- 12 Marks

Question

Shakara Limited was incorporated on January 1, 2022. During the year ended December 31, 2022, the company made a profit before taxation of N18,150,000.

The following capital expenditure were made during the year:

| Expenditure | N’000 |

|---|---|

| Plant and machinery | 7,200 |

| Motor vehicles | 1,800 |

The depreciation charged for the year amounted to N1,650,000, and capital allowance granted by the Federal Inland Revenue Services (FIRS) for the same period amounted to N2,250,000.

Company income tax rate is 30%, and deferred tax liability brought forward was N1,200,000.

Required:

i. Calculate the company income tax liability for the year ended December 31, 2022. (3 Marks)

ii. Calculate the deferred tax balance that should be disclosed in the statement of financial position of Shakara Limited as at December 31, 2022. (3 Marks)

iii. Prepare notes showing the movement of deferred tax charged to profit or loss for the year ended December 31, 2022. (3 Marks)

Answer

b. Shakara Limited

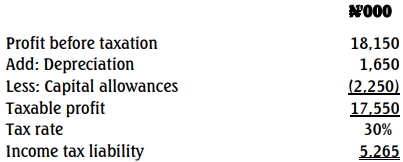

i. Computation of tax payable for the year ended December 31, 2022

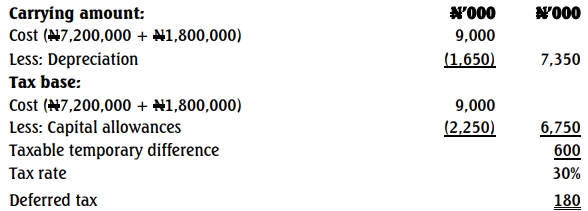

ii. Computation of deferred tax balance at at December 31, 2022

iii. Computation of movement in deferred tax balance for the year

iv. Computation of income tax expenses for the year

- Tags: Capital Allowance, Deferred Tax, IAS 12, Income Tax, Tax Liability

- Level: Level 2

- Uploader: Kofi