- 30 Marks

Question

Housing-for-all Corporation is an entity established by Kazua State to engage in building construction. The corporation is partly financed with subvention from the State and also from the proceeds from its operations. It applied for a bid to construct twenty (20) classroom buildings in the riverine area of the state. After all the initial procurement processes on bid-opening were carried out, the corporation won the contract in June 2018. The contract price was N220m. The building construction contract was billed for completion in two years. The company uses stages of completion on the basis of value of work completed. The following financial data were available in respect of the contract as at December 31, 2019:

| Description | Amount (N’000) |

|---|---|

| Total contract price | 220,000 |

| Total expected costs | 180,000 |

| Costs incurred to date | 120,000 |

| Value of work certified as complete | 140,000 |

| Amount billed to client (Kazua State) | 130,000 |

| Progress payment received from client | 100,000 |

The contract was duly completed in June 2020.

Required:

a. Determine the expected profit of the contract, stage of completion in percentage, as well as the amount to be recognized in Housing-for-all Corporation’s income statement at December 31, 2019. (11 Marks)

b. Calculate the amount to be recognized as gross amount due to or from the client, Kazua State, the amount of trade receivable, and prepare extracts of financial statements in respect of the construction contracts at December 31, 2019. (13 Marks)

c. Identify what constitutes the composition of contract costs as contained in IPSAS 11. (6 Marks)

Answer

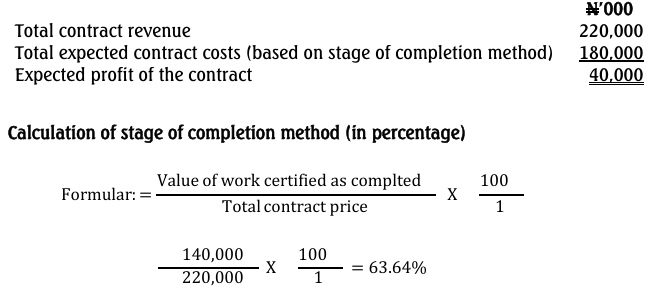

a. Calculation of expected profit of the contract at December 31, 2019

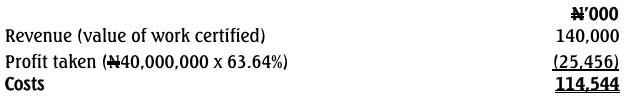

Determination of the amount to be recognised in Housing-for-all Corporation‟s income statement

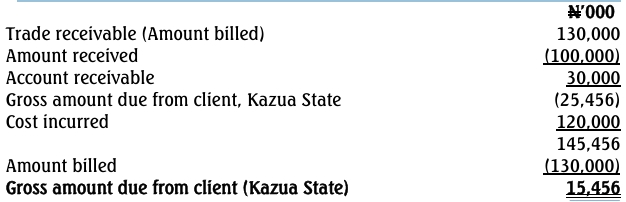

b. Calculation of amount to be recognised in the statement of financial position for gross amount due to or from client, Kazua State and accounts receivable

Housing-for-all Corporation

Income statement extracts for the year ended December 31, 2019

Housing-for-all Corporation

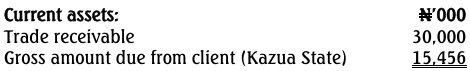

Statement of financial position extracts as at December 31, 2019

c. Composition of Major Contract Costs as Contained in IPSAS 11

- Site labour costs, including site supervision.

- Cost of materials used in construction.

- Depreciation of plant and equipment used on the contract.

- Cost of moving plant, equipment, and materials to and from the contract site.

- Cost of hiring plant and equipment.

- Costs of design and technical assistance directly related to the contract.

- Estimated costs of rectification and guarantee work, including expected warranty costs.

- Claims from third parties.

- Costs attributable to contract activity in general and allocable to the contract on a systematic basis.

- Other specifically chargeable costs under the terms of the contract.

- Uploader: Kofi