- 20 Marks

Question

Paquris Limited is into the manufacture of various products. The following data refer to one of its products for a one-month period:

| Direct material – Units 120,000 | ₦3,000,000 |

| Direct labour – Hours 120,000 | ₦6,600,000 |

| Direct expenses | ₦2,000,000 |

| Variable production overhead | ₦1,500,000 |

| Fixed production overhead | ₦3,600,000 |

| Variable non-production overhead | ₦1,020,000 |

| Fixed non-production overhead | ₦4,740,000 |

| Sales – Units 115,000 | ₦25,300,000 |

| Opening inventory | – |

You are required to:

a. Prepare the statement of profit or loss using full absorption costing. (8 Marks)

b. Prepare the statement of profit or loss using marginal costing. (7 Marks)

c. Prepare closing inventory valuation on both bases. (3 Marks)

d. State and explain the differences between (a) and (b). (2 Marks)

Answer

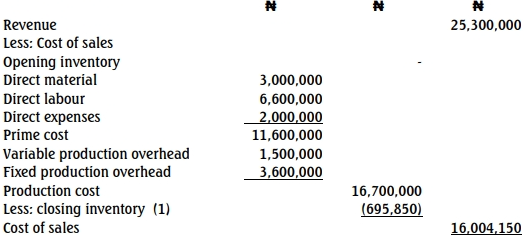

a. Absorption costing

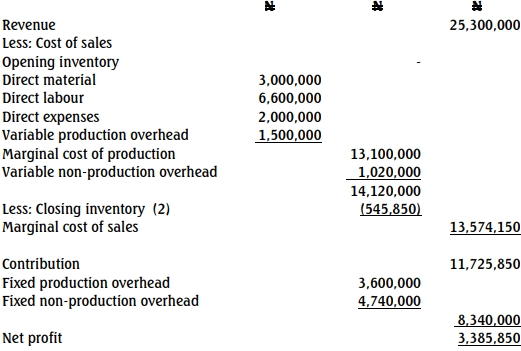

b. Marginal costing

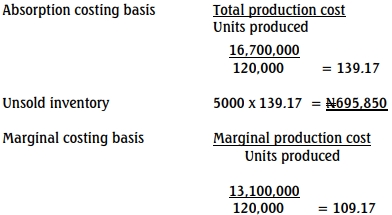

c. Closing inventory valuation

![]()

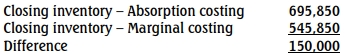

d. Explanation of Differences between Absorption and Marginal Costing

The difference is as a result of the difference in the closing stock.

- Tags: Absorption Costing, Marginal Costing, Profit statements

- Level: Level 1

- Topic: Costing Techniques

- Series: MAY 2022

- Uploader: Kwame Aikins