- 20 Marks

FRPA – APRIL 2023 – L3 – Q4 – Ratio Analysis and Performance Report for Loan Assessment

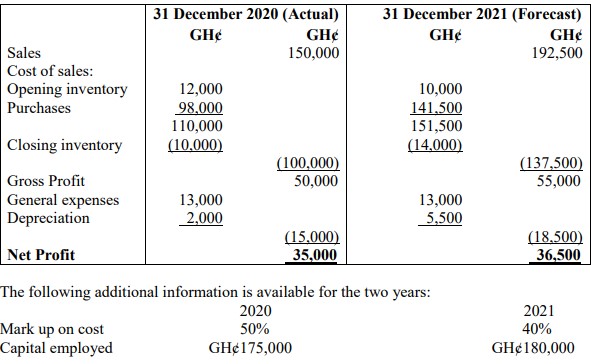

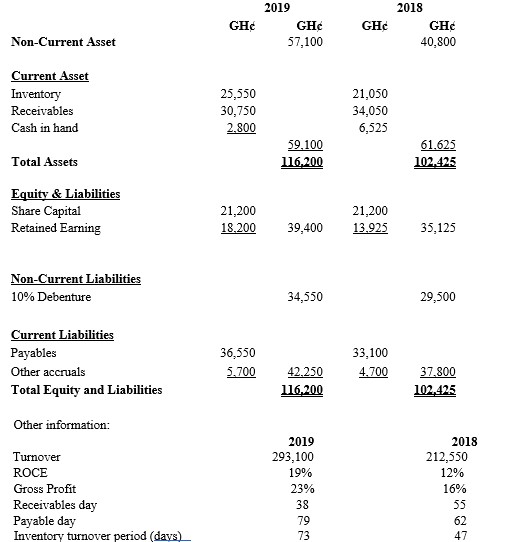

Compute five specified ratios for 2021 and 2020 using provided financial statements and write a report analyzing the company's performance comparing the two years.

Question

As the Credit Officer for TCB Bank, Alpha Technology Solutions Limited has submitted its financial statements as part of the process to secure a loan of GHS 5million. You are required to:

i. Compute the following ratios for 2021 and 2020.

• Gross Profit Margin

• Return on Capital Employed

• Acid Test Ratio

• Payable period

• Debt to equity

ii. Write a report to the Head of Credit analyzing the performance of the company for the 2020 and 2021. Your report should explain the ratios and analyze them in relation to the previous year.

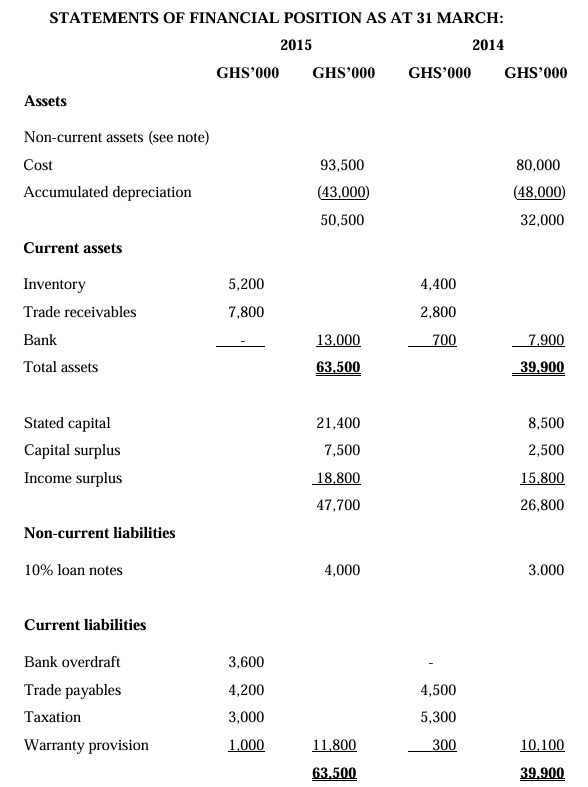

ALPHA TECHNOLOGY SOLUTIONS LIMITED STATEMENT OF FINANCIAL POSITION AS AT 31ST DECEMBER 2021

| 2021 (GHS) | 2020 (GHS) | |

|---|---|---|

| NON-CURRENT ASSETS | ||

| Property, Plant and Equipment | 438,631 | 428,210 |

| Fixed Deposit | – | 400,000 |

| Total Non-Current Assets | 438,631 | 828,210 |

| CURRENT ASSETS | ||

| Inventories | 2,284,401 | 2,409,650 |

| Accounts Receivable | 2,712,529 | 1,368,010 |

| Cash on Hand and Bank | 642,951 | 2,177,519 |

| Total Current Assets | 5,639,881 | 5,955,179 |

| TOTAL ASSETS | 6,078,512 | 6,783,389 |

| 2021 (GHS) | 2020 (GHS) | |

|---|---|---|

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||

| NON-CURRENT LIABILITIES | ||

| Loans | 115,484 | 115,484 |

| Deferred Tax | 18,127 | 22,110 |

| Total Non-Current Liabilities | 133,611 | 137,594 |

| CURRENT LIABILITIES | ||

| Accounts Payable | 1,843,574 | 2,869,489 |

| Current Tax | 30,512 | 129,464 |

| Total Current Liabilities | 1,874,086 | 2,998,953 |

| Total Liabilities | 2,007,697 | 3,136,547 |

| SHAREHOLDERS’ EQUITY | ||

| Stated Capital | 1,240,000 | 1,240,000 |

| Retained Earnings | 2,830,815 | 2,406,842 |

| Total Shareholders’ Equity | 4,070,815 | 3,646,842 |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | 6,078,512 | 6,783,389 |

ALPHA TECHNOLOGY SOLUTIONS LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31ST DECEMBER 2021

| 2021 (GHS) | 2020 (GHS) | |

|---|---|---|

| Revenue | 11,180,208 | 12,957,649 |

| Direct Cost | (7,446,676) | (9,703,650) |

| Gross Profit | 3,733,532 | 3,253,999 |

| Other Income | – | 23,436 |

| Administrative Expenses | (3,168,234) | (2,483,480) |

| Operating Profit | 565,298 | 793,955 |

| Income Tax Expense | (141,325) | (198,489) |

| Profit/(Loss) After Taxation | 423,973 | 595,466 |

Find Related Questions by Tags, levels, etc.