- 20 Marks

Question

———————————————————————

Question:

As investors and policymakers adapt to the global energy transition in a bid to offer an effective hedge against swings in oil prices, the Federal Government has recognised that it is beneficial for the country to diversify its economy. The attention of the country is now towards the development of the solid minerals sector. The Nigeria Minerals and Mining Act 2007 (as amended) was enacted to regulate the industry. Incentives for operators in the sector are as provided for in Section 5 of the Act.

One of the earliest investors in the mining sector, Dutse Mines (Nigeria) Limited, was granted a mining title by the Mining Cadastre Office (MCO) for exploitation of limestone in Nkalagu in the south-eastern zone of Nigeria in 2008. In spite of so many challenges the company is facing, it has managed to remain afloat in business.

The company has, of recent, been having tax disputes with the relevant tax authority, and your firm of chartered accountants has been engaged to help resolve them. In the 2022 tax returns filed by the company, the major area of dispute between the company and the tax authority was disparity in the treatment of certified exploration and processing expenditure of ₦60,000,000 incurred during the course of the year.

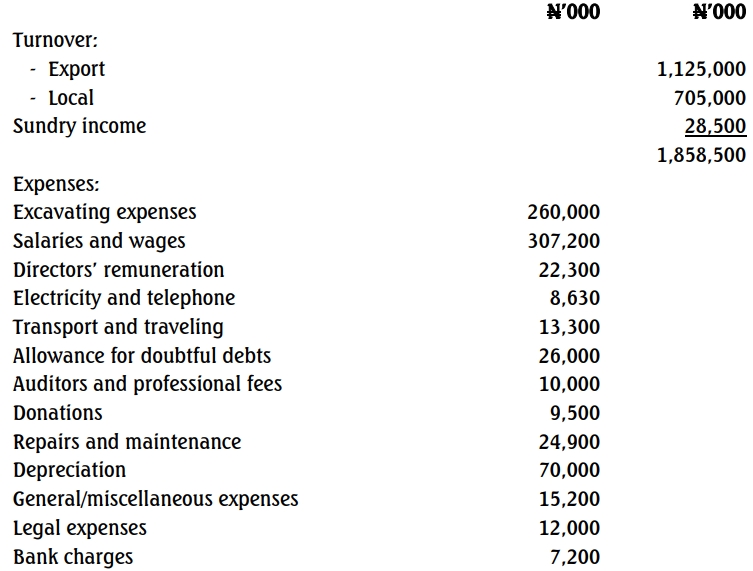

Your firm is provided with the following extracts (and supporting documents) from the books of the company for the year ended December 31, 2021:

Additional Information:

- Sundry income included ₦8,500,000 realised as profit from disposal of the old excavating machine.

- Allowance for doubtful debts consisted of:

- Bad debts written off: ₦2,500,000

- General allowance for doubtful debts: ₦10,500,000

- Specific allowance for doubtful debts: ₦8,000,000

- Loan to customer written off: ₦5,000,000

- Donation included ₦5,000,000 given to victims of environmental degradation, as part of the company’s social responsibility to the host community.

- Legal fees included ₦750,000 paid as a penalty for late filing of tax returns.

- The tax written down values of qualifying capital expenditure at the end of 2021 tax year were:

- Motor vehicles (2 years remaining): ₦25,000,000

- Furniture and fittings (utilised for 2 years): ₦22,500,000

- Mining expenditure (6 years remaining): ₦40,000,000

Required:

As the Manager (Tax Matters) assigned to handle this matter, you are to forward the report to your Senior Partner (Tax Matters) showing:

a. Computation of tax liabilities of the company for the relevant assessment year (14 Marks).

b. Comments on tax incentives available to a company in the mining of solid minerals in Nigeria (6 Marks).

Answer

Colamrud & Co (Chartered Accountants)

Lagos Road, Enugu

INTERNAL MEMO

Date: ……

From: Manager (Tax Matters)

To: Senior Partner (Tax Matters)

Subject: Dutse Mines (Nigeria) Limited

I refer to our client’s request on the determination of tax liability for the 2022 assessment year and advice on tax incentives for companies operating in the mining sector in Nigeria. I hereby present a report for your review before the same is presented to the client.

