- 20 Marks

Question

You are the Financial Director of Kudi Limited, a Nigerian company that imports raw materials mainly from Tiko (currency: T$) and exports finished products to Katuga (currency: K$). Kudi is partly financed by a loan raised in the domestic market and usually hedges its foreign currency exposure using forward or money markets. Most customers are allowed a 3-month credit. The company recently sold products to a customer in Katuga for K$20 million.

Available Information:

| Exchange Rate | K$ per N | T$ per N |

|---|---|---|

| Spot Rate | 1.9600 | 1.4600 |

| 1 Month Forward | 1.9580 | 1.4579 |

| Central Bank Base Rate Per Annum | Nigeria | Katuga | Tiko |

|---|---|---|---|

| Rate (%) | 5.5% | 4.25% | 3.75% |

Required:

(a) Comment on the Interest Rate Parity (IRP) and Purchasing Power Parity (PPP) methods for estimating exchange rates. (6 Marks)

In answering the following questions, include relevant calculations:

- Given that interest rates are higher in Nigeria than in Tiko, should T$ be depreciating against the naira and thus trading at a discount? (3 Marks)

- Determine the 3-month K$ forward rate of exchange implied by the given information and calculate the naira receipts expected in 3 months from the customer in Katuga. (3 Marks)

- Assess whether buying T$ on the spot market now and placing it on deposit would be a sensible policy for Kudi. (3 Marks)

(b) Discuss the concept and significance of foreign exchange economic exposure for a multinational company. (5 Marks)

(Total 20 Marks)

Answer

(a) Interest Rate Parity (IRP) and Purchasing Power Parity (PPP)

- Interest Rate Parity (IRP): IRP suggests that the difference in interest rates between two countries should be equal to the expected change in exchange rates between their currencies. With Nigeria’s interest rate higher than Tiko’s, T$ should theoretically depreciate against the naira. This relationship provides a basis for estimating future exchange rates based on interest rate differentials.

- Purchasing Power Parity (PPP): PPP postulates that exchange rates will adjust to offset differences in inflation between two countries. If Nigeria has higher inflation than Tiko, the naira should depreciate against T$ over time to maintain equal purchasing power.

(i) Impact of Higher Interest Rates in Nigeria on T$

Since Nigeria’s interest rate is higher than Tiko’s, T$ should theoretically depreciate against the naira due to the IRP, leading T$ to trade at a discount.

(ii) 3-Month K$ Forward Rate Calculation

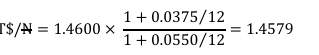

Using IRP formula:

Forward Rate =

(iii) Spot Market Strategy for T$ Purchase

A sensible policy would be to buy T$ on the spot market and place it on deposit, benefitting from the interest rate differential. This approach provides Kudi with available funds when required, potentially reducing foreign exchange exposure.

(b) Foreign Exchange Economic Exposure

Economic exposure reflects the risk that a firm’s market value will be affected by unexpected exchange rate movements. For Kudi, this means that currency fluctuations in T$ and K$ affect its costs, revenues, and competitive position, impacting long-term profitability and cash flows.

- Topic: Foreign Exchange Risk Management

- Series: NOV 2017

- Uploader: Dotse