- 20 Marks

Question

a. Bank Statement is a mirror of any entity’s cash book, and they are expected to have equal balances at any point in time. However, this is not usually the case. Based on the ongoing statement, state five reasons that could cause the bank statement balance to differ from the cash book balance. (5 Marks)

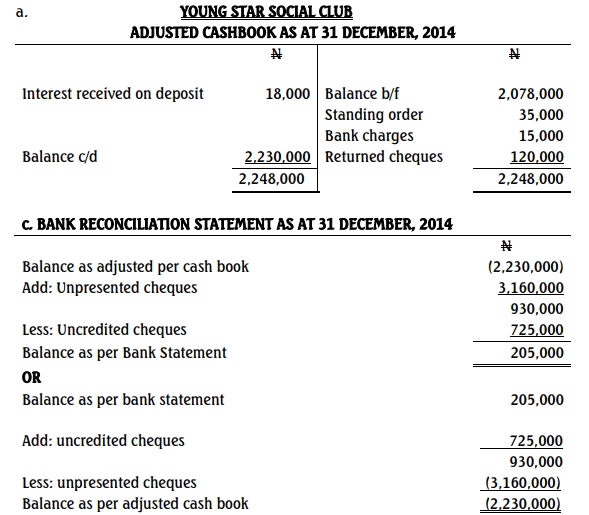

b. The Treasurer of Young Star Social Club (YSSC) did not keep proper records for receipts and payments for the month of December 2014, causing mistrust among members. He has decided to seek your assistance to prepare a bank reconciliation statement before presenting the account to the club members.

The bank statement and the receipts and payments cash book of the club on December 31, 2014, showed a credit balance of N205,000 and N2,078,000, respectively. A comparison of the bank statement with the receipts and payment cash book of the club revealed the following:

i. Cheque drawn but not presented N3,160,000

ii. Amount lodged in the bank but not credited N725,000

iii. Entries in bank statement not recorded in receipts and payments cash book:

- Standing order for loan refund N35,000

- Interest received on deposit account N18,000

- Bank charges N15,000

- Cheque paid-in but returned with “refer to drawer” N120,000

Required:

i. Prepare an adjusted cash book as at December 31, 2014; (8 Marks)

ii. Prepare the Bank Reconciliation Statement showing the balance on December 31, 2014. (7 Marks)

(Total 20 Marks)

Answer

a. Reasons for Discrepancy (5 Marks)

- Unpresented cheques: Cheques issued but not yet presented for payment.

- Uncredited cheques: Deposits made but not yet credited by the bank.

- Bank charges: Charges imposed by the bank, not yet recorded in the cash book.

- Direct debits or standing orders: Payments made directly from the bank account on instruction.

- Dishonoured cheques: Cheques lodged but returned unpaid by the bank.

- Tags: Adjustments, Bank Statement, Cash Book, Reconciliation

- Level: Level 1

- Topic: Bank reconciliations

- Series: NOV 2015

- Uploader: Dotse