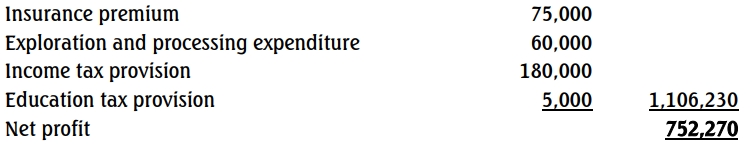

(a) Determination of Tax Liabilities

The Nigeria Minerals and Mining Act 2007 (as amended) treats exploration and processing expenditure costs as part of mining expenditure, for which capital allowances must be claimed. Hence, the treatment of the ₦60 million spent on exploration and processing as an item expensed during the accounting year is not in line with the provisions of the Act.

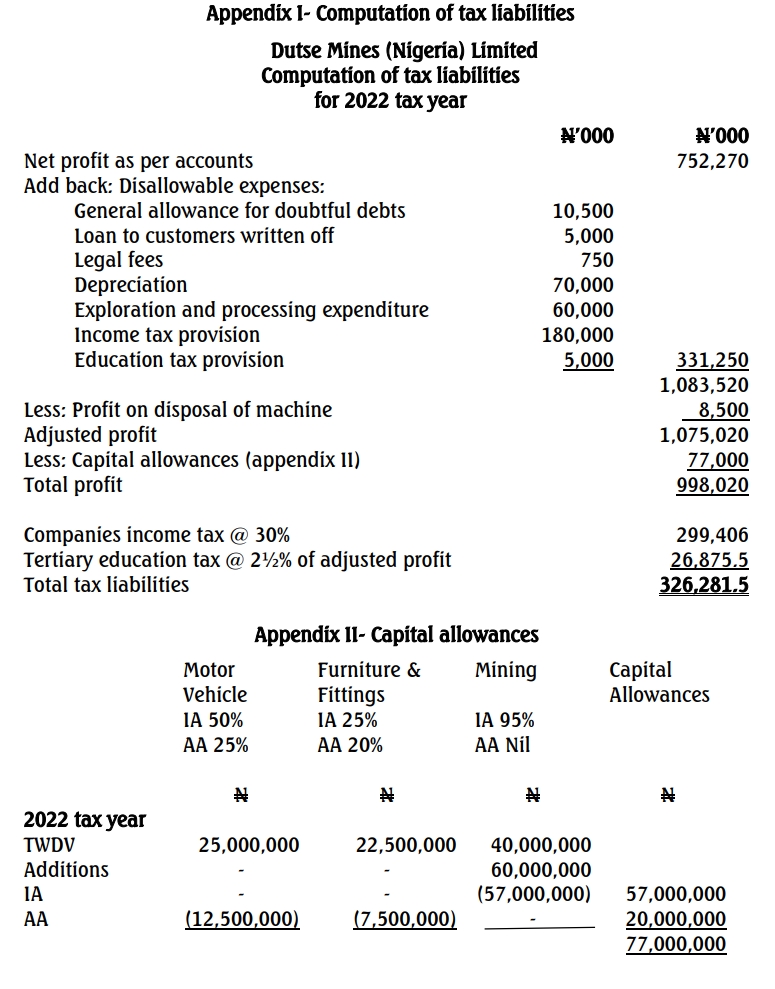

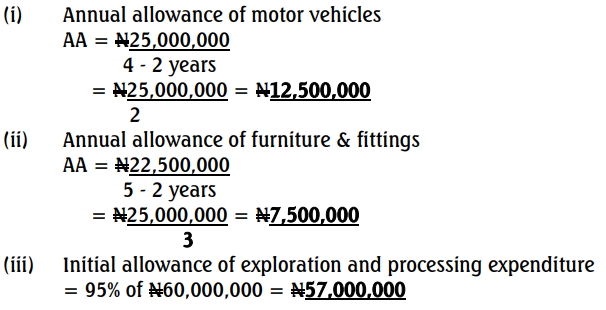

Based on the detailed result as presented in attached appendices I and II, the client made an adjusted profit of ₦1,075,020,000; entitled to claim capital allowances of ₦77,000,000, resulting in a total profit of ₦998,020,000.

