- 14 Marks

Question

You have received a prize amount of GH¢5,000 and you wish to invest it for five years. The two alternatives are to use a bank account where the 14% per annum gross rate is compounded monthly or a savings fund where the 14.5% per annum gross rate is compounded annually.

Required:

i) Calculate the size of each fund at the end of the five years. (Ignore tax considerations). (8 marks)

ii) Calculate the effective annual interest rate of the bank account investment. (4 marks)

iii) Advise your client on the basis of your calculations. (2 marks)

Answer

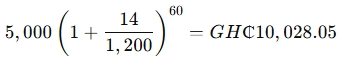

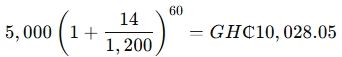

i) 14% compounded monthly:

After five years, there will have been 60 interest payments.

Fund =

4.5% compounded annually:

After five years, there will have been five interest payments.

Fund =

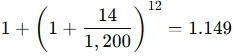

ii) Effective annual interest rate (14% compounded monthly):

After one year, GH₵1 would become:

So, the effective annual interest rate is 14.9%.

iii) Client advice:

The return on the bank account investment (14.9%) exceeds the return on the savings fund (14.5%), so, other things being equal, the bank account investment is better.

- Topic: Mathematics of Business Finance

- Series: MAY 2018

- Uploader: Kwame Aikins