- 15 Marks

Question

As a senior official in a firm of tax consultants, your tax manager has just discussed issues relating to one of your clients.

The summary of the discussion is as follows:

Mr. Eket, a native of Oron who resides in Uyo, Akwa Ibom State, owned two properties, one in Kano and the other in Benin. The property in Kano was built at a cost of N23 million, while that in Benin was acquired at a cost of N19.5 million. In the year 2012, the property in Kano was sold by Mr. Eket for N32 million, with disposal expenses amounting to N2.80 million.

In the year 2014, Mr. Eket died, and the property in Benin was transferred to his wife, Emem, by the executor of his will. The market value of the properties in Kano and Benin were N28 million and N23 million, respectively.

In October 2016, the property in Benin was acquired by the Edo State Government for highway construction, and a compensation of N27 million was paid to Emem.

Required:

- (a) Determine the capital gains tax payable (if any).

(5 Marks) - (b) Determine the relevant tax authority to which the liability is due.

(5 Marks) - (c) Give reasons for the treatment in (a) and (b).

(5 Marks)

Answer

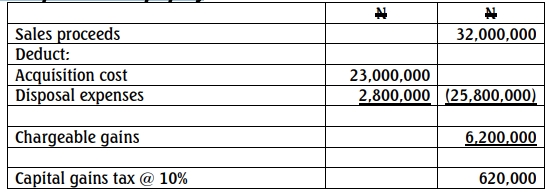

(a) Mr Eket

Computation of capital gains tax for 2012 year of assessment

Disposal of Kano property

Mr. Eket

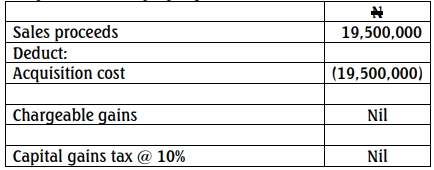

Computation of capital gains tax for 2014 year of assessment

Disposal of Benin property to Emem

Mr. Eket

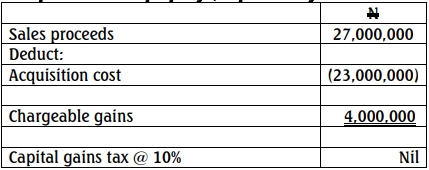

Computation of capital gains tax for 2014 year of assessment

Disposal of Benin property (Acquisition by the Edo State Government)

(b) The relevant tax authority to which the Capital Gains Tax (CGT) is payable for the property in Kano is Akwa Ibom State Internal Revenue Service, while that of Benin is also the same Revenue Service.

c. Reasons for the solutions in 5a & 5b

(i) Basis for determining the capital gains tax in (a) above:

The disposal of property in Kano by Eket is liable to capital gains tax at 10% of the chargeable gain because it is not established that the Kano property is a private residence of Mr. Eket. Therefore, the property is a chargeable asset liable to CGT in 2012 year of assessment on actual year basis. The disposal of Benin property to Emem is by way of gift, therefore the consideration must be such amount that is sufficient to secure the disposal. Therefore, neither gain nor a loss shall accrue to the executors for Eket‟s Will in 2014 year of assessment.

However, the disposal of Benin property to Edo State Government was through forced acquisition. Assets disposed due to compulsory or forceful acquisition are specifically exempted from capital gains tax, provided the owner has not taken any prior step to dispose such asset. The chargeable gain of N4 million on disposal of Benin property in 2016 YOA shall be exempted from CGT.

(ii) The relevant tax authority to which the capital gains tax is due is Akwa-Ibom State Internal Revenue Service. The reason is that Mr. Eket and Emem (Mrs Eket) are native of Akwa-Ibom State and reside in Oron, Akwa-Ibom State.

- Topic: Capital Gains Tax (CGT)

- Uploader: Kofi