a) Statement of Financial Performance for the year ended 31 December 2023.

b) Statement of Financial Position as of 31 December 2023.

c) Disclosure notes to the financial statements.

Find Related Questions by Tags, levels, etc.