- 20 Marks

Question

Tosin Oguntona was an employee of a Federal Government parastatal in Nigeria. While in service, he invested his earnings in various investments, deriving incomes from them along with his monthly pension. The following details were provided:

| Assessment Years | 2013 | 2014 |

|---|---|---|

| Dividend Income | ||

| Dividend from Nigerian companies | N1,200,000 | N1,500,000 |

| Dividend from abroad paid into a domiciliary account | $4,000 | $4,500 |

| Rental Income | ||

| Rent from buildings in Ibadan | N630,000 | N720,000 |

| Rent from buildings in Abuja | N1,500,000 | N1,740,000 |

| Rent from buildings in Oyo | N420,000 | N520,000 |

| Rent from buildings in Lagos | N750,000 | N780,000 |

| Expenses | ||

| Repairs and maintenance | N90,000 | N96,000 |

| Personal income tax paid | N240,000 | N280,000 |

| Water rate | N40,000 | N50,000 |

| Depreciation on building | N620,000 | N700,000 |

| Agent’s commission | N96,000 | N108,000 |

| Insurance | N120,000 | N150,000 |

| Depreciation on plant | N150,000 | N162,000 |

| Interest Incomes | ||

| Interest received from bank | N360,000 | N420,000 |

| Interest on domiciliary account | $1,200 | $1,500 |

Other information:

- Capital allowances agreed with the revenue authority for 2013 and 2014 assessment years were N150,000 and N180,000 respectively.

- Insurance on properties included N24,000 and N30,000 for 2013 and 2014, respectively, for his private residence.

- Pension of N80,000 per month was received.

- Exchange rate: N160 to $1.

Required:

Compute the Assessable Incomes of Tosin Oguntona for 2013 and 2014 Assessment Years.

Answer

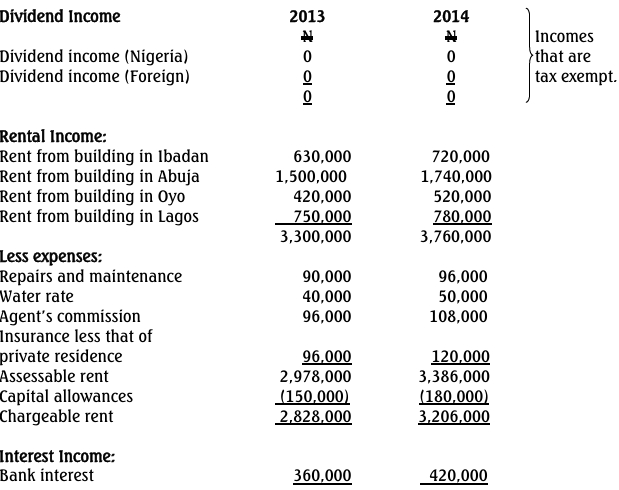

Tosin Oguntona Computation of Assessable Incomes for 2013 and 2014 Assessment Years

- Tags: Capital allowances, Dividend income, Interest Income, Rental Income

- Level: Level 2

- Topic: Taxation of Trusts and Estates

- Series: MAY 2018

- Uploader: Kofi