- 20 Marks

FR – Mar 2025 – L2 – Q1 – Consolidated Financial Statements

Prepare consolidated financial statements for Aba LTD, including adjustments for acquisition, intra-group sales, government grants, and impairment.

Question

Aba LTD (Aba), a technology company, acquired 60% of the share capital of Boafo LTD (Boafo) on 1 January 2024. There are two elements to the purchase consideration – a share exchange transaction of three shares in Aba for every five shares acquired in Boafo, and a cash consideration of GH¢20.4 million on the date of acquisition. The share price of Aba at the acquisition date was GH¢1.2 per share. Only the cash consideration of GH¢20.4 million has been recorded in the books by Aba. The market price of Boafo’s shares just before the acquisition was GH¢1.015.

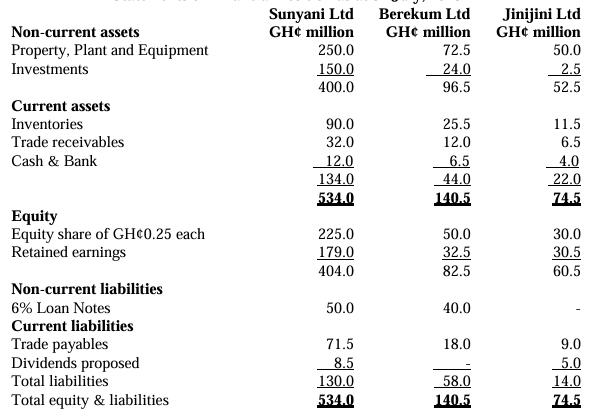

The summarised draft Financial Statements of both companies as at 31 December, 2024 are as follows:

Statement of Profit or Loss for the year ended 31 December 2024

| Aba (GH¢’000) | Boafo (GH¢’000) | |

|---|---|---|

| Sales revenue | 200,500 | 50,500 |

| Cost of sales | (110,000) | (24,000) |

| Gross profit | 90,500 | 26,500 |

| Admin expenses | (50,300) | (15,700) |

| Finance cost | (1,200) | – |

| Profit before tax | 39,000 | 10,800 |

| Income tax expense | (5,450) | (2,200) |

| Profit for the year | 33,550 | 8,600 |

Statement of Financial Position as at 31 December 2024

| Aba (GH¢’000) | Boafo (GH¢’000) | |

|---|---|---|

| Non-current assets: | ||

| Property, plant & equipment | 40,500 | 35,000 |

| Investment in Boafo | 20,400 | – |

| 60,900 | 35,000 | |

| Current assets | ||

| Inventories | 10,500 | 12,000 |

| Trade and other receivables | 20,000 | 2,500 |

| Cash and cash equivalents | 12,500 | 550 |

| 43,000 | 15,050 | |

| 103,900 | 50,050 | |

| Equity | ||

| Share capital (GH¢1 per ordinary shares) | 50,000 | 35,000 |

| Retained earnings as at 31 December 2023 | 10,000 | 5,000 |

| Retained earnings for year ended 31 December 2024 | 33,550 | 8,600 |

| 93,550 | 48,600 | |

| Non-current liabilities | ||

| Long-term borrowings | 5,600 | 800 |

| Current liabilities | ||

| Trade and other payables | 4,750 | 650 |

| 10,350 | 1,450 | |

| 103,900 | 50,050 |

The following information is relevant:

i) The fair values of Boafo’s net assets were equal to their carrying amounts at the date of acquisition with the exception of a plant which was valued at GH¢4 million below its carrying amount. The remaining useful life for this plant is four (4) years and this period has not changed as a result of the acquisition. Depreciation of plant is on a straight-line basis and charged to cost of sales. The fair value of the plant has not been incorporated in the financial statements.

ii) In the post-acquisition period, Aba sold goods to Boafo at a total value of GH¢4.6 million. These goods cost Aba GH¢3 million. During the year, Boafo had sold GH¢2.5 million out of the GH¢4.6 million goods from Aba for GH¢3.2 million.

iii) On the first of July 2024, Aba received a grant from the Government in the form of a building. The value of this building was GH¢5 million with a useful life of 20 years. The Accountant of Aba who is not a Chartered Accountant credited the value of the building to revenue. It has been advised that the recognition of this transaction should be done in line with the provisions of IAS 20: Accounting for Government Grants and Disclosure of Government Assistance. It is the group’s policy to recognise grants relating to assets as deferred income.

iv) Aba’s policy is to value non-controlling interest at fair value at the date of acquisition. For this purpose, Boafo’s share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest.

v) Goodwill was reviewed for impairment at the end of the reporting period and had suffered an impairment loss equivalent to 10% of goodwill at acquisition which is to be treated as an operating expense.

