- 20 Marks

STP – Feb 2018 – L2 – Q4- Taxation and Operating Strategies

Calculate Honson Plc's tax liability for Kumasi/Accra, advise on Nsawam, and discuss non-tax factors for facility location.

Question

Honson Pic, a UK-based manufacturing company, is planning to build a new processing facility in Ghana. The Chief Executive Officer in a meeting with Management needs to decide whether to cite the facility in Accra or in Kumasi. Market intelligence has no preference for citing the facility either in Kumasi or Accra since information gathered indicate that business activities would largely be same in Kumasi and Accra for the next 10 years.

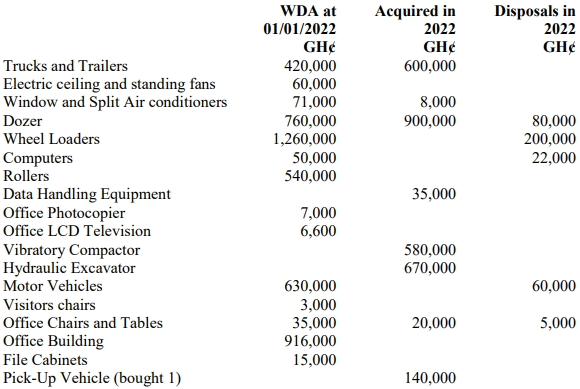

The following forecast information is relevant for the decision-making process being considered by management.

| Kumasi | Accra | GH¢ | GH¢ |

|---|

Required: i. Calculate Hamson Plc’s income tax liability for each proposed location for the first year. ii. Would you advise Hamson Plc to consider citing the facility in Nsawam, taking into consideration the close proximity of Nsawam to Accra? iii. Discuss three (3) non-tax factors that Hamson UK Plc may consider in the decision-making process to locate the facility either in Kumasi, Accra or elsewhere in the country.

b). With reference to the Income Tax Act, 2015 (Act 896) explain the following: i. Private Ruling issued by the Commissioner-General: (2 marks) ii. Conditions under which a Private Ruling will be binding on the Commissioner-General and on the person to whom the Private Ruling is issued.

Find Related Questions by Tags, levels, etc.

- Tags: Corporate Taxation, Income Tax, Location Decision, Non-Tax Factors, Tax computation, Tax Incentives

- Level: Level 2

- Topic: Taxation and Operating Strategies in Business

- Series: FEBRUARY 2018