- 20 Marks

ATP – Aug 2019 – L2 – Q3 – Corporate Tax and Penalties

Compute Yentua Limited’s 2018 tax liabilities, including penalties, using financial statement data.

Question

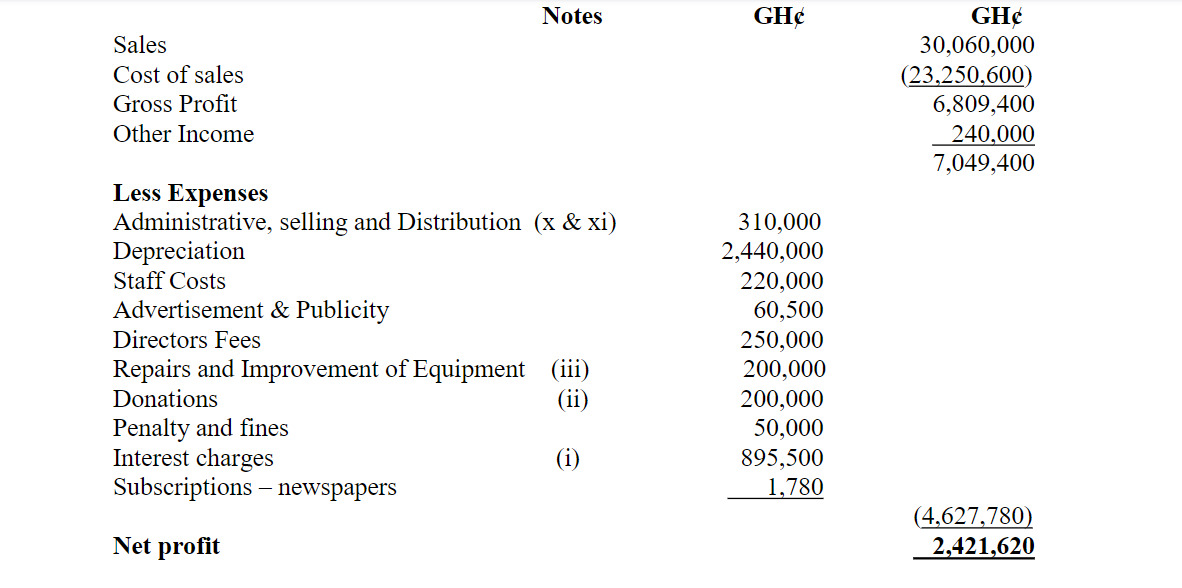

Yentua Limited is a company registered in Ghana under the Companies Act 1963, Act 179 on 15th September 2017. It started operations on 1st October, 2017. The company buys metal scraps both from internal and external sources and sells to the iron rod manufacturers in Tema. The company was not registered with the Ghana Revenue Authority and therefore has never submitted any tax returns on its operations. The activities of the company came to light when a team of Revenue Officers from the Enforcement unit of the Ghana Revenue Authority met the Managing Director and his staff in full operation. The team educated the Managing Director and his management team on importance of payment of taxes and registering with the Ghana Revenue Authority and submitting the tax returns to the Authorities regularly. The Managing Director then presented Tax Credit Certificates (TCC) totalling GH¢ 134,000 and receipts for duties paid on imported goods as taxes paid and therefore claimed his company was tax compliant. The Managing Director later approached you as a Tax Practitioner to help the company complete its tax returns on its business operations to Ghana Revenue Authority. The extracts from the company’s financial statement presented by the Finance officer for the year ended 30th September 2018 were as follows:

