- 20 Marks

FR – Mar 2025 – L2 – Q3 – Preparation of Financial Statements

Prepare Halidu LTD's financial statements for 2024, including comprehensive income, changes in equity, and financial position per IFRS.

Question

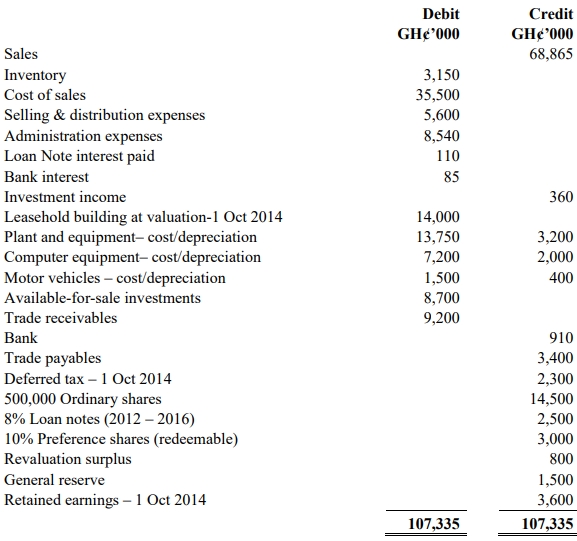

The following trial balance relates to Halidu LTD (Halidu) at 30 June 2024:

| GH¢’000 | GH¢’000 | |

|---|---|---|

| Revenue | 3,120,000 | |

| Cost of sales | 1,757,400 | |

| Distribution costs | 45,600 | |

| Administration expenses | 118,800 | |

| Loan interest paid | 28,800 | |

| Property – cost | 1,200,000 | |

| Property – depreciation at 1 July 2023 | 225,000 | |

| Plant and equipment – cost | 1,011,600 | |

| Plant and equipment – depreciation at 1 July 2023 | 291,600 | |

| Licence – cost | 240,000 | |

| Licence – amortisation at 1 July 2023 | 96,000 | |

| Trade receivables | 259,200 | |

| Inventory – 30 June 2024 | 112,800 | |

| Bank | 78,000 | |

| Trade payables | 211,200 | |

| Share capital (GH¢0.25 each) | 420,000 | |

| Revaluation surplus | 78,000 | |

| 12% loan note (issued 1 July 2023) | 240,000 | |

| Taxation | 12,000 | |

| Retained earnings at 1 July 2023 | 68,700 | |

| 4,774,200 | 4,774,200 |

The following notes are relevant:

i) Halidu made credit sales for GH¢196 million on a sale or return basis and this is currently included in revenue in the trial balance. At 30 June 2024 customers who had not paid for the goods, had the right to return GH¢62.4 million of them. Halidu applied a mark-up on cost of 30% on all these sales. In the past Halidu’s customers have sometimes returned goods under this type of agreement.

ii) On 1 July 2023, Halidu revalued its property to GH¢1,440 million, of which GH¢360 million relates to the land. This property was acquired 10 years ago at a cost of GH¢1,200 million which included GH¢300 million for the land. The building had an estimated life of 40 years when it was acquired and this has not changed as a result of the revaluation. Depreciation is charged on a straight line basis. The revaluation has not yet been recorded in the books. Halidu has a policy of transferring any excess depreciation to retained earnings.

iii) During the year, Halidu sold some plant that cost GH¢120 million on 1 December 2020. The proceeds of this sale were GH¢72 million and these have been credited to cost of sales. No other entries have been made relating to the disposal. Plant and equipment is to be depreciated on the reducing balance basis at a rate of 20% per annum. Halidu charges a full year’s depreciation in the year of acquisition and none in the year of disposal.

iv) The licence is being amortised on the straight line basis at a rate of 20% per annum. All depreciation and amortisation is to be charged to cost of sales.

v) The directors have estimated the provision for income tax for the year ended 30 June 2024 at GH¢76.2 million. The balance of taxation in the trial balance relates to over/under provision of tax in the previous year. The only deferred tax consequence relates to those mentioned in note (ii) above. The company pays tax on profit at the rate of 25%.

vi) Halidu intends to dispose of a major line of its business operations in the course of the year. At the date the held for sale criteria were met, the carrying amount of the assets and liabilities comprising the line of business were:

| GH¢’000 | |

|---|---|

| Plant and equipment | 138,000 |

| Trade receivables | 9,000 |

| Trade payables | 7,000 |

It is anticipated that Halidu will realise GH¢135 million for the business. No entries have yet been made in respect of this information.

Required:

Prepare and present a statement of comprehensive income, a statement of changes in equity and a statement of financial position at 30 June 2024 in a form suitable for presentation to the shareholders and in accordance with the requirements of International Financial Reporting Standards (IFRS).

Find Related Questions by Tags, levels, etc.