- 20 Marks

Question

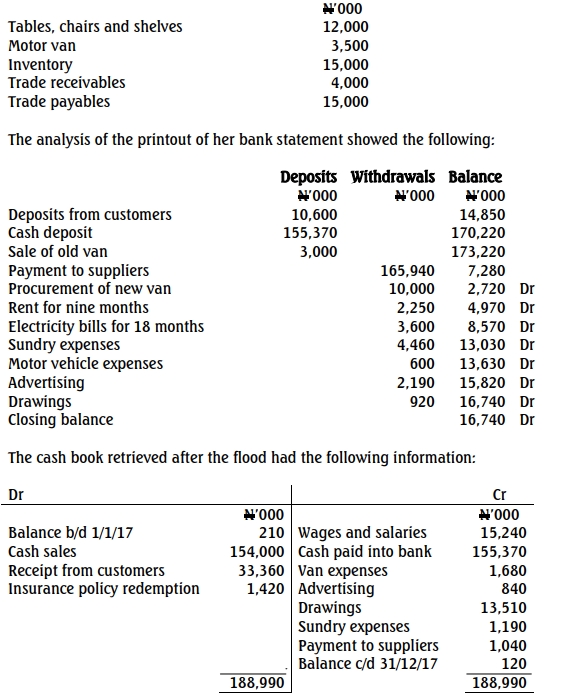

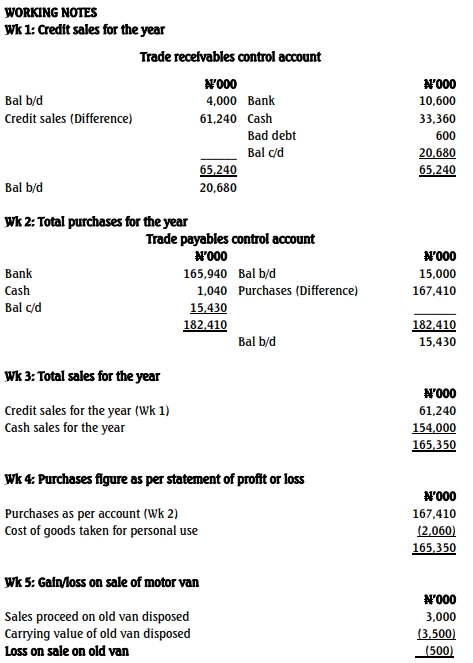

Peju runs a big grocery store in Ibadan, but many of her accounting records were destroyed by a flood incident close to the end of the financial year of the business. From the records that were retrieved after the incident, the following balances were gathered in respect to her assets and liabilities at the beginning of the year:

In addition, you were informed that:

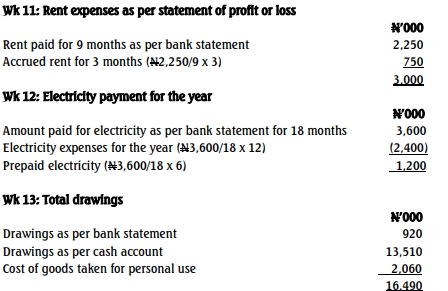

(i) Inventory was valued at N46,510,000, trade receivables at N20,680,000, and trade payables at N15,430,000.

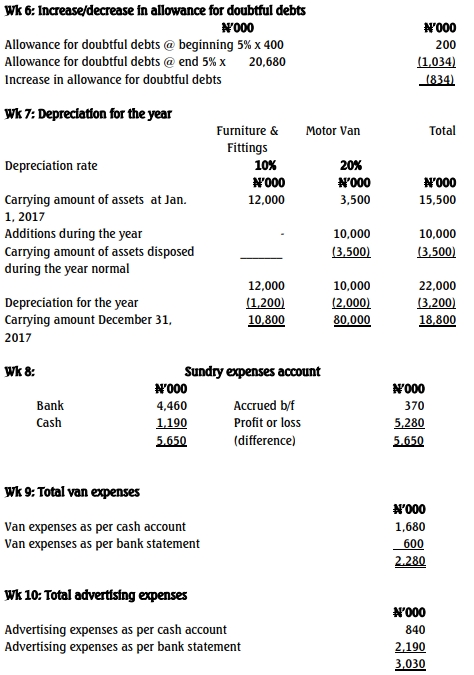

(ii) Sundry expenses accrued amounted to N370,000 for 2016.

(iii) Depreciation is to be provided as follows: furniture and fittings 10% and motor vehicle 20% on reducing balance method.

(iv) Peju took some groceries from the store costing N2,060,000. She is yet to pay.

(v) Allowances for doubtful debts are raised at the beginning and end of the year at 5%. Bad debts of N600,000 had been written off the trade receivables as at December 31, 2017.

(vi) The insurance policy redeemed was to be used as additional capital.

Required:

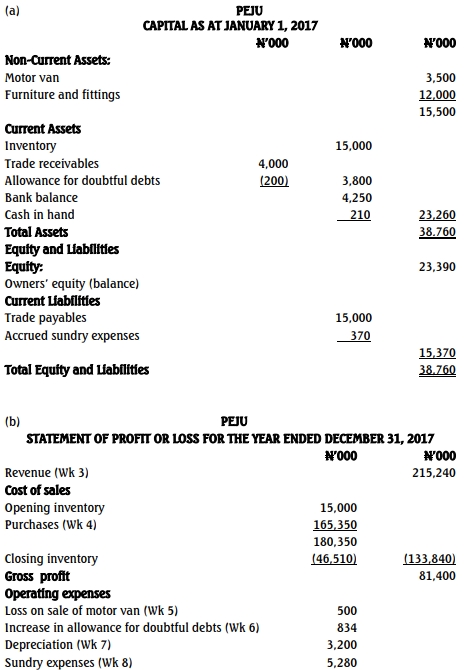

a. Calculate the capital as at January 1, 2017. (6 Marks)

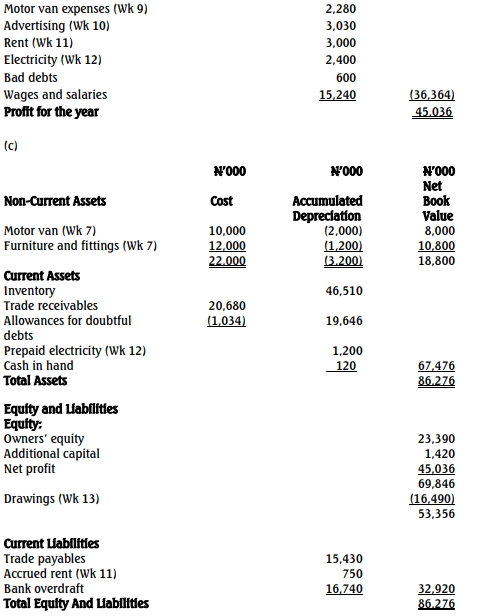

b. Prepare the statement of profit or loss for the year ended December 31, 2017. (8 Marks)

c. Prepare the statement of financial position as at December 31, 2017. (6 Marks)

Answer

- Tags: Financial Position, Incomplete Records, Profit or Loss

- Level: Level 1

- Topic: Accounting from Incomplete Records

- Series: MAY 2018

- Uploader: Theophilus