- 20 Marks

Question

CASHIO Limited must choose between two investments, Project ABUWA and Project BRIWA. It cannot undertake both investments. The expected cash flows for each project are:

| Year | Project ABUWA (₦) | Project BRIWA (₦) |

|---|---|---|

| 0 | (800,000) | (800,000) |

| 1 | 200,000 | 600,000 |

| 2 | 360,000 | 240,000 |

| 3 | 360,000 | 20,000 |

| 4 | 170,000 | – |

The company has a policy that the maximum permissible payback period for an investment is three years and if a choice has to be made between the two projects, the project with the earlier payback will be chosen.

a. Calculate the payback period for each project:

i. Assuming that cash flows occur at year-end

ii. Assuming that cash flows after Year 0 occur at a constant rate throughout each year (16 Marks)

b. Which project should be selected according to the company’s payback rule? (2 Marks)

c. State the reasons for your decision in (b) above. (2 Marks)

Answer

PROJECT ABUWA

(a)

i. Assuming that cash flows occur at year end

Pay Back Period = A + B/C

Where;

A = the last year with a negative cumulative cash flow

B= the absolute value of cumulative net cash flow at the end of the period A(the last year with a negative cumulative cash flow)

C = the total cash inflow during the period following period A

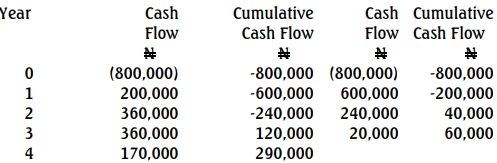

Workings:

(i) Assuming cash flows occur at a constant rate throughout the year:

Project ABUWA will pay back after

2 years + {(240,000 /360,000) x 12 months}

=2 years 8 months

Project BRIWA will pay back after

1 year + {(200,000 /240,000) x 12 months}

=1 year 10 months

If cash flows occur at the end of each year, project ABUWA will pay

back at the end of year 3 and project BRIWA will pay back at the end

of year 2.

(ii) Assuming that cash flows after Year 0 at a constant rate throughout

each year:

Pay Back Period + Initial Outlay / Annual Constant Cash Flow

PROJECT ABUWA

Cash flow after year 0 = N 200,000

Pay Back Period = N800,000 / N200,000 = 4 years

PROJECT BRIWA

Cash flow after year 0 = N600,000

Pay Back Period = N800,000 / N600,000

= 1.33 years

Assuming cash flows after Year 0 is at a constant rate throughout each year,

project ABUWA will pay back at the end of year 4 and project BRIWA will pay

back at the end of year 2.

(b) Project BRIWA should be selected as it has an earlier payback period

(c) Reason: Based on the company’s policy, the project with the earlier payback period is chosen. Project BRIWA achieves payback earlier, within 2 years, while Project ABUWA reaches payback at 3 years.

- Tags: Capital Budgeting, Cash Flows, Investment Appraisal, Payback Period

- Level: Level 1

- Topic: Investment Decisions

- Series: MAY 2021

- Uploader: Kwame Aikins