- 20 Marks

Question

a) Obi Consults is a civil engineering consulting firm of many years. The founding partners are Bibi, Kose, and Fowora. The financial year-end of the firm is December 31 each year. The following information was extracted from the partnership’s financial statements/records for the year ended December 31, 2018:

| Details | Amount (N) |

|---|---|

| (i) Net profit for the year | 21,575,000 |

| (ii) Provision for depreciation | 13,250,000 |

| (iii) Fine paid for traffic offence | 25,000 |

| (iv) Donations to “politicians in business” | 150,000 |

| (v) Donation to National Library Board | 165,000 |

| (vi) Profit from sale of excavator | 1,600,000 |

| (vii) Capital allowances | 6,575,000 |

| (viii) Balancing allowance | 677,000 |

| (ix) Balancing charge | 1,315,000 |

Additional information:

- Profit sharing ratio: Bibi – 1/2, Kose – 1/4, Fowora – 1/4

- Bibi and Fowora are entitled to 5% interest per annum on a loan of N10,500,000 each. Fowora’s loan was refunded fully on his retirement.

- Salaries paid: Bibi – N10,800,000, Kose – N8,250,000, Fowora – N8,250,000

- Fowora retired on June 30, 2018, and Jaycee was admitted as a new partner on July 1, 2018, with an annual salary of N8,250,000. Jaycee introduced a loan of N7,000,000 on July 1, 2018, entitled to a 5% interest per annum.

- The profit-sharing ratios after Jaycee’s admission: Bibi – 1/2, Kose – 7/20, Jaycee – 3/20

You are required to:

(i) Compute the adjusted/assessable income of the partnership. (5 Marks)

(ii) Determine the share of profits among the partners. (3 Marks)

(iii) Show relevant workings for prorated salaries and interest on loans, assuming simple interest. (2 Marks)

(iv) Compute the assessable income of each partner. (10 Marks)

Answer

a)

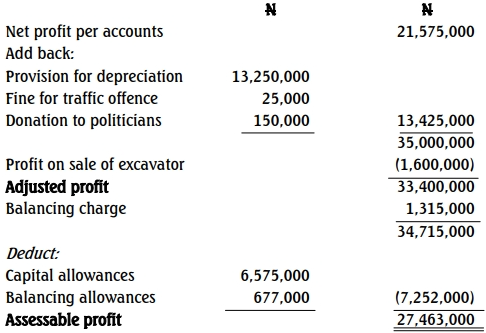

Obi Consults

(i) Computation of adjusted/assessable income for 2019 year of assessment

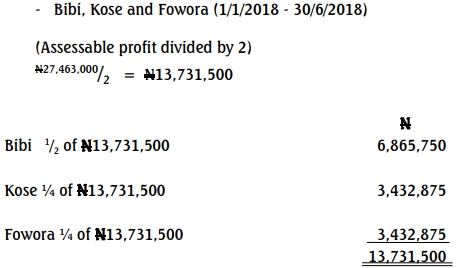

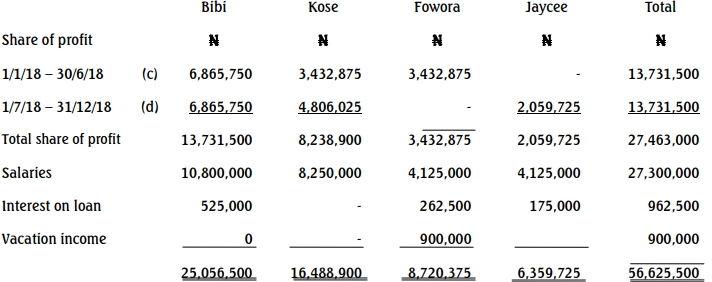

(ii) Determination of share of profit amongst old partners

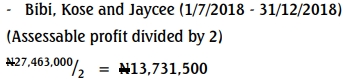

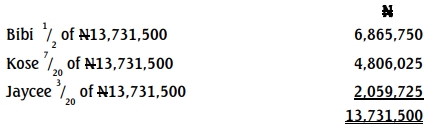

Determination of share of profit among current partners

(iii) Determination of Fowora‟s salaries for the relevant period

(1/1/2018 – 30/6/2018) = 6/12 x N8,250,000 = N4,125,000

- Determination of amount due to Fowora as interest on loan for the

relevant period (1/1/2018 – 30/6/2018) = 5% of N10,500,000 = N525,000 x 6 /12 = N262,500 - Determination of salaries earned by Jaycee for the relevant period

1/7/2018 – 31/12/2018 = 6/12 of N8,250,000 = N4,125,000 - Interest on Loan due to Jaycee for the relevant period

1/7/2018 -31/12/2018 = 5% of N7,000,000 = N350,000 x 6 / 12 = N175,000.

(iv) Computation of assessable income of each partner

For 2019 year of assessment

- Tags: Adjusted Income, Assessable Income, Capital Allowance, Partnership, Proration, Retirement, Tax computation

- Level: Level 2

- Topic: Taxation of Partnerships and Sole Proprietorships

- Series: MAY 2019

- Uploader: Kwame Aikins