- 20 Marks

Question

Fenty Trust Ltd is a non-resident company acting as the trustee for four resident Ghanaians, each holding a 22.5% share in the Trust. The Trust was set up on the instruction of Mr. Karl Odogo before he died. Mr. Karl Odogo was a businessman with interests in real estate, transportation, and numerous natural resources.

The Board of Trustees decided to continue in the above businesses and others. As part of the Trust Deed, the Board of Trustees was to make donations for good causes and discretionary payments to the beneficiaries where appropriate.

In the year 2022, the following transactions took place:

- Total rental income from the real estate was GH¢9,375,000.

- Administrative expenses of the Trust for the year 2022 amounted to GH¢725,000.

- A friend of Karl Odogo contributed GH¢600,000 to the Trust by way of donation.

- Interest received on the bank account of the Trust was GH¢350,000 gross.

- The Trust received a total amount of GH¢1,240,000 from the transport operations.

- Total depreciation computed and treated using generally accepted accounting principles was GH¢104,000.

- Remuneration and fees of the Trustees for the 2022 year of assessment were GH¢980,000.

- The External Auditors of the Trust charged GH¢45,000 for the year 2022, and it has been paid.

- Donations were made to the following persons and institutions:

- Ghana Heart Foundation (receipt obtained from Ghana Health Service): GH¢15,000

- Kumasi Children’s Home (receipt from Social Welfare Department): GH¢15,000

- XYZ Political Party (receipt from the Political Party): GH¢45,000

- Funeral of a cousin of one of the members of the Governing Board of the Trustees: GH¢5,000

- The Ghana Revenue Authority has granted a capital allowance of GH¢81,250.

- Discretionary payments of GH¢265,000 for each beneficiary were made during the year.

Required:

a) Compute the chargeable income and tax payable by the Trust for the 2022 year of assessment. (12 marks)

b) Outline the general tax rules on trust institutions and trust beneficiaries. (8 marks)

Answer

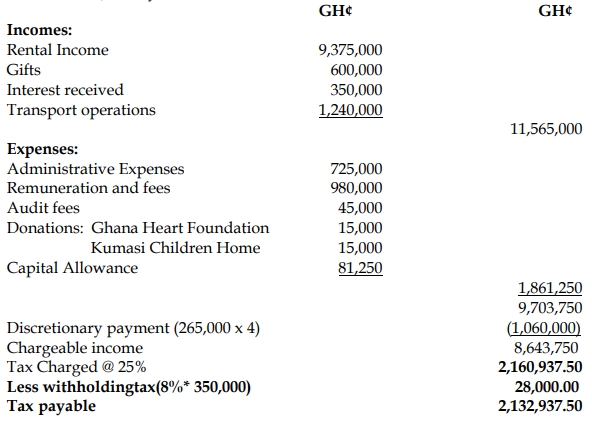

a) Computation of Chargeable Income and Tax Payable by Fenty Trust Ltd for the 2022 Year of Assessment

b) General Tax Rules on Trust Institutions and Trust Beneficiaries

Trust Institutions:

- A trust is taxed as a separate entity from its beneficiaries, with separate calculations required for each trust, regardless of whether they have the same trustees.

- A trust is treated as an entity for tax purposes unless it is a trust of an incapacitated individual (not being a minor), in which case it is taxed as though it were an individual.

- Income and expenses derived or incurred by a trust, or by a trustee (other than as a bare agent), are treated as derived or incurred by the trust and not by any other person.

- Assets owned and liabilities owed by a trust or trustee (other than as a bare agent) are treated as owned or owed by the trust, not by any other person.

Trust Beneficiaries:

- Distributions by a resident trust are exempt from tax in the hands of the beneficiaries.

- Distributions by a non-resident trust are included in the taxable income of the beneficiaries.

- Gains on the disposal of a beneficiary’s interest in a trust are included in the calculation of the beneficiary’s taxable income.

- Tags: Beneficiaries, Capital Allowance, Tax Rules, Taxable Income, Trust Income

- Level: Level 3

- Topic: Ethical principles in taxation

- Series: NOV 2023

- Uploader: Theophilus