Required:

Prepare for Aba LTD a Consolidated Statement of Profit or Loss for the year ended 31 December 2024 and a Consolidated Statement of Financial Position as at 31 December 2024.

Find Related Questions by Tags, levels, etc.

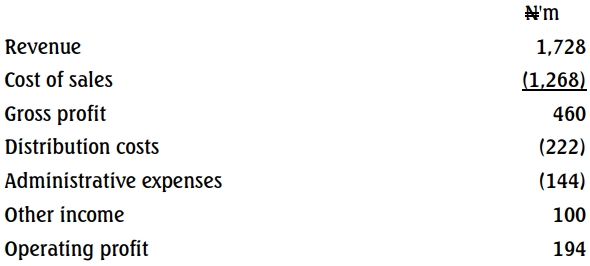

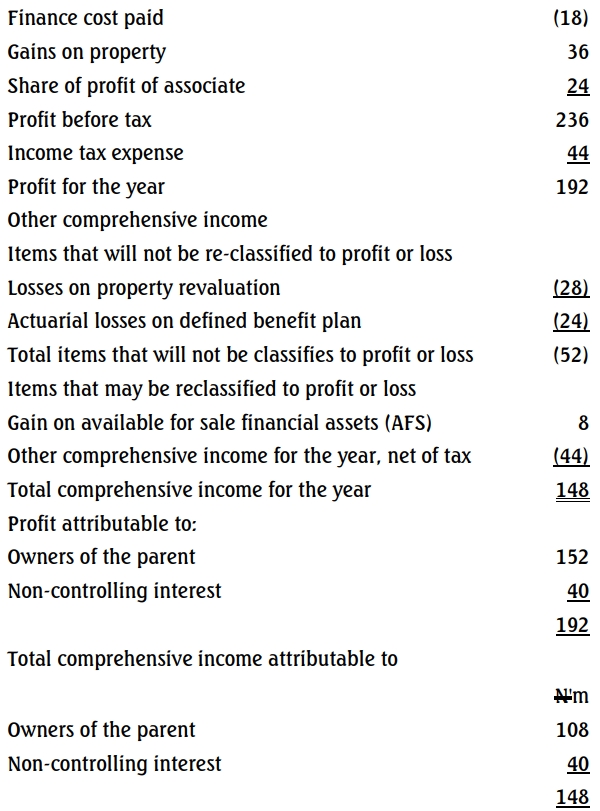

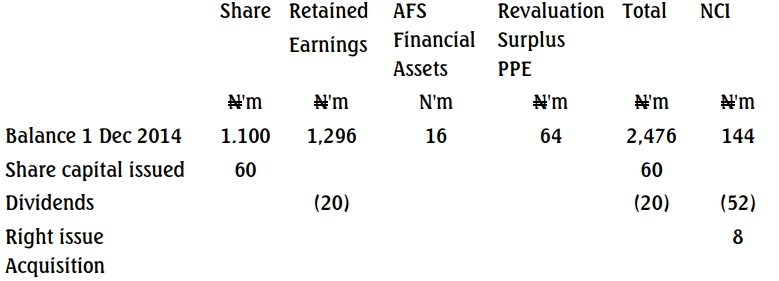

