- 40 Marks

Question

Palemo Temidayo (PT) is a large engineering company listed on the stock market. The company is considering the purchase of Zinco, an unlisted company that produces a number of engineering components.

The board of directors is concerned about the appropriate price to pay for Zinco. As a starting point, it has been decided to provide a range of valuations based on different industry-recognized techniques.

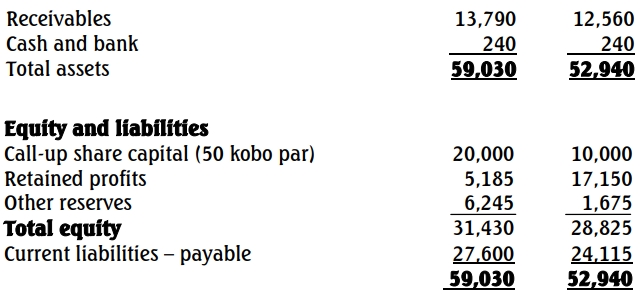

Summarized financial statements of Zinco Limited for the last two years are shown below:

Statements of Profit or Loss for the years ended 30 June

| 2020 (N’000) | 2019 (N’000) | |

|---|---|---|

| Sales Revenue | 112,400 | 101,090 |

| Opening Profit before exceptional items | 6,510 | 4,100 |

| Exceptional Items | (10,025) | – |

| Interest Paid (Net) | (1,400) | (890) |

| Profit/(Loss) before Tax | (4,915) | 3,210 |

| Taxation | (1,050) | (890) |

| Profit/(Loss) after Tax | (5,965) | 2,320 |

| Note: Dividend | 1,000 | 500 |

Statement of Financial Position as at 31 March (N’000)

Additional Information Relating to Zinco:

- If the acquisition succeeds, there will be revenue synergy leading to an increase in annual sales revenue of Zinco of 25% for three years, and 10% per year thereafter.

- Non-cash expenses, including depreciation, were N4,100,000 in 2020.

- Income tax rate is 30% p.a.

- Capital expenditure was N5 million in 2020 and is expected to grow at approximately the same rate as revenue.

- Working capital, interest payments, and non-cash expenses are expected to increase at the same rate as revenue.

- Zinco has a patent with a current market value of N50 million. This has not been included in the non-current assets.

- Operating profit is expected to be approximately 8% of revenue in 2021 and to remain at the same percentage in future years.

- Dividends are expected to grow at the same rate as revenue.

- The realizable value of inventory is expected to be 70% of its book value.

- The estimated cost of equity is 12%.

- The average P/E ratio of listed companies of similar size to Zinco is 30:1.

- Average earnings growth in the industry is 6% per year.

Required:

a. Prepare a report that gives an estimate of Zinco using:

(i) Asset-based valuation (8 Marks)

(ii) P/E ratios (6 Marks)

(iii) Dividend-based valuation (6 Marks)

(iv) The present value of expected future cash flows (5 Marks)

(v) Discuss the potential accuracy of each of the methods used and recommend, with reasons, a value or range of values that PT might bid for Zinco. State clearly any assumptions that you make.

b. The directors of PT are considering issuing some ₦100 nominal value ten-year bonds to finance the purchase of Zinco. To make the bonds look attractive to potential investors, the bonds are to be issued at a discount of 10%. Based on PT’s credit rating, investors are expected to require a return of 7% per year from such bonds.

You are required:

To estimate the coupon rate that PT will have to pay on these bonds in order to satisfy the investors. (5 Marks)

Answer

a. Report

The valuation of private companies involves considerable subjectivity. Many alternative solutions to the one presented below are possible and equally valid.

As PT is considering the purchase of Zinco, this will involve gaining ownership through the purchase of Zinco’s shares; hence an equity valuation is required.

Before undertaking any valuations, it is advisable to recalculate the earnings for 2020 without the exceptional item. It is assumed that this is a one-off expense, which was not fully tax allowable.

The revised profit or loss is:

| 2020 (₦’000) | |

|---|---|

| Sales revenue | 112,400 |

| Operating profit before exceptional items | 6,510 |

| Interest paid (net) | (1,400) |

| Profit before tax | 5,110 |

| Taxation (30%) | (1,533) |

| Profit after tax | 3,577 |

| Dividend | 1,000 |

| Change in equity | 2,577 |

Estimated value = ₦3,577,000 x 30 = ₦107,310,000

(i) Asset-based valuation (8 Marks)

An asset valuation might be regarded as the absolute minimum value of the company. Asset-based valuations are most useful when the company is being liquidated and the assets disposed of. In an acquisition, where the company is a going concern, asset-based values do not fully value future cash flows or items such as the value of human capital, market position, etc.

Asset values may be estimated using book values, replacement cost values, or disposal values. The information provided does not permit a full disposal value, although some adjustments to book value are possible. In this case, an asset valuation might be:

This value is not likely to be accurate as it assumes the economic value of non-current assets is the same as book value, which is very unlikely. The same argument may also be related to current assets and liabilities other than inventory.

(ii) P/E ratios (6 Marks)

P/E ratios of companies are sometimes used to value unlisted companies. This is problematic as the characteristics of all companies differ, and a P/E ratio valid for one company might not be relevant to another.

There is also a question of whether the P/E ratio should be adjusted downwards for an unlisted company and how different expected growth rates should be allowed for.

Expected earnings growth for Zinco is much higher than the average for the industry, especially during the next three years. In view of this, it might be reasonable to apply a P/E ratio of at least the industry average when attempting to value Zinco.

The after-tax earnings of Zinco, based upon the revised statement of profit or loss, are ₦3,577,000.

Using a P/E ratio of 30, this gives an estimated value of ₦3,577,000 × 30 = ₦107,310,000.

It could be argued that the value should be based upon the anticipated earnings rather than the past earnings months ago.

This is estimated to be:

This is a much higher value. P/E-based valuation might also be criticized as it is based upon profits rather than cash flows.

(iii) Dividend-based valuation (6 Marks)

Dividend-based valuation assumes that the value of the company may be estimated as the present value of future dividends.

Using 2-Stage Dividend Model:

Total value = ₦80,213

This is a relatively low estimated value due to Zinco’s low dividend payout ratio and no final liquidating dividend value.

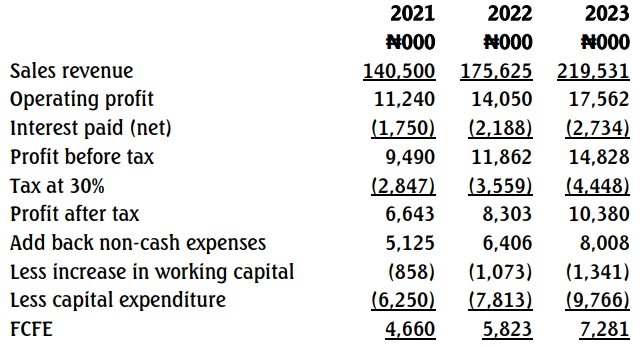

(iv) The Present Value of Expected Future Cash Flows (5 Marks)

The present value of FCFE is computed as follows:

Recommended Valuation

The minimum value is the adjusted asset value of ₦76,880,000, and the maximum is approximately ₦299,021,000.

b. Estimation of Coupon Rate (5 Marks)

- Tags: Asset-Based Valuation, Bond pricing, Discounted Cash Flow, Dividend valuation, P/E Ratio

- Level: Level 3

- Uploader: Kofi