- 15 Marks

Question

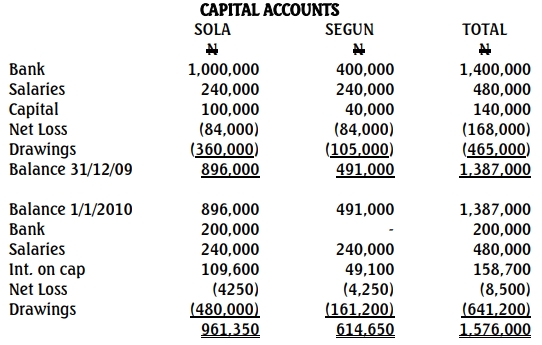

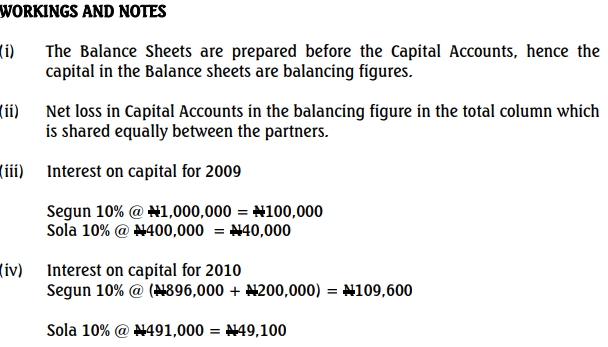

Segun and Sola went into partnership on 1 January 2009. The partnership agreement specifies that both partners should maintain Capital Accounts without Current Accounts. Each partner will be entitled to salary of N240,000 per annum and interest of 10% on capital at the end of the year. Profits and losses are to be shared equally after salaries and interest on capital have been taken into account.

Sola introduced capital of N1,000,000 on 1 January 2009 and N200,000 on 1 January 2010. He withdrew N360,000 from the business in 2009 and N480,000 in 2010.

Segun introduced capital of N400,000 on 1 January 2009. He withdrew N105,000 from the business in 2009 and N161,200 in 2010. The partnership did not keep proper books of accounts in 2009 and 2010.

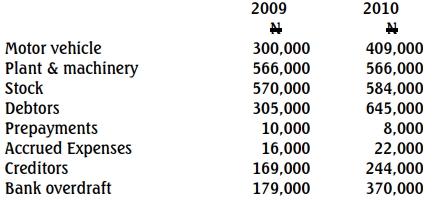

However, the assets and liabilities of the partnership for the two years ended 31

December 2010 are as follows:

You are required to

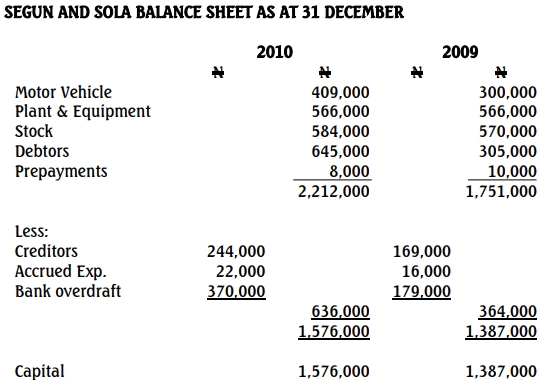

Prepare in vertical format, the comparative Balance Sheets and Capital Accounts of the partners at the end of 2009 and 2010 based on the above information.

Answer

- Tags: Partnership Accounting, Partnership Agreement

- Level: Level 1

- Uploader: Theophilus