- 30 Marks

Question

DASET DRINKS NIGERIA PLC.

(30 MARKS)

Daset Drinks Nigeria Plc. has been operating in the Nigerian food and beverages

industry as an entity with three distinct factories across the country. One of the

factories bottles soft drink while the other two produce bottles and crown corks for

the soft drink factory.

The company has recently been experiencing problems with its performance

evaluation system across the three factories. Each factory manager is of the

opinion that his factory is the one contributing the most to the overall performance

of the company.

In a recent management retreat, the guest speaker, a performance management

expert, emphasised the need to develop Key Performance Indicators (KPI) for each

of the factories and departments in the company. According to him, this will

enhance performance evaluation of all the managers in the company and will also

make performance management easier. He suggested that the company should

adopt a divisional structure whereby each of the factories will become an

autonomous division with responsibilities for investment, revenues, profits and

costs.

At the last Executive Management meeting, after the retreat, the company‟s top

management decided to adopt the recommendations of the guest speaker. The top

management agreed transfer prices acceptable to each of the divisional managers

and also the needs to decide whether the two factories manufacturing bottles and

corks cocks could sell to external markets.

The top management has mandated you, as the company‟s management

accountant, to supply necessary data that will assist them in taking appropriate

decisions.

Financial data collected about the company‟s operations are as follows:

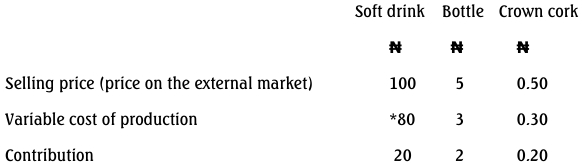

The costs and selling prices of the divisions are:

This includes costs of bottle and crown cork. To produce one bottle of soft drink

requires one bottle and one crown cork.

The bottling division has the choice to buy its bottle and crown cork requirements

from the external market.

The variable costs of production for external sales and internal transfers are the

same and bottles and crown corks are being transferred to the bottling division at

these costs.

For brand protection, the soft drink factory is not willing to buy bottles and crown

corks from any external supplier.

Required:

a. Differentiate among an investment centre, a profit centre, a revenue centre

and a cost centre, in a divisional organisation giving one example of each.

(8 Marks)

b. Explain a divisional structure, stating the problems associated with this type

of structure in an organisation. (8 Marks)

c. Advise the top management on the transfer prices that will maximise the

company‟s profit and be acceptable to the factory managers.

(10 Marks)

d. Discuss TWO qualitative factors that the top management needs to consider

in taking these decisions. (4 Marks)

Answer

(a)

DASET DRINKS NIGERIA LIMITED

Investment centre

An investment centre is a division within an organisation where the manager

is responsible not only for the costs of the division and the revenues, but also

for decisions relating to investment in assets for the division. An investment

centre manager usually has authority to purchase new assets, such as items

of plant or equipment, and so should be responsible for the profit or return

that the division makes on the amount that it has invested.

The performance of an investment centre might be measured by calculating

the profit as a percentage of the amount invested (The Return on

Investments (ROI)). It could also be measured by considering the residual

profit after making provision for cost of capital.

An investment centre might include a number of different profit centres. For

example, a company manufacturing cars and buses may have two

investment centres: (1) car-making and (2) bus-making. Within the bus

making division, there could be several profit centres, each of these being a

separate location or factory at which buses are manufactured and

assembled.

Profit centre

A profit centre is a department or division within the organisation for which

revenues as well as costs are established.

The profit or loss that the centre makes is determined by measuring the costs

of the products or services produced by the centre to the revenues earned

from selling them.

The following is an example of a summarised profit centre report:

Revenues of the profit centre

N

‟000

***

Costs of the units sold by the profit centre

Profit/(loss) of the profit centre

A profit centre may consist of several cost centres. For example, a factory

might be treated as a profit centre, and within the factory, the machining

department, assembly department and finishing department could be three

cost centres.

Revenue centre

A revenue centre is a department or division within the organisation for

which revenues are generated.

In a revenue centre, there is no

measurement of cost or profit. Revenue centre managers will only need to

have information relating to revenues and will be accountable for revenuesonly. For example, the income accountant in a hospital is only responsible

for recording and controlling the different incomes that are received from

funding bodies or other sources (for example, private patients, donors,

fundraising and so on).

