- 20 Marks

Question

Syntax Plc., a fertilizer company, is concerned about fluctuating sales and earnings. This caused the management of the company to consider acquisition of another company in the same line of business.

In order to boost its sales and stabilize its earnings, Syntax Plc.’s management has identified Synapse Chemical Company Plc. as a possible target. Syntax proposed to acquire Synapse for a consideration of N20 million, which was agreed to by both companies.

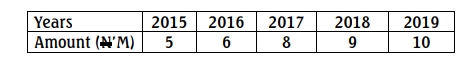

Synapse’s expected future profits, as projected from its past financial records, are as follows:

Forecast Profits

| Year | Revenue (N’m) | Cost of Sales (N’m) | Other Expenses (N’m) | Depreciation (N’m) | Total Expenses (N’m) | Profit Before Tax (N’m) |

|---|---|---|---|---|---|---|

| 2015 | 60 | 30 | 15 | 5 | 50 | 10 |

| 2016 | 70 | 35 | 15 | 4 | 54 | 16 |

| 2017 | 78 | 39 | 15 | 4 | 58 | 20 |

| 2018 | 86 | 43 | 15 | 4 | 62 | 24 |

| 2019 | 94 | 47 | 15 | 4 | 66 | 28 |

The following information is relevant:

- The forecast profits have been limited to five years.

- All sales are for cash.

- The net book value of Synapse’s assets of N2 million is intended to be sold for N1 million in 2015. The expected loss from the disposal of these assets has been included in the depreciation for 2015. These assets currently have a tax written down value of N3 million. Capital allowances were claimed as at when due.

- Synapse currently has a tax liability of N4.5 million due for payment in 2015.

- The interest charges of N1 million of Synapse Plc. have been included in other expenses.

- In order to maintain the future earnings forecast of Synapse Chemical Company, Syntax Plc. needs to invest in capital expenditure.

7. Company income tax is currently at 30 percent, and the tax delay is one year.

8. The after-tax weighted average cost of capital has been calculated at 22%.

The management of Syntax Plc. has asked you, as a Financial Expert, to appraise the intended acquisition of Synapse Chemical Company Plc. and advise on the reasonableness of the acquisition. Your advice should be in the form of a report to the Board of Directors of Syntax Plc.

Answer

Report to the Board of Directors of Syntax Plc.

Subject: Appraisal of the Proposed Acquisition of Synapse Chemical Company Plc.

Introduction

The objective of this report is to assess the financial and strategic viability of acquiring Synapse Chemical Company Plc. The analysis evaluates the reasonableness of the proposed acquisition price of N20 million using a discounted cash flow (DCF) valuation approach and incorporates relevant financial data, tax implications, and future investment requirements.

Analysis

- Valuation Using Discounted Cash Flow (DCF):

The projected profits before tax (PBT) are adjusted for taxation and reinvestment requirements to calculate net cash flows. These cash flows are then discounted using the 22% after-tax weighted average cost of capital (WACC).- Net Operating Cash Flow (NOCF) Calculation:

Net cash flows are derived by adjusting PBT for tax and adding back depreciation.Year PBT (N’m) Tax @ 30% (N’m) Depreciation (N’m) NOCF (N’m) 2015 10 (3.0) 5 12.0 2016 16 (4.8) 4 15.2 2017 20 (6.0) 4 18.0 2018 24 (7.2) 4 20.8 2019 28 (8.4) 4 23.6 - Present Value (PV) of NOCFs:

Cash flows are discounted using WACC (22%).Year NOCF (N’m) Discount Factor @ 22% PV (N’m) 2015 12.0 0.820 9.84 2016 15.2 0.672 10.22 2017 18.0 0.551 9.92 2018 20.8 0.451 9.38 2019 23.6 0.369 8.71 Total PV of Cash Flows = N48.07 million

- Deduct Liabilities:

Synapse has an outstanding tax liability of N4.5 million, reducing the net valuation to N43.57 million.

- Net Operating Cash Flow (NOCF) Calculation:

- Comparison with Acquisition Price:

The valuation (N43.57 million) exceeds the proposed acquisition price of N20 million, indicating that the acquisition is reasonably priced and financially justifiable.

Strategic Considerations

- Market Expansion: Synapse’s acquisition aligns with Syntax’s strategy to stabilize earnings and boost sales in the fertilizer market.

- Earnings Stability: The forecast cash flows demonstrate consistent growth, contributing to Syntax’s financial resilience.

- Synergies: Operational and financial synergies can enhance profitability post-acquisition.

Recommendations

Based on the analysis, the acquisition of Synapse Chemical Company Plc. at N20 million is financially reasonable and strategically beneficial. It is recommended that Syntax Plc. proceed with the acquisition, subject to:

- Verification of Synapse’s financial projections and assumptions.

- Assurance of timely tax compliance and liability settlement.

- Post-acquisition integration planning to maximize synergies.

Conclusion

The acquisition presents an opportunity for Syntax Plc. to achieve its objectives of stabilizing earnings and expanding market share. The proposed price is below the calculated valuation, ensuring value for shareholders.

- Topic: Mergers and acquisitions

- Series: NOV 2014

- Uploader: Dotse