- Companies income tax payable: ₦299,406,000.

- Tertiary education tax: ₦26,875,500.

Total Tax Liability: ₦326,281,500.

Solid Minerals Sector

(i) Tax holiday for an initial period of 3 years from the commencement of operations, renewable for an additional 2 years. Any dividends paid during the tax holiday period will not suffer withholding tax.

(ii) Exporters of mineral products may be permitted to retain part of their foreign exchange earnings in a domiciliary account for the purpose of acquiring spare parts and other mining inputs.

(iii) Exemption from customs and import duties in respect of plant, machinery, equipment, and accessories imported exclusively for mining operations. However, the plant and equipment can only be disposed of locally upon payment of the applicable customs and import duties.

(iv) Transferability of foreign currency through the CBN for the payment for servicing of certified loans and remittance of foreign capital in the event of sale or liquidation of the business.

(v) Grant of personal remittance quota for expatriate personnel, free from any tax imposed by any enactment for the transfer of external currency out of Nigeria.

(vi) Accelerated capital allowance on mining expenditure (95% initial allowance and retention of 5% until the asset is disposed of).

(vii) Grant of investment allowance of 10% on qualifying plant and machinery.

(viii) All infrastructure costs provided by the mining company and approved by the Mining Cadastre Office (MCO) to be capitalized and capital allowance claimed at 95% in the first year of operations.

(ix) An additional rural investment allowance on infrastructure cost, depending on the location of the company and the type of infrastructure provided.

(x) New entrants to the mining sector may apply to the Minister of Mines to enjoy annual indexation of unutilized capital allowance carried forward by 5%, which lapsed in 2012. Such applications, however, will be treated on a case-by-case basis.

(xi) The Minister may grant a concession for the royalty payable on any mineral to be deferred by a number of years, subject to the approval of the Federal Executive Council (FEC).

(xii) Actual amounts incurred out of reserves made for environmental protection, mine rehabilitation, reclamation, and mine closure costs shall be tax-deductible, subject to certification by an independent expert.

Additional Provisions Under CITA:

(xiii) The profits earned by a mining company after the initial tax holiday period may continue to be exempted from income tax under the following circumstances:

- If the minerals are exported from Nigeria and the proceeds from such exports are repatriated to Nigeria and used exclusively for the purchase of raw materials, plants, equipment, and spares.

- If the minerals produced are exclusive inputs for the manufacture of products for exports, provided the exporter gives a certificate of purchase of input to the company.

- Potential full or partial exemption of interest on foreign loans from income tax, subject to the conditions stipulated under CITA.

(xiv) With the implementation of the Finance Act 2019:

- Where a mining company makes a turnover of less than ₦25 million, no tax will be paid.

- Where turnover is between ₦25 million and less than ₦100 million, tax will be paid at 20%.

(xv) Any interest, rent, royalty, or dividend received by a Nigerian company from abroad and brought into the country through any of the approved Nigerian banks will be exempted from companies income tax.

(xvi) Interest and/or gains received from bonds issued by any government or corporate body in Nigeria, as well as from short-term securities issued by the Federal Government, are exempt from income tax. This exemption is only applicable until the 2022 financial year (2023 tax year). However, bonds issued by the Federal Government of Nigeria shall continue to enjoy this exemption.

(xvii) The company may be entitled to:

- Employment tax relief (lower of the gross emoluments paid to qualifying employees or 5% of the assessable profits for the year).

- Work experience acquisition programme relief (exempt income tax of 5% of the assessable profits).

- Infrastructure tax relief (20% of the public infrastructure provided).

Thank you.

Tomison Oyewole

Workings:

- Uploader: Kofi