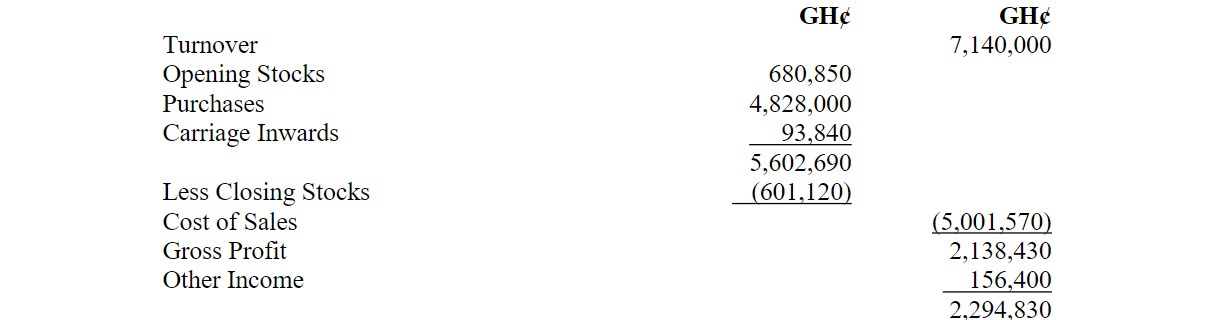

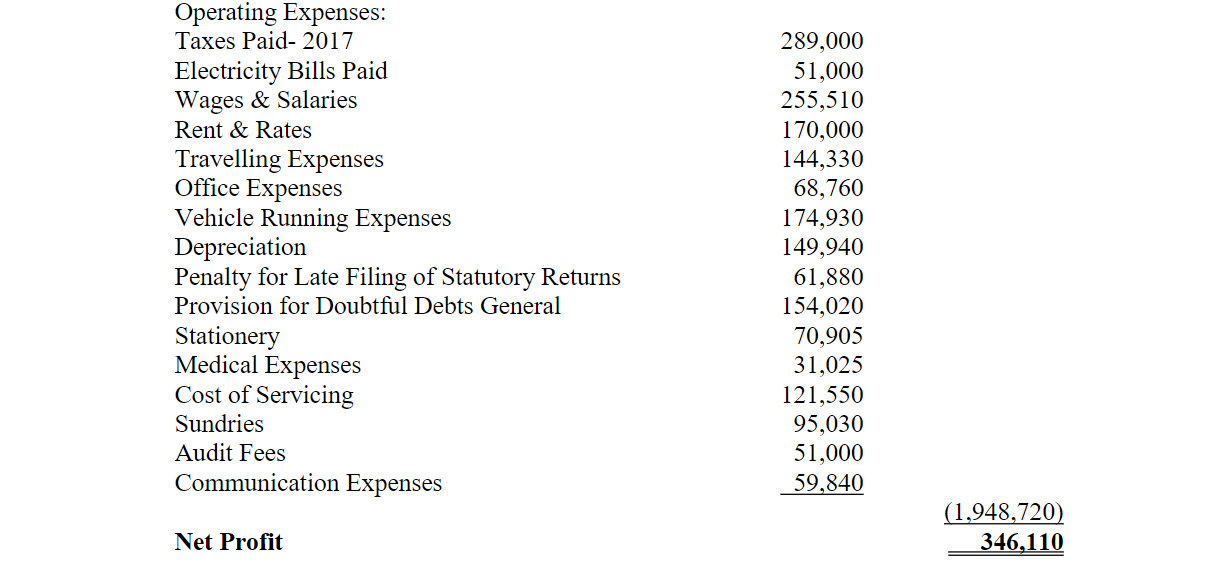

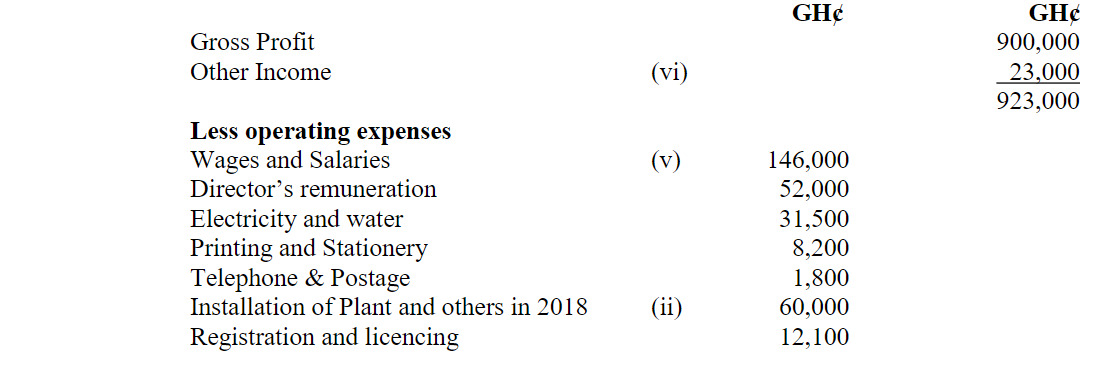

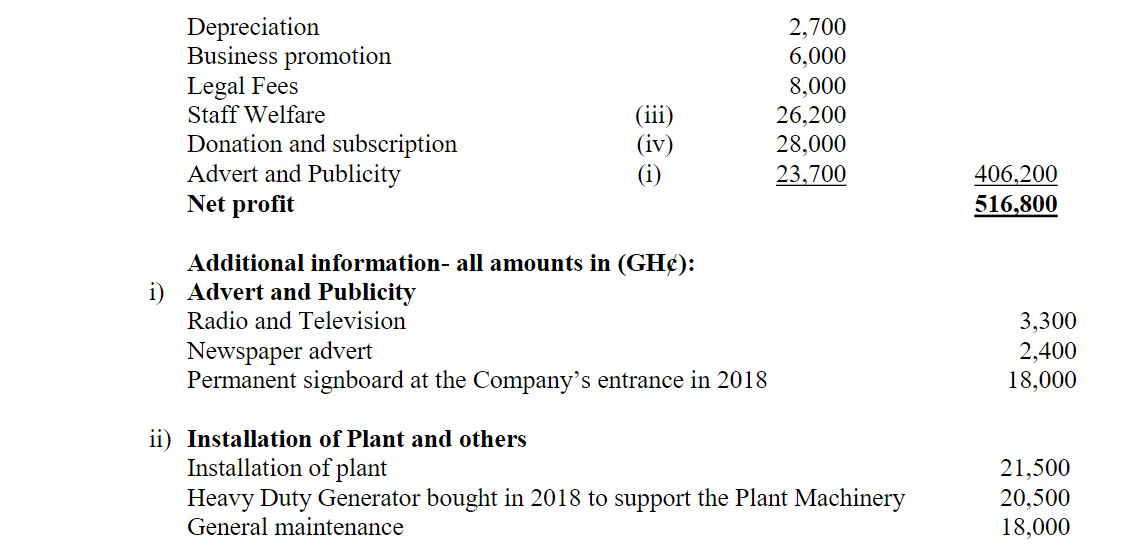

Yentua Limited

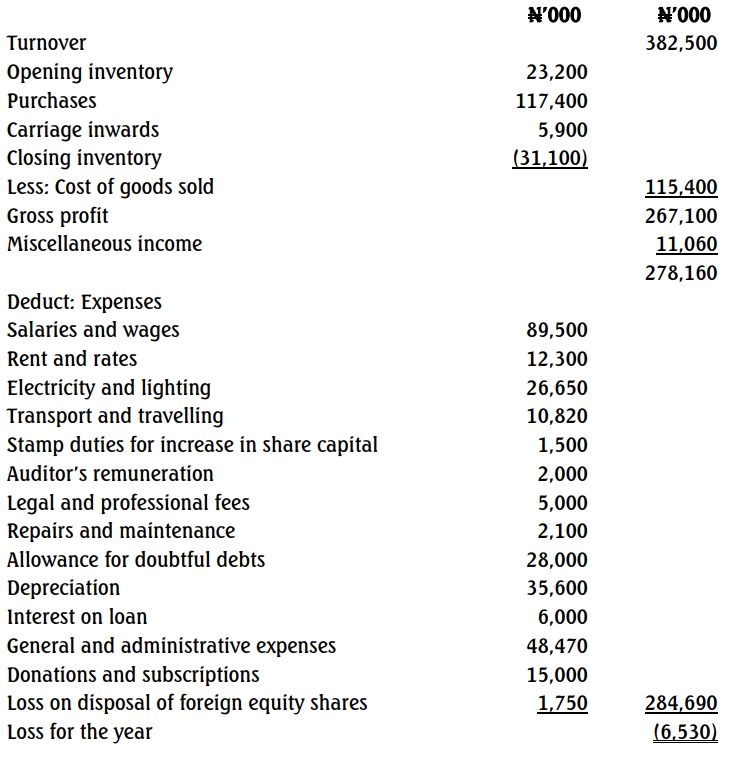

Income Statement

| GH¢ | GH¢ | |

|---|---|---|

| Turnover | 7,800,000.00 | |

| Cost of Sales | (6,929,300.00) | |

| Gross Profit | 870,700.00 | |

| Administration and General Expenses | (660,000.00) | |

| Net Profit | 90,000.00 |

Note 2: Cost of Sales

| GH¢ | |

|---|---|

| Local Purchases | 4,400,000.00 |

| Imports | 1,580,000.00 |

| Freight and Insurance | 98,500.00 |

| Import Duties | 436,000.00 |

| Cargo Truck | 240,000.00 |

| Repairs and Maintenance | 52,000.00 |

| Depreciation – Truck | 48,000.00 |

| Fuel and Lubricants | 24,000.00 |

| Transport and Handling | 50,800.00 |

| Total | 6,929,300.00 |

Note 3: Administration and General Expenses

| GH¢ | |

|---|---|

| Salaries and Allowances | 285,000.00 |

| Directors Remuneration | 64,000.00 |

| Consultancy Fees | 90,000.00 |

| Printing and Stationery | 10,500.00 |

| Rent (Office Building) | 60,000.00 |

| Rent (Residential) | 36,000.00 |

| Equipment Rentals | 79,000.00 |

| Utilities | 35,500.00 |

| Total | 660,000.00 |

Required:

Determine the tax liabilities due from the company in respect of direct taxes for 2018 year of assessment, including any relevant penalties that are applicable. Corporate Tax rate applicable to the company is 25%.

Find Related Questions by Tags, levels, etc.

- Tags: Capital allowances, Corporate Tax, Financial Statement, Penalties, Withholding Tax

- Level: Level 2

- Topic: Income Tax Computation

- Series: AUG 2019