- 8 Marks

PSAF – Nov 2024 – L2 – Q4a – Financial Ratio Analysis

Compute financial ratios for Ghana Wind Farms LTD to analyze performance trends.

Question

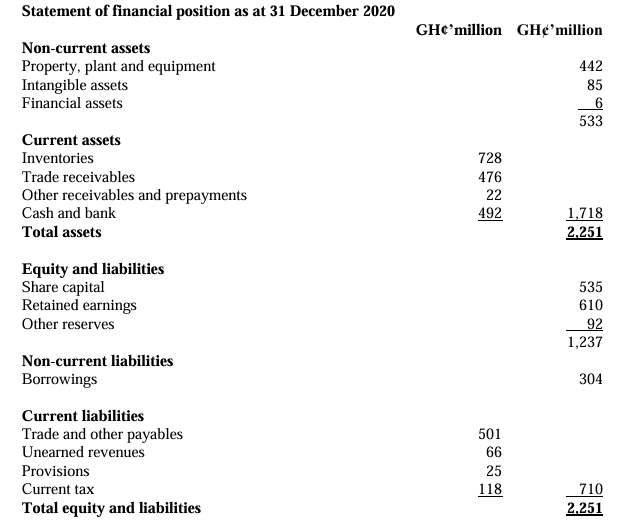

Ghana Wind Farms LTD, a State-Owned Enterprise (SOE), has appointed a new Board of Directors in January 2023. The new Board, after settling for a year, is interested in assessing their performance for the year 2023 against the performance of the previous Board in the year 2022 through ratio analysis. Below is the financial statement of Ghana Wind Farms LTD for the two years.

Ghana Wind Farms LTD

Statement of Profit or Loss for the Year Ended 31 December 2023

| 2023 (GH¢) | 2022 (GH¢) | |

|---|---|---|

| Revenue | 9,860,000 | 6,218,000 |

| Direct Cost | (5,905,000) | (5,822,000) |

| Gross Profit | 3,955,000 | 396,000 |

| Distribution Costs | (297,000) | (264,000) |

| Administrative Expenses | (505,000) | (455,000) |

| Other Income | 236,000 | 13,000 |

| Other Gains | – | 1,482,000 |

| Operating Profit | 3,389,000 | 1,172,000 |

| Finance Cost | (1,000,000) | (334,000) |

| Profit Before Tax Expense | 2,389,000 | 838,000 |

| Tax Expense | (500,000) | (144,000) |

| Profit After Tax | 1,889,000 | 694,000 |

Ghana Wind Farms LTD

Statement of Financial Position as at 31 December 2023

| 2023 (GH¢) | 2022 (GH¢) | |

|---|---|---|

| ASSETS | ||

| Non-Current Assets | ||

| Property, Plant & Equipment | 17,000,000 | 15,000,000 |

| Investment | 5,000 | 2,000 |

| Advances & Loans | – | 30,000 |

| Total Non-Current Assets | 17,005,000 | 15,032,000 |

| Current Assets | ||

| Inventories | 687,000 | 546,000 |

| Trade and Other Receivables | 2,829,000 | 1,978,000 |

| Prepayments | 87,000 | 42,000 |

| Cash and Cash Equivalents | 383,000 | 434,000 |

| Total Current Assets | 3,986,000 | 3,000,000 |

| TOTAL ASSETS | 20,991,000 | 18,032,000 |

| EQUITY & LIABILITIES | ||

| Equity | ||

| Government Equity | 8,000 | 8,000 |

| Other Government Equity | 613,000 | 306,000 |

| Capital Surplus | 8,471,000 | 7,599,000 |

| Income Surplus | (1,434,000) | 478,000 |

| Total Equity | 7,970,000 | 8,697,000 |

| Non-Current Liabilities | ||

| Deferred Credit | 6,692,000 | 670,000 |

| Deferred Tax Liabilities | 2,498,000 | 2,572,000 |

| Borrowings (Due After One Year) | 1,297,000 | 950,000 |

| Total Non-Current Liabilities | 10,487,000 | 4,192,000 |

| Current Liabilities | ||

| Bank Overdraft | 166,000 | 180,000 |

| Provision for Company Tax | 109,000 | 109,000 |

| Trade and Other Payables | 1,820,000 | 4,516,000 |

| Borrowings (Due Within One Year) | 439,000 | 338,000 |

| Total Current Liabilities | 2,534,000 | 5,143,000 |

| Total Liabilities | 13,021,000 | 9,335,000 |

| TOTAL EQUITY AND LIABILITIES | 20,991,000 | 18,032,000 |

Required:

a) Compute the following ratios:

i) Current Ratio

ii) Quick Ratio

iii) Inventory Turnover (Days)

iv) Trade Receivable Collection Period (Days)

v) Trade Payables Period (Days)

vi) Working Capital Cycle

vii) Interest Cover Ratio

viii) Total Debt – Total Asset Ratio

Find Related Questions by Tags, levels, etc.

- Tags: Efficiency, Financial Performance, Liquidity, Ratio Analysis, Solvency

- Level: Level 2

- Topic: Financial Statements Discussion and Analysis

- Series: Nov 2024

Report an error