- 20 Marks

Question

a) B & C Brothers are partners sharing profits and losses equally between themselves for many years. However, they have now decided to dissolve their partnership as at 31 December 2016. Below is their Statement of financial position as at 31 December, 2016:

Statement of Financial Position as at 31 December, 2016

| GH¢000 | GH¢000 | |

|---|---|---|

| Non-Current Assets: | ||

| Land and Buildings | 3,200 | |

| Furniture and Fittings | 3,400 | 6,600 |

| Current Assets: | ||

| Trade receivables | 11,200 | |

| Cash and Bank balances | 7,200 | 18,400 |

| Total Assets | 25,000 | |

| Capital accounts: | ||

| B | 8,000 | |

| C | 6,000 | 14,000 |

| Trade payables | 11,000 | |

| Total Capital and Liabilities | 25,000 |

Additional information: At dissolution, the trade receivables realized was GH¢10,800,000, the land and buildings GH¢1,600,000 and the furniture and fittings GH¢3,800,000. The expenses incurred on dissolution were GH¢400,000 and discounts amounted to GH¢800,000 were received from suppliers.

Required: i) Prepare Realisation Account (5 marks)

ii) Prepare Cash Account (3 marks)

iii) Prepare Partners’ Capital Account (2 marks)

b) The objective of IAS 2 Inventories is to prescribe the accounting treatment for inventories and provide guidance for measuring and valuation of inventories. It determines the cost of inventories and subsequent recognition as an expense, including any write-down to net realizable value.

Required: i) Explain Inventories. (3 marks)

ii) Explain how inventories are measured and valued in the financial statements in accordance with IAS 2. (3 marks)

c) In order to enhance the quality of information in financial statements, business transactions are grouped into different classes or categories on the basis of their economic characteristics. The broad classes or categories are called elements of financial statements.

Required: Explain any TWO elements of financial statements in line with the IASB Conceptual Framework for Financial Reporting and identify their criteria for recognition. (4 marks)

Answer

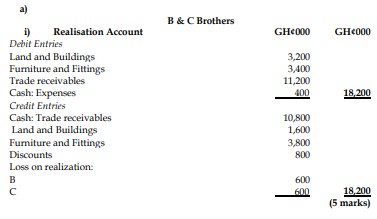

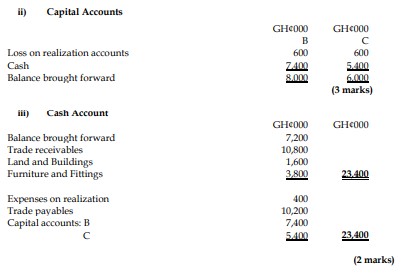

a) i) Realisation Account

b) i) Explain Inventories Inventories, per paragraph 6 of IAS 2, are assets that are:

- Held for sale in the ordinary course of business

- In the process of production for such sale

- In the form of materials or supplies to be consumed in the production process or in the rendering of services.

Inventories per IAS 2 comprise a) Merchandise, b) Production Supplies, c) Materials, d) Work in Progress, e) Finished Goods authorized for issue. (3 marks)

ii) Valuation of Inventories Inventories are measured at the lower of Cost and Net Realizable Value (NRV).

Cost should include all:

- Costs of purchase (including taxes, transport, and handling) net of trade discounts received

- Costs of conversion (including fixed and variable manufacturing overheads)

- Other costs incurred in bringing the inventories to their present location and condition

Net Realizable Value is the estimated selling price in the ordinary course of business, less the estimated cost of completion and the estimated costs necessary to make the sale. (3 marks)

c) Elements of Financial Statement and its recognition criteria Definition of Assets Assets are future economic benefits controlled by the entity as a result of past transactions or other past events.

Criteria for Recognition of Assets:

- It is probable that the future economic benefits embodied in the asset will eventuate; and

- The asset possesses a cost or other value that can be measured reliably.

Definition of Liabilities Liabilities are the future sacrifices of economic benefits that the entity is presently obliged to make to other entities as a result of past transactions or other past events.

Criteria for Recognition of Liabilities:

- It is probable that the future sacrifice of economic benefits will be required; and

- The amount of the liability can be measured reliably.

(Any 2 elements for 4 marks)

- Tags: Dissolution, Financial Reporting, Inventory, Partnership, Realisation Account

- Level: Level 1

- Uploader: Theophilus