- 15 Marks

Question

Kuku Plc. had a need for a machine. After four years of purchase, the machine will no longer be capable of efficient working at the level of use by the company. The company typically replaces machines every four years. The production manager has noted that in the fourth year, the machine will require additional maintenance to maintain normal efficiency. This raises the question of whether the machine should be replaced after three years instead of four years, as per company practice.

Relevant information is as follows:

(i) A new machine will cost N240,000. If retained for four years, it will have zero scrap value at the end. If retained for three years, it will have an estimated disposal value of N30,000. The machine qualifies for capital allowance of 20% on a reducing balance basis each year, except in the last year. In the final year, if the disposal proceeds are less than the tax written-down value, the difference will be an additional tax relief.

The machine is assumed to be bought and disposed of on the last day of the company’s accounting year.

(ii) The company tax rate is 30%, payable on the last day of the relevant accounting year.

(iii) Maintenance costs are covered by the supplier in the first year. In the second and third years, maintenance costs average N30,000 annually. In the fourth year, they increase to N60,000. Maintenance costs are tax-allowable and payable on the first day of the accounting year.

(iv) The company’s cost of capital is 15%.

Required:

a. Prepare calculations to determine whether it is economically beneficial to replace the machine after three years or four years. (12 Marks)

b. Discuss two additional factors that could influence the company’s replacement decision, including any potential weaknesses in the decision criteria. (3 Marks)

Answer

(a)

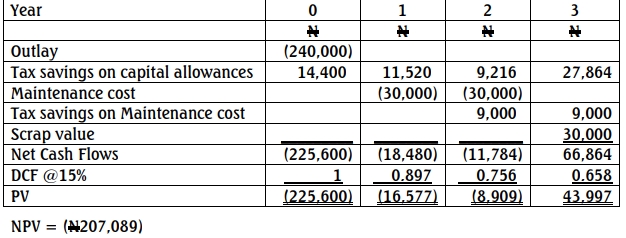

3-Year Life

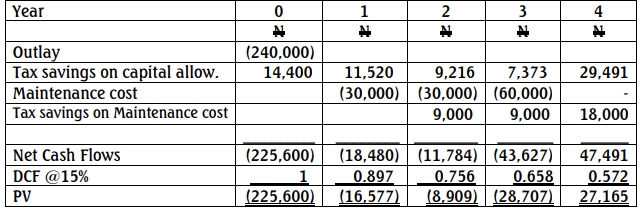

4-Year Life

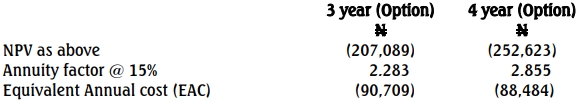

Summary:

Recommendation: A four-year life is marginally more economical and should therefore be adopted.

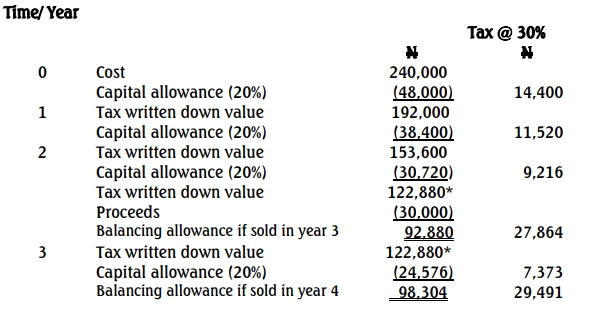

WORKINGS

*Represents tax written down value if machine is not sold at the end of the 3rd year.

b. Relevant Issues

- Price Changes: The analysis in (a) ignores price changes of all descriptions as a change in the price of a new machine could easily alter the conclusion. The same applies to all input factors.

- Machine Replacement Assumptions: The approach assumes that replacement will occur with an identical machine. The machine may become technologically outdated, or the company may no longer need such a machine. Realistically, not many assets are replaced with identical models continually.

- Timing of Cash Outflows: Payments every fourth year might pose fewer cash flow challenges than payments every third year.

- Uploader: Kofi