- 20 Marks

Question

The directors of Kenny plc wish to make an equity issue to finance an ₦800 million expansion scheme, with an expected net present value of ₦110 million. It is also to re-finance an existing 15% term loan of ₦500 million and pay off a penalty of ₦35 million for early redemption of the loan.

Kenny has obtained approval from its shareholders to suspend their pre-emptive rights and for the company to make a ₦1,500 million placement of shares, which will be at the price of 185 kobo per share. Issue costs are estimated to be 4 per cent of gross proceeds. Any surplus funds from the issue will be invested in commercial paper, which is currently yielding 9 per cent per year.

Kenny’s current capital structure is summarised below:

| ₦ million | |

|---|---|

| Ordinary shares (25 kobo per share) | 800 |

| Share premium | 1,120 |

| Revenue reserves | 2,310 |

| Total Equity | 4,230 |

| 15% term loan | 500 |

| 11% bond | 900 |

| Total Capital | 5,630 |

The company’s current share price is 190 kobo, and bond price is ₦102. Kenny can raise bond or medium-term bank finance at 10 per cent per year.

The stock market may be assumed to be semi-strong form efficient, and no information about the proposed uses of funds from the issue has been made available to the public.

Taxation may be ignored.

Required:

a. Discuss FOUR factors that Kenny’s directors should have considered before deciding which form of financing to use. (6 Marks)

b. Explain what is meant by pre-emptive rights, and discuss their advantages and disadvantages. (4 Marks)

c. Estimate Kenny’s expected share price once full details of the placement, and the uses to which the finance is to be put, are announced. (8 Marks)

d. Suggest two reasons why the share price might not move to the price that you estimated in (c) above. (2 Marks)

Answer

a) Factors Kenny’s Directors Should Consider When Choosing Between Alternative Forms of Finance:

- Cost:

- The cost of each financing source should reflect its risk and appropriateness for the company. While debt is typically cheaper than equity, it does not always make it the better option.

- Cost influences the company’s overall cost of capital and, subsequently, the market value of its shares. The objective should be to select the financing method that minimizes the overall cost of capital.

- Risk:

- Financing affects the company’s financial risk profile, which can be assessed using measures such as financial gearing, interest cover, cash-flow cover, and the company’s beta coefficient (systematic risk).

- Control:

- The choice of financing impacts the ownership and control structure of the company. Equity financing could dilute existing shareholders’ control, whereas debt financing would not affect ownership.

- Market Conditions:

- Prevailing market trends can influence the financing choice. For example, falling share prices may reduce the success of an equity issue, and expected declines in interest rates might make a fixed-rate debt issue unattractive.

- Speed of Raising Finance:

- Urgency may dictate the financing method. Some forms of financing can be secured more quickly than others, making speed an overriding factor in decision-making.

- Flexibility:

- Financing options should offer flexibility, such as the ability to redeem easily, switch to another form (e.g., interest rate swaps), or manage obligations effectively.

b) Pre-emptive Rights:

Definition:

Pre-emptive rights mean that companies wishing to issue additional equity shares for cash must first offer these shares to existing shareholders in proportion to their current holdings.

Advantages of Pre-emptive Rights:

- Maintenance of Ownership Percentage:

- Pre-emptive rights allow shareholders to maintain their percentage ownership in the company.

- This is particularly important for companies controlled by a few large investors or institutional shareholders.

- Fair Pricing for Existing Shareholders:

- Without pre-emptive rights, companies might have to offer new shares at a lower price to attract new investors, potentially diluting existing shareholders’ value.

Disadvantages of Pre-emptive Rights:

- Restrictive Practice:

- Pre-emptive rights can be seen as a restrictive practice that may no longer align with the fast-paced and dynamic nature of modern stock markets.

- Delays in Raising Finance:

- Companies may face delays and higher costs when raising finance if pre-emptive rights are enforced, as opposed to faster methods like private placements.

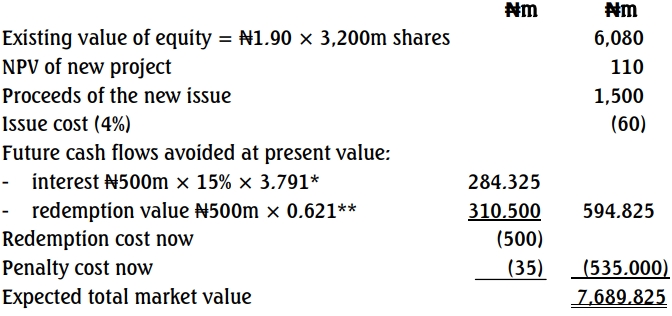

c) Estimation of Kenny’s Expected Share Price Post-Announcement

In a semi-strong efficient market, the share price should reflect all publicly available information, including the impact of the expansion scheme and the refinancing of the term loan.

* Annuity factor at 10% for 5 years

** PV factor at 10% for year 5

The appropriate discounting rate to use is the rate of interest at which the company can otherwise borrow equivalent amount.

d. i) Changes in factors affecting the value of the company‟s shares between the setting of the terms of issue and the issue date.

ii) existing shareholder reaction to the issue.

iii) the effect of the extra volume of shares on their marketability.

iv) whether forecast earnings from the new funds are considered realistic by the

market.

- Tags: Equity Issue, Market Efficiency, NPV, Pre-emptive rights, Share Valuation

- Level: Level 3

- Uploader: Kofi