- 15 Marks

Question

As part of the induction programme for the newly recruited staff of your firm of Tax Consultants, you have been saddled with the responsibility of making a presentation on companies tax computation for beginners during the firm’s training session.

The following data were submitted for the purpose of the training:

JohnGab Limited, a training company, was incorporated on 1 June 2008 but commenced business on 1 September 2008. The following information is made available to you:

| Period | Assessable Profit (₦’000) |

|---|---|

| Four month-period ended 31 December 2008 | 37,500 |

| Year ended 31 December 2009 | 60,000 |

| Year ended 31 December 2010 | 90,000 |

The following assets were purchased during the period:

| Date | Asset | Cost (₦’000) |

|---|---|---|

| 5 June 2008 | Land and building | 17,500 |

| 1 July 2008 | Motor car | 6,000 |

| 15 October 2008 | Machinery | 14,000 |

| 28 February 2009 | Furniture | 3,750 |

| 1 May 2009 | Delivery van | 5,000 |

In order to clearly explain the extant rules on computation of capital allowances by

companies, you are required to:

a. State the basis periods of assessment and compute the total capital allowances for the first five years of assessment. (5 Marks)

b. Calculate the capital allowances due to be utilized for the first three years of assessment in respect of the qualifying capital expenditure incurred by the company. (5 Marks)

Answer

JOHNGAB LIMITED

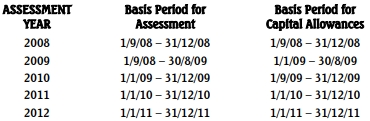

DETERMINATION OF BASIS PERIODS

FOR THE RELEVANT ASSESSMENT YEARS AND CAPITAL ALLOWANCESS

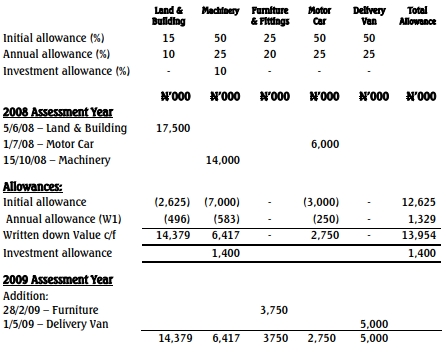

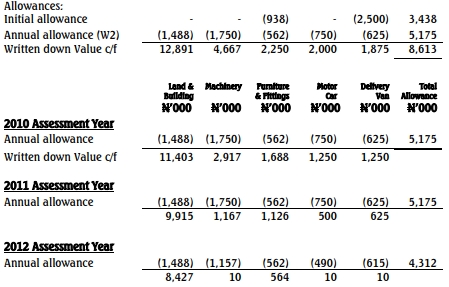

(b) COMPUTATION OF CAPITAL ALLOWANCES

DUE FOR 3 YEARS

Note: Since the Capital Allowance is less than 3/2 of Assessable Profit for each of the relevant years, all the Capital Allowances are claimable.

- Topic: Companies Income Tax (CIT)

- Series: NOV 2015

- Uploader: Kwame Aikins