- 20 Marks

Question

The following projections relate to XYZ Automobiles Nigeria Limited.

| Month | Sales (N) | Purchases (N) | Wages (N) | Overheads (N) |

|---|---|---|---|---|

| November 2016 | 400,000 | 204,000 | 76,000 | 38,000 |

| December 2016 | 420,000 | 200,000 | 76,000 | 42,000 |

| January 2017 | 460,000 | 196,000 | 80,000 | 46,000 |

| February 2017 | 500,000 | 200,000 | 84,000 | 48,000 |

| March 2017 | 600,000 | 216,000 | 90,000 | 50,000 |

Additional information:

- Cash balance on January 1, 2017, is expected to be N80,000.

- A plant will be installed in November 2016 at a cost of N1,000,000 and the monthly installment of N50,000 is payable from January 2017.

- A sum of N30,000 will be paid as dividends in the month of March 2017.

- Company income tax of N45,000 will be due for payment in March 2017.

- Advance payment of N800,000 in respect of a sale of a truck will be received in March 2017.

- In line with the company’s policy, 50% of sales are on a cash basis. 50% of credit sales are collected in the month immediately following the month of sales while the balance is paid a month after the payment of the first installment.

- All purchases are on credit and the creditors are paid fully two months after the month of purchase.

- Wages and overheads are paid as and when due.

Required:

Prepare a cash budget for each of the THREE months ending March 31, 2017.

Answer

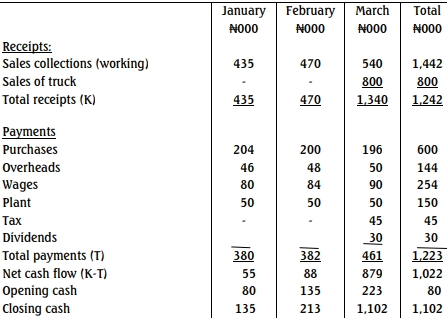

XYZ Automobiles Nigeria Ltd

Cash Budget for three months ending 31st

March, 2017

NB: The total column is not a requirement of the question, but has been inserted for

tutorials.

Cash Collection from Sales:

| Collections (N ‘000) | January | February | March |

|---|---|---|---|

| November | 100 | – | – |

| December | 105 | 105 | – |

| January | 230 | 115 | 115 |

| February | – | 250 | 125 |

| March | – | – | 300 |

| Total | 435 | 470 | 540 |

- Tags: Budget Preparation, Cash Budget, Cash Flow, Financial planning

- Level: Level 1

- Topic: Basics of Business Finance and Financial Markets

- Series: MAY 2017

- Uploader: Kwame Aikins