- 30 Marks

Question

Femi Appliances Limited (FAL) is a Nigerian-based manufacturer of household appliances with many distribution centers across various locations in Nigeria and along the ECOWAS sub-region. FAL is now considering the development of a new motor vehicle vacuum cleaner – VC4.

The product can be introduced quickly and has an expected life of four years, after which it may be replaced with a more efficient model. Costs associated with the product are estimated as follows:

Direct Costs (per unit):

- Labour:

- 3.5 skilled labour hours at ₦500 per hour

- 4 unskilled labour hours at ₦300 per hour

- Materials:

- 6 kilos of material Z at ₦146 per kilo

- Three units of component P at ₦480 per unit

- One unit of component Q at ₦640

- Other variable costs: ₦210 per unit

Indirect Costs:

- Apportionment of management salaries: ₦10,500,000 per year

- Tax allowable depreciation of machinery: ₦21,000,000 per year

- Selling expenses (excluding salaries): ₦16,600,000 per year

- Apportionment of head office costs: ₦5,000,000 per year

- Rental of buildings: ₦10,000,000 per year

- Annual interest charges: ₦10,400,000

- Other annual overheads: ₦7,000,000 (includes building rates ₦2,000,000)

If the new product is introduced, it will be manufactured in an existing factory, having no effect on rates payable. The factory could be rented out for ₦12,000,000 per year to another company if the product is not introduced.

New machinery costing ₦86,000,000 will be required, depreciated on a straight-line basis over four years with a salvage value of ₦2,000,000. The machinery will be financed by a four-year fixed-rate bank loan at 12% interest per year. Additional working capital requirements may be ignored.

The new product will require two additional managers at an annual gross cost of ₦2,500,000 each, while one current manager (₦2,000,000) will be transferred and replaced by a deputy manager at ₦1,700,000 per year. Material Z totaling 70,000 kilos is already in inventory, valued at ₦9,900,000.

FAL will utilize the existing advertising campaigns for distribution centers to also market the new product, saving approximately ₦5,000,000 per year in advertising expenses.

The unit price of the product in the first year will be ₦11,000, with projected demand as follows:

- Year 1: 12,000 units

- Year 2: 17,500 units

- Year 3: 18,000 units

- Year 4: 18,500 units

An inflation rate of 5% per year is anticipated, with prices rising accordingly. Wage costs are expected to increase by 7% per year, and other costs (including rent) by 5% annually. No price or cost increases are expected in the first year of production.

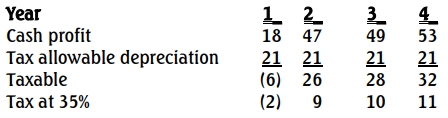

Income tax is set at 35%, payable in the year the profit occurs. Assume all sales and costs are on a cash basis and occur at the end of the year, except for the initial purchase of machinery, which would take place immediately. No inventory will be held at the end of any year.

Required:

a. Calculate the expected internal rate of return (IRR) associated with the manufacture of VC4. Show all workings to the nearest ₦million. (19 Marks)

b. i. Explain what is meant by an asset beta and how it differs from an equity beta. (2 Marks)

ii. Given the company’s equity beta is 1.2, the market return is 15%, and the risk-free rate is 8%, discuss whether introducing the product is advisable. (4 Marks)

c. The company is concerned about a potential increase in corporate tax rates. Advise the directors by how much that the tax rate would have to change before the project is not financially viable. A discount rate of 17% per year may be assumed for part (c). (5 Marks)

Answer

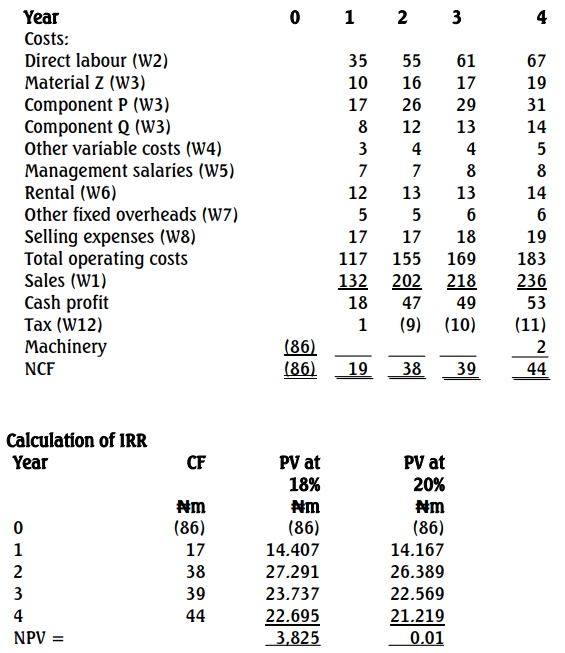

a. Project‘s Cash Flows (₦ million)

At 20%, the NPV is zero and therefore the IRR is approximately 20%.

