- 20 Marks

Question

You run a financial consultancy firm and have been approached by a new client for advice on a potential acquisition. Kola Plc (KP) is a large engineering company that was listed on the stock market ten years ago, with the founders retaining a 20% stake in the business. KP initially experienced rapid growth in earnings before tax, but soon after listing, competition intensified, leading to a significant decline in growth, which currently stands at 4%. Concerned about limited future growth opportunities, the board has decided to adopt a market development strategy for growth by acquiring companies in less competitive regions using KP’s significant cash reserves. The board has identified Temidayo Engineering (TE) as a potential acquisition target.

Temidayo Engineering (TE):

TE is a private engineering company established eight years ago, with early accumulated losses that have now turned profitable, achieving an 8% annual growth in earnings before tax. Cash reserves remain low, and capital access has been a constraint on TE’s investment potential. The founders and their families own 70% of the shares, while a venture capitalist holds the remaining 30%.

Acquisition Information:

KP’s board prefers that TE’s founders remain as directors post-acquisition and has sufficient cash reserves to purchase TE outright. A cash offer of ₦13.10 per share is considered likely to encourage TE’s shareholders to approve the acquisition. Alternatively, KP’s board is exploring a share-for-share exchange to preserve cash for future acquisitions and dividends. Recent mergers in the industry have attracted a 25-30% acquisition premium, with TE’s shareholders expecting a premium towards the higher end for a share-for-share offer. KP has asked you to design a share-for-share offer scheme with a 30% premium.

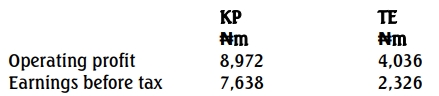

Extracts from the Latest Financial Statements:

Additional Financial Information:

- KP has ₦0.50 ordinary shares totaling ₦7,500 million, with each share trading at ₦5.28. It is expected that KP’s price-to-earnings (P/E) ratio will increase by 10% if the acquisition proceeds.

- TE upgraded its main manufacturing facility last year, expecting annual pre-tax cost savings of ₦50 million from the current financial year. TE has ₦0.25 ordinary shares totaling ₦700 million. TE’s P/E ratio is estimated to be 20% higher than KP’s current P/E ratio based on comparable company analysis.

- KP’s CEO estimates annual pre-tax revenue and cost synergies of ₦304 million post-acquisition, while the finance director anticipates additional pre-tax financial synergies of ₦106 million, though cautiously, following reports that many acquisitions overestimate synergies. The tax rate is 20%.

Required:

a. Discuss possible sources of financial synergy arising from KP’s acquisition of TE. (6 Marks)

b. Advise the directors on a suitable share-for-share exchange offer that meets TE’s shareholders’ criteria and calculate the impact of both cash and share-for-share offers on the post-acquisition wealth of KP’s and TE’s shareholders. (14 Marks)

Answer

a. Possible Sources of Financial Synergy Arising from KP’s Acquisition of TE

Financial synergy in an acquisition often arises from creating value through combining the financial strengths and efficiencies of two companies. In this context, KP’s acquisition of TE offers several potential financial synergies:

- Funding Opportunities: As a private company, TE faces funding constraints, which have limited its growth. KP, with substantial cash reserves, can alleviate this limitation, enabling TE to invest in growth opportunities that were previously unattainable. This could result in increased cash flows and profitability for the combined entity.

- Enhanced Debt Capacity and Lower Cost of Capital: Assuming KP and TE have less-than-perfectly correlated cash flows, combining their operations could result in reduced volatility in overall cash flows. This stability increases the combined firm’s debt capacity and enables it to secure financing at a lower cost, thus enhancing the overall value through a reduced cost of capital.

- Utilization of Tax Losses: TE has unrelieved tax losses from earlier years, which it can utilize more effectively after the acquisition. Although TE can independently offset these losses, the larger combined profit base post-acquisition allows these losses to be applied faster, increasing the present value of tax savings and improving cash flow.

- Diversification Benefits: TE is privately owned, and its shareholders currently face unsystematic risk. By joining KP, which is publicly traded, TE’s shareholders may benefit from risk diversification, potentially lowering the overall cost of capital and enhancing the value of the combined entity.

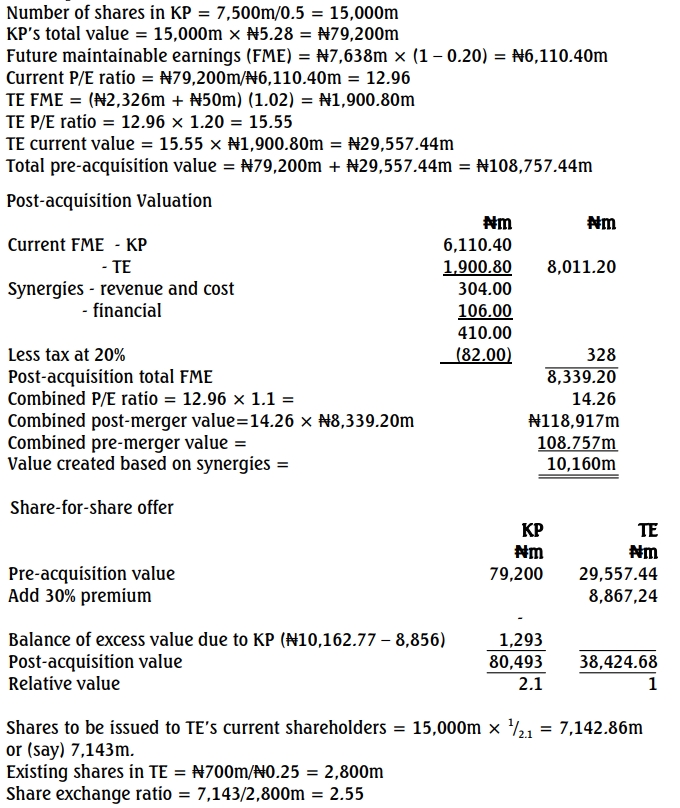

b) Pre-acquisition valuations

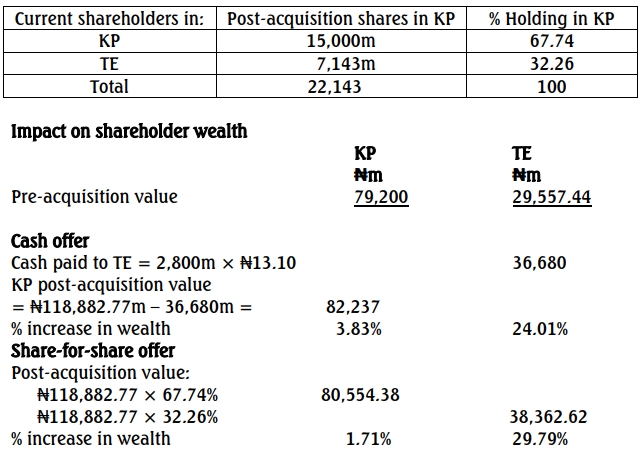

This means that every current share in TE will receive approximately 2.55 shares in KP. The shareholding structure in KP will be as follows:

Thus, the terms of the share-for-share offer meet the criteria specified by the directors of TE.

- Topic: Mergers and acquisitions

- Uploader: Kofi