- 9 Marks

AT – Nov 2024 – L3 – Q2b – Tax Implications of 100% Acquisition in Mining Operations

Explain the tax implications of a 100% acquisition and compute the gains from the acquisition.

Question

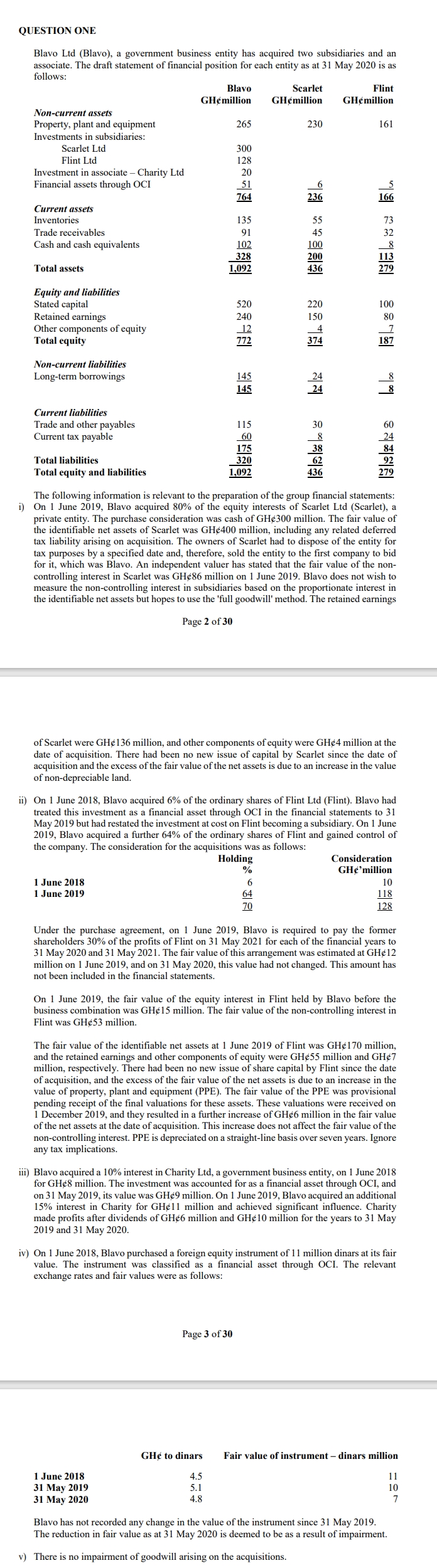

Tongo LTD (Tongo) is a mining company operating in the Upper East Region of Ghana. The following relates to the operations of Tongo for the 2023 year of assessment:

| Description | GH¢ |

|---|---|

| Revenue (Gross) | 200,000,000 |

| Cost of Operations | 80,000,000 |

| Margin/Profit | 120,000,000 |

Additional Information:

- Tempane Mines LTD acquired 100% interest in Tongo for a consideration of GH¢310,000,000 at the end of 2023.

- The cost of assets acquired at their respective acquisition dates are as follows:

| Year | Cost of Assets (GH¢) |

|---|---|

| 2020 | 100,000,000 |

| 2021 | 75,000,000 |

| 2023 | 50,000,000 |

Required:

i) Explain the tax implication of the 100% acquisition.

ii) Compute the gains from the above acquisition and determine how the gains should be treated.

Find Related Questions by Tags, levels, etc.

- Tags: Acquisition, Capital Allowance, Corporate Restructuring, Deferred Tax, Mining Tax, Tax implications

- Level: Level 3

- Topic: Minerals and mining

- Series: Nov 2024