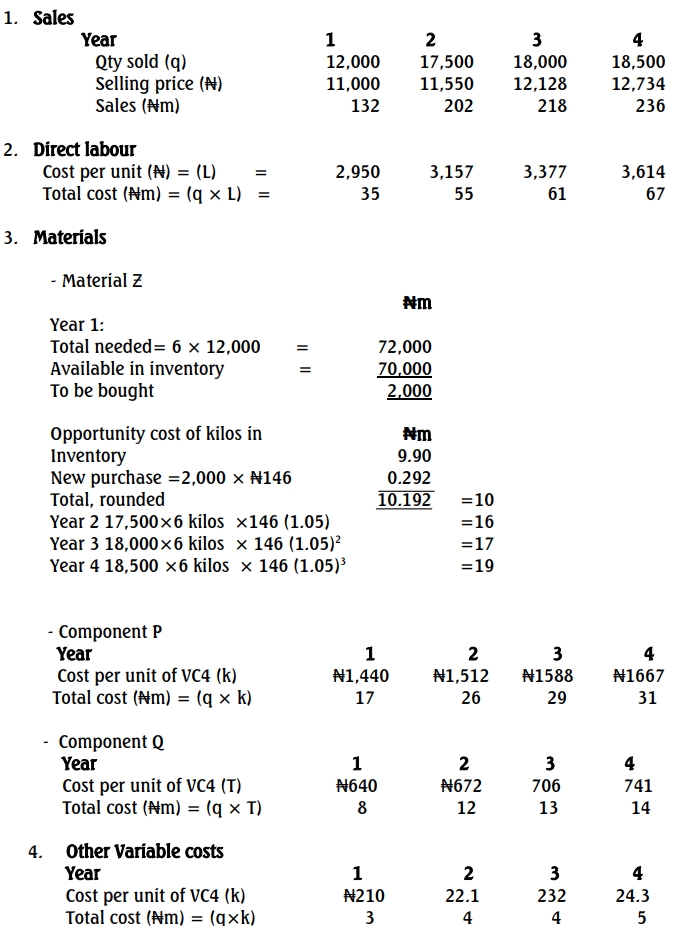

Working notes

5. Management salaries

Only incremental management salaries are relevant, the two new managers plus the replacement deputy manager, costing total ₦6,700,000

(₦5,000,000 + ₦1,700,000) in year 1, increasing by 7% per year

subsequently.

6. Rental

The opportunity rental of ₦12 million is the relevant cost in year 1,

increasing by 5% per year subsequently.

7. Other fixed overhead

The only relevant cost is the amount given (₦7millon) less the apportioned building rates of ₦2m (i.e. ₦5 million in year 1). This will rise by 5% per year subsequently.

8. Selling expenses

These will be ₦16.60 million (rounded to ₦17 million in year 1 and then

rising by 5% per year subsequently.

9. Interest cost

This is ignored as the cost of finance is encompassed within the discount

rate.

10. Apportioned head office costs do not involve cash flow and therefore

irrelevant.

11. Advertisement cost

No incremental cash flow is involved and therefore irrelevant.

12. Tax

b(i). Explanation of Asset Beta vs. Equity Beta

An asset beta reflects the company’s systematic business risk and is the weighted average of the beta of equity and debt, accounting for tax effects if relevant. It captures only the inherent business risk, excluding the financial risk associated with a company’s capital structure. Thus, it measures the company’s exposure to market risk that cannot be diversified away, based solely on the assets.

On the other hand, an equity beta accounts for both systematic business risk and financial risk, as it represents the risk taken on by equity holders in a leveraged company. This beta includes the impact of financial leverage (the proportion of debt financing) on the overall risk profile.

Using the Capital Asset Pricing Model (CAPM), the required return (RiR_iRi) is calculated as:

![]()

b(ii). Analysis of the Project’s Acceptance Based on Required Return and Other Considerations

Given that the internal rate of return (IRR) for the project is 19%, which exceeds the required return of 16.4%, it initially appears that the project is financially viable. However, other considerations should be evaluated:

- Cost of Equity vs. WACC: The required return calculated (16.4%) reflects the cost of equity alone, which is suitable only if the company is entirely equity-financed. However, the project is expected to be funded via a bank loan, introducing financial leverage and financial risk. Thus, the appropriate metric for evaluation should be the weighted average cost of capital (WACC), which accounts for both equity and debt financing costs.

- Beta of Project vs. Beta of Company: The beta used (1.2) is based on the company’s overall risk profile, not the specific risk of the new project. If the new project belongs to a different risk class, both in terms of business and financial risk, then the current beta may not accurately represent the project’s risk, making the required return potentially inappropriate.

- Level of Diversification: If the company lacks sufficient diversification, unsystematic risk may still be a factor for the company. In such a case, management may need to account for some level of unsystematic risk, as the beta derived from CAPM assumes only systematic risk.

- Problems with CAPM: The CAPM model, while widely used, has both theoretical limitations and practical issues in terms of data collection. As a result, the calculated required rate of return might not perfectly reflect the true return needed for this project, leading to potential misalignment with the actual cost of capital.

- Non-Financial Factors: Non-financial considerations could also significantly impact the investment decision. Factors such as strategic positioning, brand value, environmental impact, and long-term company goals may justify undertaking the project even if financial metrics alone suggest otherwise.

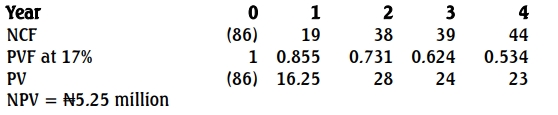

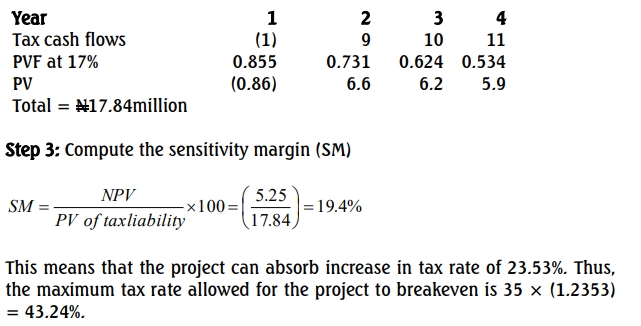

c) Step 1: Compute the NPV of the project, using discount rate of 17%.

Step 2: Calculate, at 17%, the present value of tax liability.

- Topic: Strategic Cost Management

- Uploader: Kofi