- 20 Marks

Question

As part of the induction program for the newly recruited staff of your firm of tax consultants, you have been tasked with a presentation on companies’ income tax computation for beginners during the firm’s training session.

You are provided with the following information relating to Wizzy-Baddo Limited, which commenced business on September 1, 2020:

- Adjusted Profit:

- Period to December 31, 2020: N6,937,500

- Year ended December 31, 2021: N9,300,500

The following assets were acquired as follows:

| Date | Asset | Cost (N) |

|---|---|---|

| June 5, 2020 | Land and building | 5,467,500 |

| July 1, 2020 | Motor vehicle | 10,000,000 |

| October 15, 2020 | Machinery | 4,375,000 |

| February 28, 2021 | Furniture | 3,458,000 |

| May 1, 2021 | Delivery van | 4,750,000 |

Required:

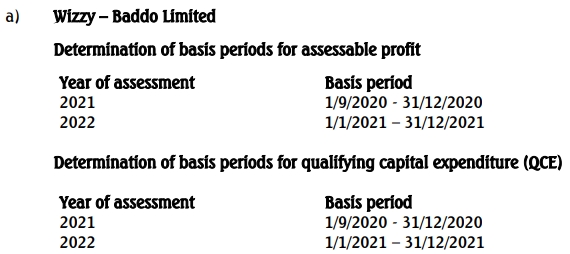

a. State the basis periods for assessable profits and qualifying capital expenditure. (5 Marks)

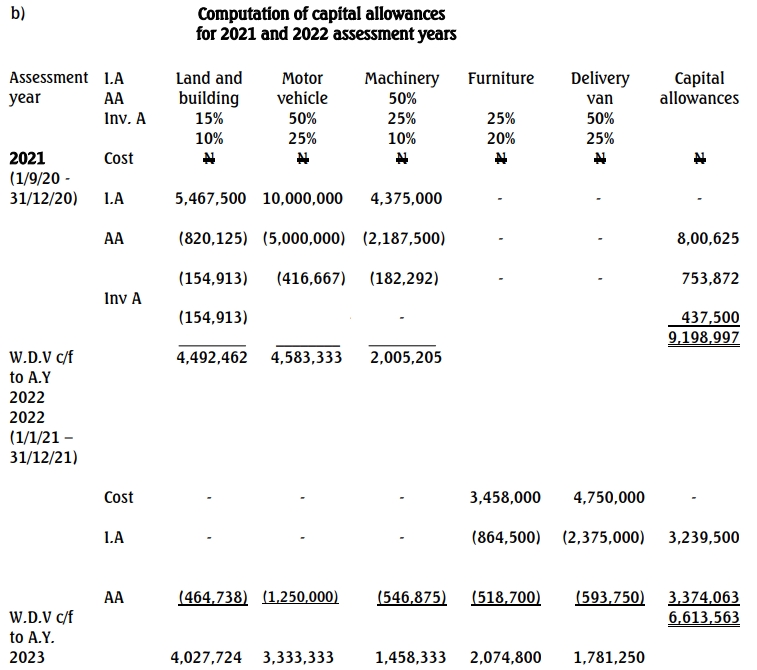

b. Compute the capital allowances.

Answer

- Topic: Companies Income Tax (CIT)

- Series: MAY 2023

- Uploader: Theophilus