- 20 Marks

Question

ZY Plc is an all-equity financed, publicly listed company in the food processing industry. The ZY family holds 40% of its ordinary shares, with the remainder owned by large financial institutions. ZY Plc currently has 10 million ₦1 ordinary shares in issue.

Recently, the company secured a long-term contract to supply food products to a large restaurant chain, necessitating an investment in new machinery costing ₦24 million. This machinery will be operational starting January 1, 2022, with payment due the same day, and sales commencing shortly afterward.

The company’s policy is to distribute all profits as dividends. If ZY Plc continues as an all-equity financed company, it will pay an annual dividend of ₦9 million indefinitely, starting December 31, 2022.

To finance the ₦24 million investment, ZY Plc is considering two options:

- A 2-for-5 rights issue, where the annual dividend would remain at ₦9 million. The cum-rights price per share is expected to be ₦6.60.

- Issuing 7.5% irredeemable bonds at par with interest payable annually in arrears. For this option, interest would be paid out of the ₦9 million otherwise allocated to dividends.

Under either financing method, the cost of equity is anticipated to remain at its current rate of 10% annually, with no tax implications.

Required:

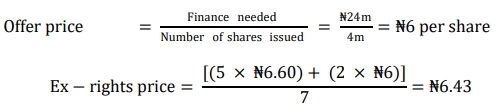

a. Calculate the issue and ex-rights share prices of ZY Plc., assuming a 2-for-5 rights issue is used to finance the new project as of January 1, 2022. Ignore taxation. (4 Marks)

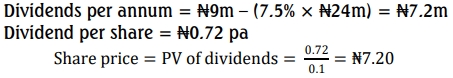

b. Calculate the value per ordinary share in ZY Plc on January 1, 2022, if 7.5% irredeemable bonds are issued to finance the new project. Assume that the cost of equity remains at 10% each year. Ignore taxation. (4 Marks)

c. Write a report to the directors of ZY Plc that includes: i. A comparison and contrast of the rights issue and bond issue methods for raising finance, referencing calculations from parts (a) and (b) and any assumptions. (6 Marks)

ii. A discussion on the appropriateness of the following alternative methods of issuing equity finance in the specific context of ZY Plc: – A placing – An offer for sale – A public offer for subscription (6 Marks)

Answer

a) Rights issue

b) Irredeemable bonds

c. Report to the Directors of ZY Plc

To: Directors of ZY Plc

From: Financial Consultant

Date: [Today’s Date]

Subject: Evaluation of Financing Options for New Machinery Investment

i. Comparison of Rights Issue and Bond Issue Methods of Raising Finance

The rights issue and bond issue methods provide distinct financing benefits and drawbacks:

- Rights Issue:

- Ownership Impact: A rights issue maintains the equity-only structure, avoiding additional debt and preserving a stable financial risk profile.

- Shareholder Wealth: Based on calculations, the ex-rights price (₦6.43) is slightly below the current cum-rights price (₦6.60), causing minimal dilution to share value.

- Control Considerations: By offering shares first to existing shareholders, control is preserved within the existing shareholder base, which may be a priority for the ZY family holding 40% of shares.

- Bond Issue:

- Leverage: Issuing 7.5% irredeemable bonds introduces financial leverage, which may enhance returns on equity but increases the financial risk, especially under fluctuating earnings.

- Cost Efficiency: Bonds incur lower costs initially due to the fixed interest (₦1.8 million annually) compared to dividends, but expose shareholders to the potential for decreased share value if debt levels appear unsustainable.

- Tax Benefits: Although tax was ignored in this scenario, interest payments on bonds would typically be tax-deductible, making bonds more advantageous in taxable environments.

In conclusion, a rights issue aligns well with ZY Plc’s conservative capital structure and dividend policy, minimizing risk and maintaining shareholder control, while the bond issue offers cost benefits at the expense of increased leverage and financial risk.

ii. Appropriateness of Alternative Methods of Issuing Equity Finance for ZY Plc

1. Placing:

- Overview: Involves selling shares to selected institutional investors at a predetermined price, often at a discount.

- Suitability: Low-cost and quick, but may be unsuitable for ZY Plc as it could reduce the control of the ZY family and increase institutional influence, which may not align with the company’s ownership goals.

2. Offer for Sale:

- Overview: Shares are sold to an issuing house, which then sells them to the public, either at a fixed price or through a tender.

- Suitability: Suitable for raising substantial funds from a broad investor base but is costly due to underwriting fees and advertising. It dilutes control more than a rights issue, which may not appeal to existing major shareholders like the ZY family.

3. Public Offer for Subscription:

- Overview: Shares are offered directly to the public by the company, without intermediaries.

- Suitability: While it raises public awareness and can attract diverse investors, it’s costly due to underwriting and marketing needs. It’s also time-consuming and may expose ZY Plc to market volatility, potentially conflicting with the immediate financing need.

In summary, given ZY Plc’s need for quick and cost-effective financing while preserving shareholder control, a rights issue remains the most appropriate method among the options considered.

- Uploader: Kofi