- 15 Marks

Question

a. IFRS 5 – Non-Current Assets Held for Sale and Discontinued Operations set out requirements that specify the accounting treatment for assets held for sale and the presentation and disclosure of discontinued operations.

Required:

- Explain the conditions that must apply at the reporting date for an asset (or disposal group) to be classified as held for sale and how the assets can be measured.

(5 Marks)

b.

- Explain how impairment of asset should be identified and accounted for at the end of a reporting period.

(4 Marks) - A company has decided to dispose of a group of its assets. The carrying amounts of the assets immediately before the classification as held for sale were as follows:

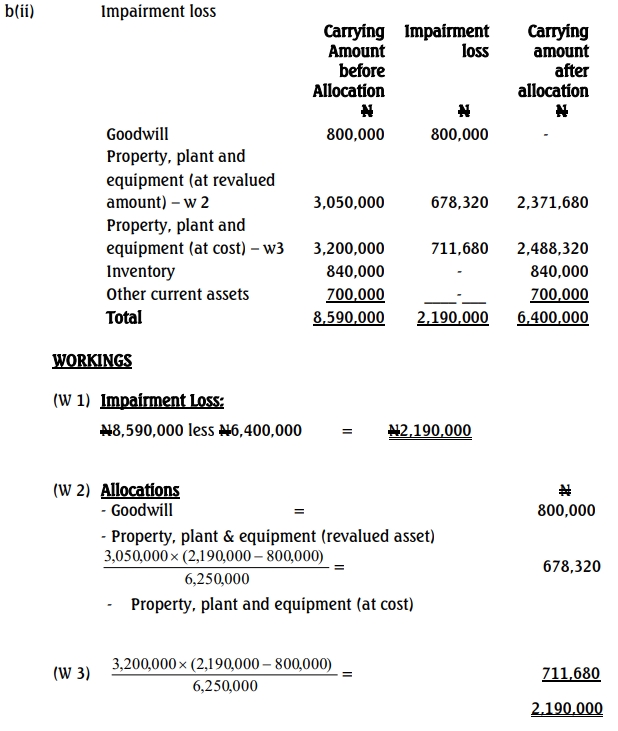

Asset Amount (₦) Goodwill 800,000 Property, plant and equipment (revalued amounts) 3,050,000 Property, plant and equipment (at cost) 3,200,000 Inventory 840,000 Other current assets 700,000 Total 8,590,000 The company estimates that the “fair value less cost to sell” of the disposal group is ₦6,400,000.

Required:

Calculate the impairment loss and its allocation to the non-current assets in the disposal group.

(6 Marks)

Answer

a. Conditions for Classification as Held for Sale (IFRS 5)

The following conditions must be met for an asset (or disposal group) to be classified as held for sale:

- Availability for Immediate Sale: The asset must be available for sale in its present condition and not require significant modifications.

- Highly Probable Sale: The sale must be highly probable, with management committed to the sale plan.

- Active Marketing Efforts: An active marketing program should be in place to locate a buyer.

- Reasonable Sale Price: The sale price should be reasonable in relation to its current fair value.

- Completion Within One Year: The sale is expected to be completed within one year from the classification date.

Measurement: Once classified as held for sale, the asset is measured at the lower of its carrying amount or fair value less costs to sell.

b(i). Identification and Accounting for Impairment of Assets

- Assessment at Reporting Period End: An entity must assess at the end of each reporting period if there are indications of impairment.

- Recoverable Amount Estimation: If impairment is indicated, the recoverable amount is estimated.

- Impairment Loss Recognition: If the recoverable amount is less than the carrying value, the asset’s carrying amount is reduced to its recoverable amount.

- Recording the Loss: Impairment losses are recorded in profit or loss.

- Future Depreciation Adjustment: For impaired assets, depreciation charges are recalculated based on the revised carrying amount over the remaining useful life.

- Tags: Disposal group, Held for Sale, IFRS 5, Impairment, Non-current Assets

- Level: Level 2

- Topic: Non-current Assets Held for Sale (IFRS 5)

- Series: MAY 2017

- Uploader: Theophilus