Cost centre

A cost centre is a department or work group for which costs are established,

in order to measure the cost of output produced by the centre. For example,

in a factory, a group of machines might be a cost centre. The costs of

operating the machines would be established, and a cost could then be

calculated for each unit of product manufactured by the machines.

In a cost centre, there is no measurement of revenue or profit.

(b)

A divisionalised structure refers to the organization of an entity in which

each operating unit has its own management team which reports to a head

office.

Divisions are commonly set up to be responsible for specific

geographical areas or product lines within a large organization.

When an organization has a divisionalised structure, some of the divisions

may supply goods or services to the other divisions in the same organization.

The division that sells goods or services to other divisions is referred to as

selling division. While the division(s) that buy(s) the goods or services is

(are) referred to as buying division(s).

The problems likely to be associated with a divisionalised structure include:

The problem of acceptable transfer price between the selling and the

buying division. A decision has to be made about what the transfer

price should be for goods and services transferred from one division to

another;

Goal congruence – Each divisional manager may be pursuing goals

that are good for his/her division but not in the best interest of the

organization as a whole. For example, a divisional manager for a

division that is an investment centre, may put off buying a needed

non – current asset so as to improve his/her return on investment

(ROI);

Top management may lose control over the organization if they allow

decentralization without accountability.

It will be necessary to monitor divisional performance closely. The cost of such monitoring

system may be high;

Performance Measurement – How to evaluate the performance of the

Divisional Managers may pose some problems; and

There may be duplication of functions and functional managers. Each

division may have to set up its functional units with managers

overseeing the functions.

(c) Ideal transfer Price:

First, what is in the best interest of the company as a whole is determined.

For each bottle of soft drink that the company produced and sold, the

company makes additional contribution as follows:

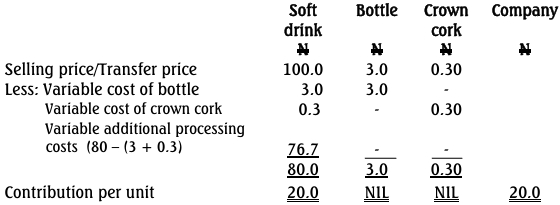

If bottling division buys bottles and crown corks internally, the company, as

a whole, will make N20.0/unit contribution even though it looks like bottle

and crown corks divisions did not contribute anything to the overall

contribution.

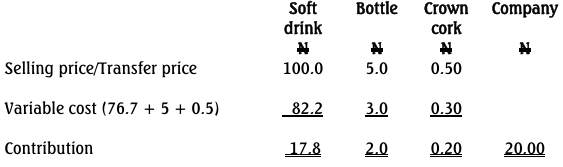

However, if the bottling division buys bottles and crown cork at external

market prices, the company, as a whole, also makes N20 contribution with

soft drinks bottle and crown cork divisions making contribution as follows:

Ideal Transfer Prices:

Since the external market price of bottles and crown corks are ₦5 and ₦0.5

respectively, and variable costs of production are ₦3 and ₦0.3 respectively,

the ideal transfer prices are as follows:

Bottles; from ₦3 to ₦5.

In view of the current arguments of the divisional managers, ₦5, which is

the external market price, will be the most ideal for evaluation of the

divisional manger‟s performance.

Crown corks; from ₦0.3 to ₦0.5.

In view of the current arguments of the divisional managers, ₦0.5, which

is the external market price, will be the most ideal for evaluation of the

divisional manger‟s performance.

(d)

Other qualitative factors the top management needs to consider in taking

these decisions include:

Will the external supplier be able to meet up with the quality that

meets with the bottling division‟s specifications?

To protect the company‟s brand, it is also very important to buy from

the internal supplier rather than the external supplier;

The company may not be able to control the external supplier as it can

do with the internal suppliers;

The external suppliers may not be able to meet up with the demand of

the bottling division for bottles and crown corks, as the case may be,

because they will have to satisfy their other customers as well;

Market conditions: Would the bottle and crown cork divisions be able

to produce and sell all their products in the external market?

The need to encourage initiatives of the divisional managers;

Loss of market shares if transfers are to be made internally using

variable costs; and

The level of exposure and experience of the divisional managers.

- Topic: Divisional Performance Measurement, Transfer Pricing

- Series: MAY 2018

- Uploader: Kofi