- 15 Marks

Question

The statement of financial position extract of Apapta Limited is given as follows:

| 2015 (N’000) | 2016 (N’000) | |

|---|---|---|

| Inventories | 3,950 | 3,250 |

| Receivables | 2,151 | 2,675 |

| Investments (Marketable Securities) | 430 | 375 |

| Cash | 565 | – |

| 7,460 | 6,300 | |

| Payables amounts due within one year | (3,865) | (3,755) |

| 3,595 | 2,545 |

Payables are analysed as follows:

| 2015 (N’000) | 2016 (N’000) | |

|---|---|---|

| Trade payables | 2,600 | 2,215 |

| Company Income Tax | 695 | 820 |

| Dividend payable | 570 | 540 |

| Bank overdraft | – | 180 |

| 3,865 | 3,755 |

Its profit or loss account extract is as follows:

| Item | 2015 (N’000) | 2016 (N’000) |

|---|---|---|

| Sales | 17,795 | 16,715 |

| Cost of sales | (12,100) | (11,200) |

| Gross profit | 5,695 | 5,515 |

Cost of sales is analysed as follows:

| 2015 (N’000) | 2016 (N’000) | |

|---|---|---|

| Opening inventory | 3,250 | 3,150 |

| Add: Purchase | 12,800 | 11,300 |

| Less: Closing inventory | (3,950) | (3,250) |

| Cost of sales | 12,100 | 11,200 |

In 2014 and 2015, credit sales were 83% of total sales.

Required:

a. Calculate the working capital cycle for 2015 and 2014. (9 Marks)

b. Compute the ratios listed below and comment on the company’s liquidity over the two years.

i. Cash ratio

ii. Current ratio

iii. Quick ratio (6 Marks)

Answer

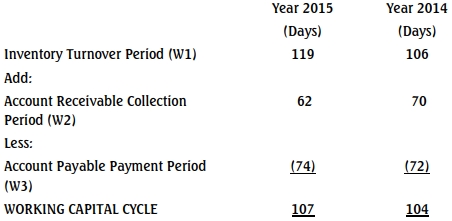

a) WORKING CAPITAL CYCLE

b)

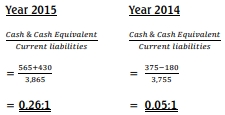

i)

Cash Ratio =

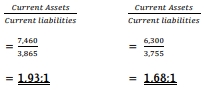

Current Ratio =

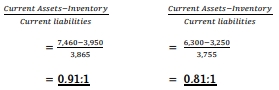

Quick Ratio =

b

ii) Comments

- Apata Limited’s Liquidity position has improved slightly over the

period as evidenced by the improvement in current and quick ratios. - The improvement noted above can be easily attributable to

reduction in trade receivables period indicating that customers are

beginning to settle their debt in time. - This was also reflected in the company’s cash position, as the

overdraft or deficit cash position in year 2014 improved to a positive

cash flow in year 2015. In fact the other cash and cash equivalent of

the company improved substantially. - The significant improvement in the cash ratio was as a result of the

increase in cash and cash equivalent of the company in addition to

the decrease in receivable collection period. - However, the company’s working capital cycle increased due to the

fact that it takes a longer time for the company to convert its

inventory to sales.

- Level: Level 2

- Topic: Inventory Accounting (IAS 2), Statement of Cash Flows (IAS 7)

- Series: MAY 2016

- Uploader: Kwame Aikins