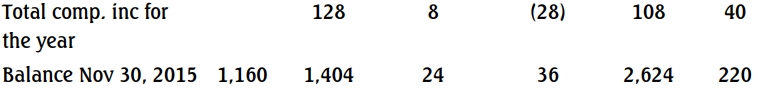

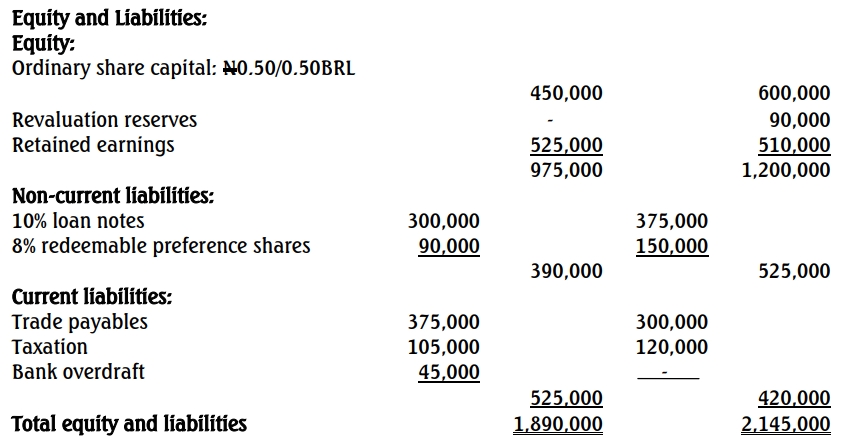

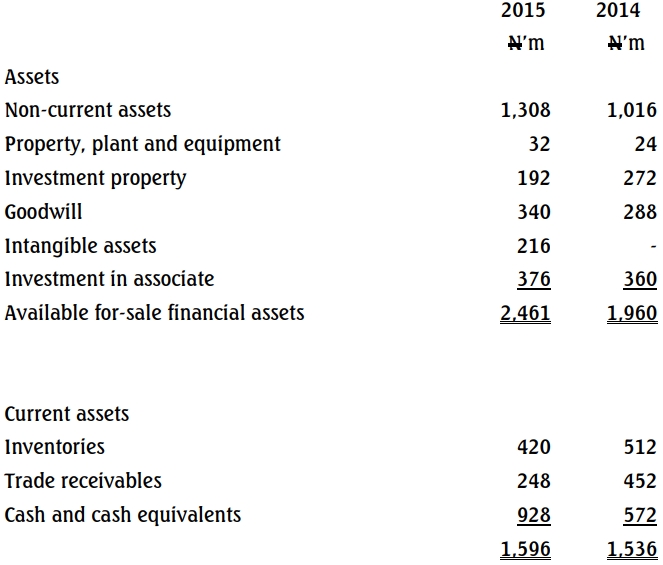

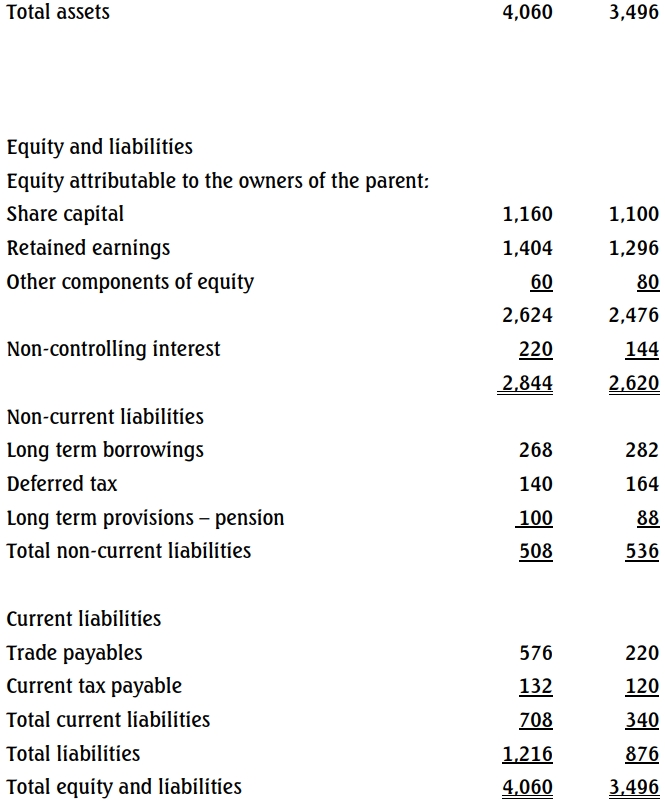

Joy-land Group: Statement of comprehensive income for the year ended November 30, 2015.

Joy-land Group: Statement of comprehensive income for the year ended November 30, 2015.