- 20 Marks

Question

DD Nigeria Limited, a private limited liability company, was incorporated in March 2010. The company produces highly successful spring water. The Board of Directors of the company comprises a non-executive Chairman, his wife as the Managing Director, and the Chairman’s childhood friend. For the day-to-day running of the business, the Managing Director is being assisted by the Production Manager, Sales/Marketing Manager, Administrative Officer, and Accounting Officer (a diploma graduate).

The company has a track record of steady growth in profitability and market share. In a bid to cut down its cost of raw materials, particularly polythene, the Board at its recent meeting decided to acquire a polythene company in the neighborhood that is witnessing dwindling fortunes due to insufficient funds to finance its working capital. The Board has also lost confidence in the Accounting Officer as his poor knowledge in tax-related matters was brought to the fore during a recent visit to the company by officials of the Federal Inland Revenue Service.

The Managing Director has approached your firm of tax consultants to help provide professional advice on tax matters in respect of some transactions and activities that occurred in the last one year.

Records of the following transactions were made available to you:

(i) The company purchased plant and machinery at a cost of ₦5,000,000 on April 1, 2019. Plant was later disposed on September 15, 2019, for ₦3,500,000. The undisposed machinery was valued at ₦4,300,000. Incidental expenses incurred on disposal were ₦250,000.

(ii) The company sold an acre of land, which was acquired on May 22, 2018, at a cost of ₦6,750,000 for ₦12,500,000 on October 19, 2018. In the following month, the company bought another land, which was to be used for the purpose of the business, for ₦15,000,000 to replace the one sold. It was, however, subsequently disposed of for ₦18,000,000 in June 2019.

(iii) Part of the industrial building (where the production unit is located) was damaged in October 2020 during a protest by some youths in the area. The company, in November 2020, received ₦2,200,000 as compensation under a policy of insurance. The company has the intention of utilizing the fund for the acquisition of another building.

Required:

As the tax consultants to DD Nigeria Limited, draft a report to the Managing Director of the company explaining and providing computations (where necessary) on the:

a. Capital gains tax liability for the relevant tax year in respect to transaction (i). (5 Marks)

b. Relief available (if any) and tax liability due in respect to transaction (ii). (9 Marks)

c. Tax implications on the compensation under the policy of insurance received on the damaged industrial building. (2 Marks)

d. Treatment of gains arising from business reorganization in line with the provision of Section 49, Finance Act 2019, which amended Section 32, Capital Gains Tax Act Cap C1 LFN 2014. (4 Marks)

Answer

24 Abbey Plaza, Ikeja Lagos

April 10, 2021

The Managing Director

DD Nigeria Limited

Colmas Road, Alabata

Abeokuta

RE: CAPITAL GAINS TAX ON DISPOSAL OF CHARGEABLE ASSETS

I refer to your mail of April 5, 2021, requesting our advice on tax matters relating to the above subject matter. We wish to comment as follows:

(a) Disposal of Plant on September 15, 2019

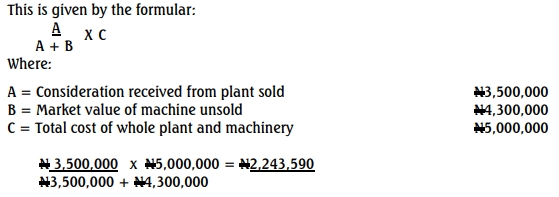

- This is a partial disposal of plant from the entire plant and machinery acquired for ₦5,000,000.

- The cost apportioned to the plant is ₦2,243,590, as per Appendix I.

- A chargeable gain of ₦1,006,410 arises, being the difference between the consideration received (₦3,500,000) and the apportioned cost.

- The chargeable gain is liable to Capital Gains Tax (CGT) at 10%, resulting in a tax liability of ₦100,641, as per Appendix II.

(b) Disposal of Land in May 2018 and June 2019

(i) Roll-Over Relief:

- A relief is available under CGT where the consideration received from the disposal of an asset is reinvested in acquiring another asset of the same class.

- The relief defers the CGT on the chargeable gain until the new asset is eventually disposed of.

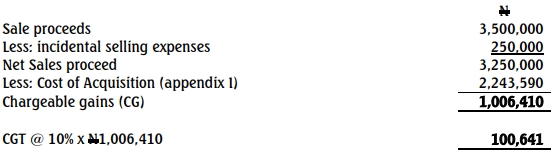

(ii) Disposal of Old Land:

- Sale price: ₦12,500,000

- Acquisition of new land for ₦15,000,000 qualifies for a full roll-over relief of ₦5,750,000 (Appendix III).

- The roll-over relief defers the CGT on the old land until the new land is disposed of.

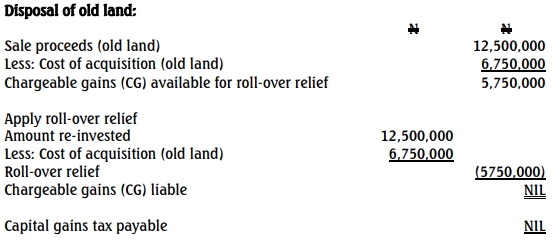

(iii) Cost of New Land:

- The carrying cost of the new land is ₦9,250,000 (₦15,000,000 original cost less ₦5,750,000 chargeable gain rolled over).

(iv) Capital Gains Tax:

- There is no CGT payable on the old land due to the roll-over relief.

- CGT of ₦875,000 is due on the disposal of the new land in the 2019 Year of Assessment as per Appendix IV.

(c) Tax Implication on Compensation Received for Damaged Industrial Building

- Where an asset is lost or destroyed, and the compensation is utilized within three years to purchase a replacement, roll-over relief is available.

- The ₦2,200,000 received as compensation under the insurance policy is deemed as consideration from the disposal of the old building.

- The company’s intention to utilize the compensation to acquire a new building qualifies for roll-over relief if the new building is acquired within three years of the disposal.

(d) Treatment of Gains Arising from Business Reorganization (S.49, Finance Act 2019)

- Gains from asset transfers in related-party business reorganizations are exempt from CGT if the minimum holding test is met.

Minimum Holding Test:

- The acquired company must be a member of the group for at least 365 days prior to the transaction.

- The acquiring company must hold the transferred assets for at least 365 days after the transaction.

- If the conditions are not met, the exemption is withdrawn.

Attached appendices (I-IV) provide detailed computations. Please reach out if further clarification is required.

Yours faithfully,

Sunny Kajooo

Principal Partner

APPENDIX I: Cost of acquisition for plant disposed

APPENDIX II: Computation of CGT for 2019 year of assessment

APPENDIX III: Computation of CGT for 2018 year of assessment

APPENDIX IV: Computation of CGT for 2019 year of assessment

- Topic: Capital Gains Tax (CGT)

- Uploader: Kofi