- 15 Marks

Question

b. Emeka has been in business as a Japan spare part dealer. The last statement of financial position of his business as at September 30, 2019, is given below:

| N’000 | N’000 | |

|---|---|---|

| Equity | ||

| Capital | 1,000 | |

| Retained earnings | 130 | |

| 1,130 | ||

| Drawings | (60) | |

| 1,070 | ||

| Non-current assets: | ||

| PPE | 1,100 | |

| Current assets: | ||

| Inventories | 190 | |

| Trade payables | 40 | |

| Bank | 45 | |

| 1,375 | 1,375 |

On October 1, 2019, he agreed with Bode to join him, and the new business will trade under the name and style EmBo Ventures.

Terms of the new business:

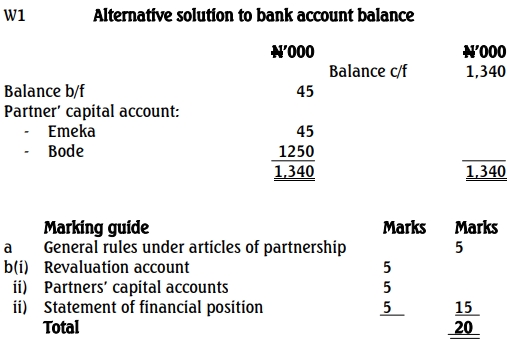

- Bode is to contribute capital of N1,250,000 for an equal share of profits.

- The firm will take over the assets and liabilities of Emeka at their book values, except for:

- PPE: N1,250,000

- Inventories: N175,000

- The partners will maintain equal capital, and any shortfall in Emeka’s capital should be made good by credit from revaluation or through additional funds.

Required:

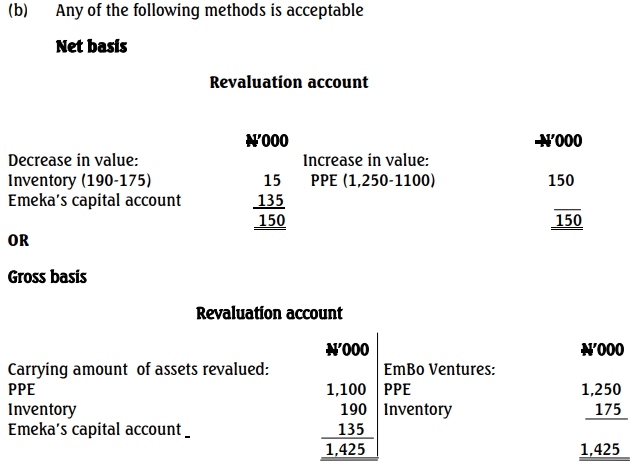

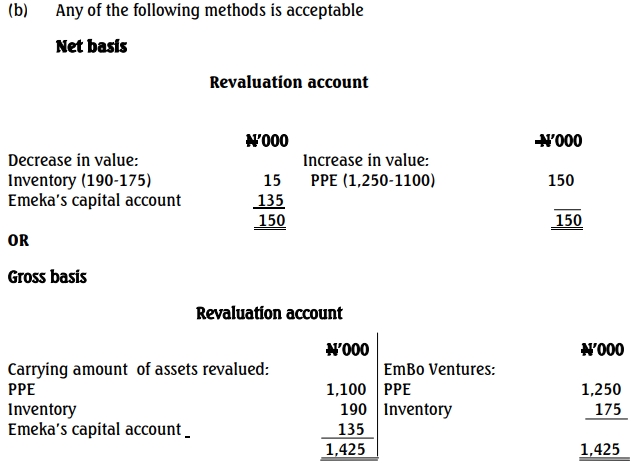

Prepare for EmBo Ventures: i. Revaluation account (5 Marks)

ii. Partners’ capital accounts (5 Marks)

iii. Statement of financial position as at October 1, 2019 (5 Marks)

(Total: 15 Marks)

Answer

- Tags: Capital Accounts, Partnership, Revaluation, Statement of Financial Position

- Level: Level 1

- Uploader: Dotse