- 20 Marks

FRPA – APRIL 2023 – L3 – Q1 – Financial Statements Preparation, Conceptual Framework, and Intangible Assets

Prepare the statement of profit or loss and other comprehensive income and the statement of financial position for ANG Ltd based on the given trial balance and additional information; explain the objective of general-purpose financial reporting and the terms relevance and faithful representation; define intangible assets, explain recognition criteria, and state disclosure requirements under IAS 38.

Question

A

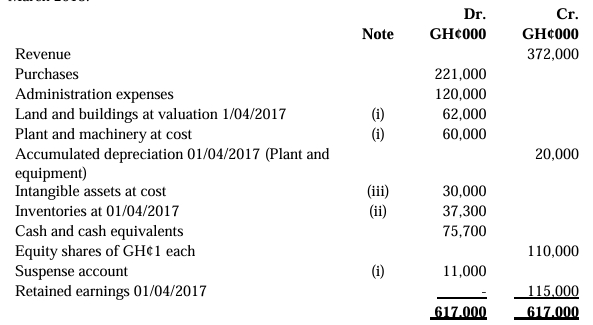

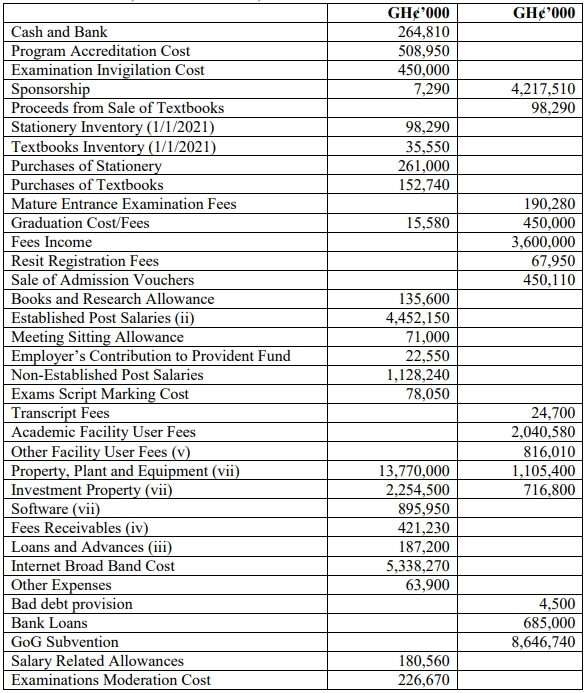

The following is the trial balance of ANG Ltd, a trading company, as of 30 September 2022:

| Debit | Credit |

|---|---|

| GH¢’000 | GH¢’000 |

| Sales | |

| Inventory | 3,150 |

| Cost of sales | 35,500 |

| Selling & distribution expenses | 5,600 |

| Administration expenses | 8,540 |

| Loan Note interest paid | 110 |

| Bank interest | 85 |

| Investment income | |

| Leasehold building at valuation – 1 Oct 2021 | 14,000 |

| Plant and equipment – cost/depreciation | 13,750 |

| Computer equipment – cost/depreciation | 7,200 |

| Motor vehicles – cost/depreciation | 1,500 |

| Trade receivables | 17,900 |

| Bank | |

| Trade payables | |

| 500,000 Ordinary shares | |

| 8% Loan notes (2019 – 2023) | |

| Revaluation surplus | |

| General reserve | |

| Retained earnings – 1 Oct 2021 | |

| 107,335 | 107,335 |

The following additional information is made available:

i. The company paid ordinary dividends of GH¢2.2 per share on 31 January 2022 and GH¢2.6 per share on 30 June 2022. The dividend payments are included in administrative expenses in the trial balance.

ii. Provision is to be made for a full year’s interest on the Loan notes.

iii. non-current assets:

• Depreciation of Property, plant and equipment is to be provided on the following bases:

- Plant and equipment – 10% on cost

- Computer equipment – 25% on cost

- Motor vehicles – 20% on reducing balance.

• No depreciation has yet been charged on any non-current asset for the year ended 30 September 2022.

• ANG Ltd revalues its buildings at the end of each accounting year. On 30 September 2022, the relevant value to be incorporated into the financial statements is GH¢14,100,000.

• The building’s remaining life at the beginning of the current year (1 October 2021) was 25 years. ANG Ltd does not make an annual transfer from the revaluation reserve to retained earnings in respect of the realization of the revaluation surplus. Ignore deferred tax on the revaluation surplus.

iv. Estimated corporate income tax payable on the profit for the year is GH¢3,500,000.

You are required to:

Prepare the following financial statements of ANG Ltd. for publication in accordance with International Financial Reporting Standards (IFRS):

a. Statement of profit or loss and other comprehensive income for the year ended 30 September 2022 and.

b. Statement of financial position as of 30 September 2022.

c. Show clearly all relevant workings.

B

I. What is the objective of general-purpose financial reporting?

II. The IASB’s Conceptual Framework for Financial Reporting states that “If financial information is to be useful, it must be relevant and faithfully represent what it purports to represent.” Explain the terms Relevance and Faithfully Representation.

C

The accounting treatment of intangible assets is prescribed by IAS 38 Intangible Assets. You are required to:

i. Define intangible asset under IAS 38 Intangible Assets.

ii. Explain the recognition criteria for intangible assets.

iii. State 5 disclosure requirements of Intangible Assets under IAS 38.

Find Related Questions by Tags, levels, etc.