- 30 Marks

Question

National Hotel, an investment unit of the Ministry of Tourism and Environment, is fifty (50) years old. It has recently been restructured from a wholly-owned government hotel to a private/government partnership. However, being the largest hotel in the country and for security reasons, the government still retains 55% of its equity.

The board of directors has decided to reposition the hotel for better performance, needing external finances amounting to N180 million, consisting of a N100 million loan over ten years and an N80 million bank overdraft. All necessary supports have been provided by the government and private equity holders.

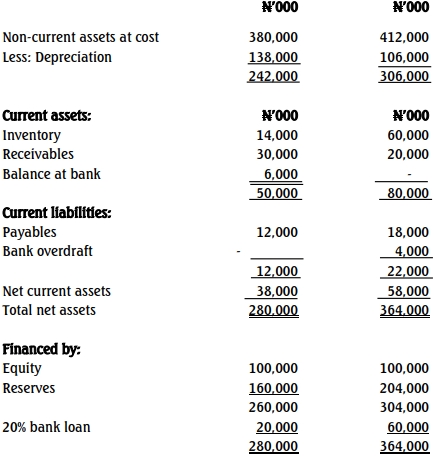

The summarized results for the last two financial years are as follows:

Income Statement

| Year ended 30 September | 2013 (N’000) | 2014 (N’000) |

|---|---|---|

| Turnover | 200,000 | 240,000 |

| Cost of Sales | (150,000) | (184,000) |

| Gross Profit | 50,000 | 56,000 |

| Overhead Expenses | (10,000) | (12,000) |

| Profit before Tax | 40,000 | 44,000 |

Statement of Financial Position

You have been engaged as a consultant to assist the hotel in preparing necessary documents and reports to achieve its objectives.

Required:

a. Calculate six relevant accounting ratios covering each of the two years: 2013 and 2014 in a tabular form. (12 Marks)

b. Interpret the result of the ratios calculated in (a) above to show the financial performance and position of the entity. (12 Marks)

c. Highlight four unfavorable factors about the hotel as revealed by your interpretation. (6 Marks)

Answer

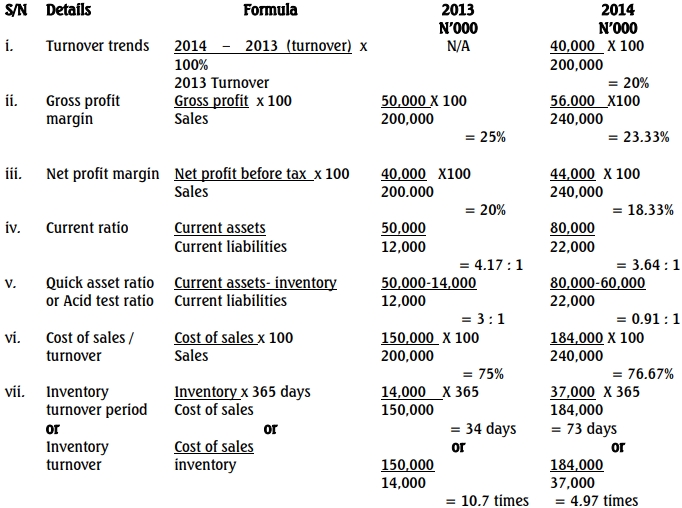

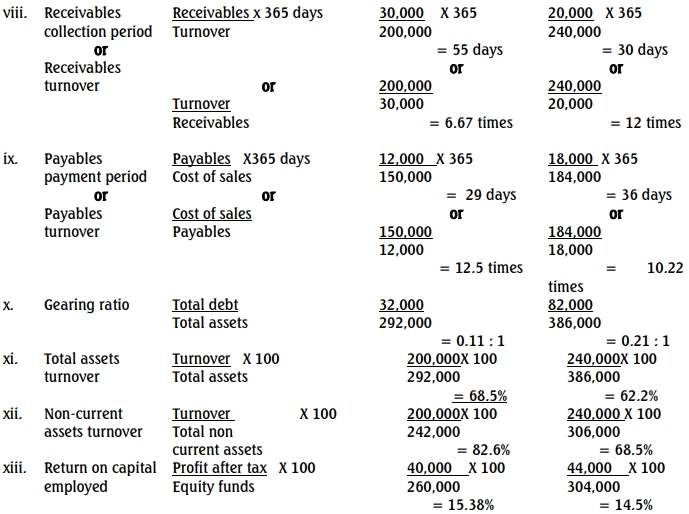

a. Calculation of Accounting Ratios

b. Interpretation of Ratios

i. The turnover increased by 20% from 2013 to 2014, showing revenue growth.

ii. Despite the fact that the turnover has increased by 20% between 2013 and

2014, the hotel‟s profit margin has dropped by 1.7% within the same period.

This could be as a result of increase in the cost of sales.

iii. The hotel net profit margin also confirmed a decline by 1.7%, due to increase

in cost of sales.

iv. The hotel‟s liquidity position is good in spite of a decline in trend in the

liquidity ratio.

v. There is a significant decline in the acid test ratio due to increase in

inventory and current liabilities at the year end.

vi. The payables payment period has increased from 29 days to 36 days,

indicating a better payment policy and financial management.

vii. The hotel‟s total debts to total assets is low but if the financial request from

the bank is granted, the situation will become worse and the gearing will

become high.

viii. The return on capital employed shows that there is a decline of 0.88%

(15.38% – 14 5%) within the two years.

c. Unfavorable Factors

i. The decline in gross and net profit margins indicates reduced profitability.

ii. The increase in gearing ratio suggests higher financial risk due to more reliance on debt.

iii. The significant drop in inventory turnover implies potential issues with excess inventory.

iv. The weakened liquidity position may affect the hotel’s ability to meet its short-term obligations.

- Topic: Public Sector Financial Statements

- Series: MAY 2019

- Uploader: Kwame Aikins