- 20 Marks

Question

The quest for economic development in every sector of the country has enabled the Federal Government to come up with various tax incentives, especially for pioneer companies.

Nature Agricultural Products Limited, a medium-sized company, was incorporated on January 10, 2015, as a manufacturer of animal feeds. The company thereafter applied for a pioneer status and was granted a pioneer certificate with a production day of March 1, 2015.

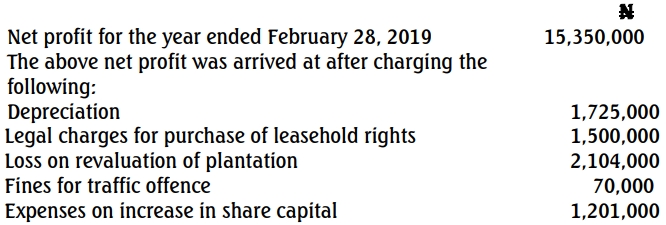

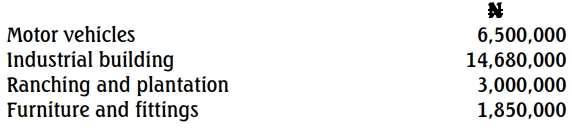

The following details were provided in respect of the business operations of the company:

(i)

(ii.) Capital expenditure incurred on or before February 28, 2018:

(iii) Accumulated profit as at February 28, 2018= N3,968,000

The management of the company did not apply for extension of the pioneer period.

Required:

a. Compute the adjusted profit for the relevant years. (3 Marks)

b. Compute the tax liabilities for the relevant assessment years. (17 Marks)

Answer

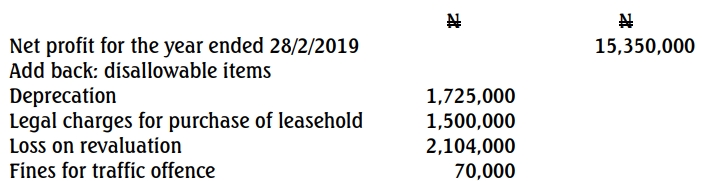

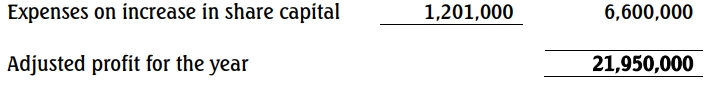

(a) Nature Agricultural Products Limited

Computation of adjusted profit

For the year ended February 28, 2019

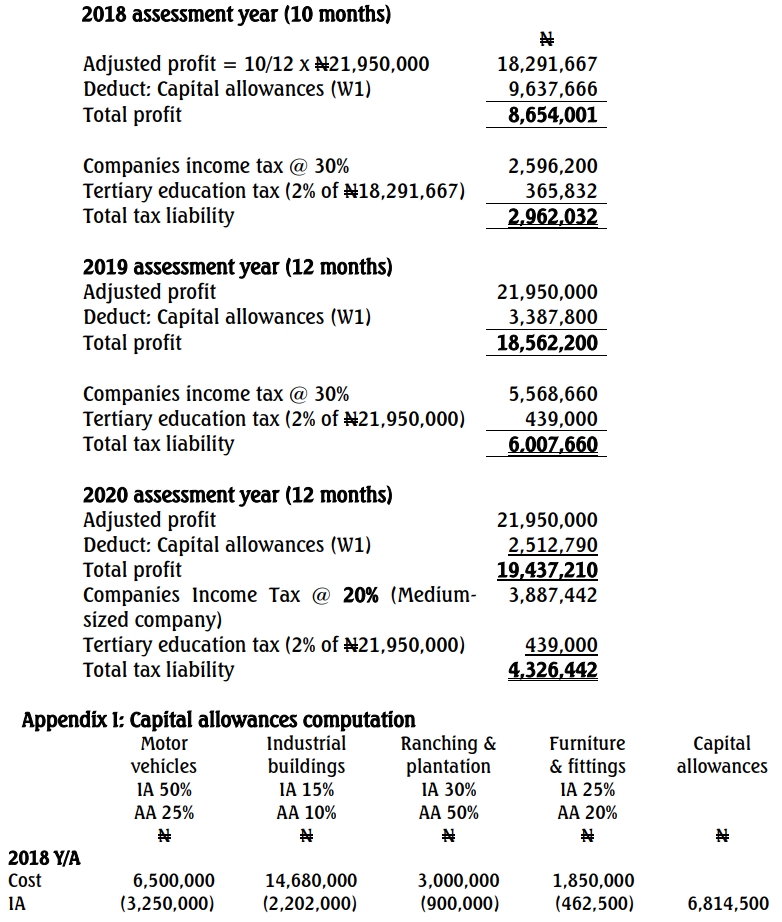

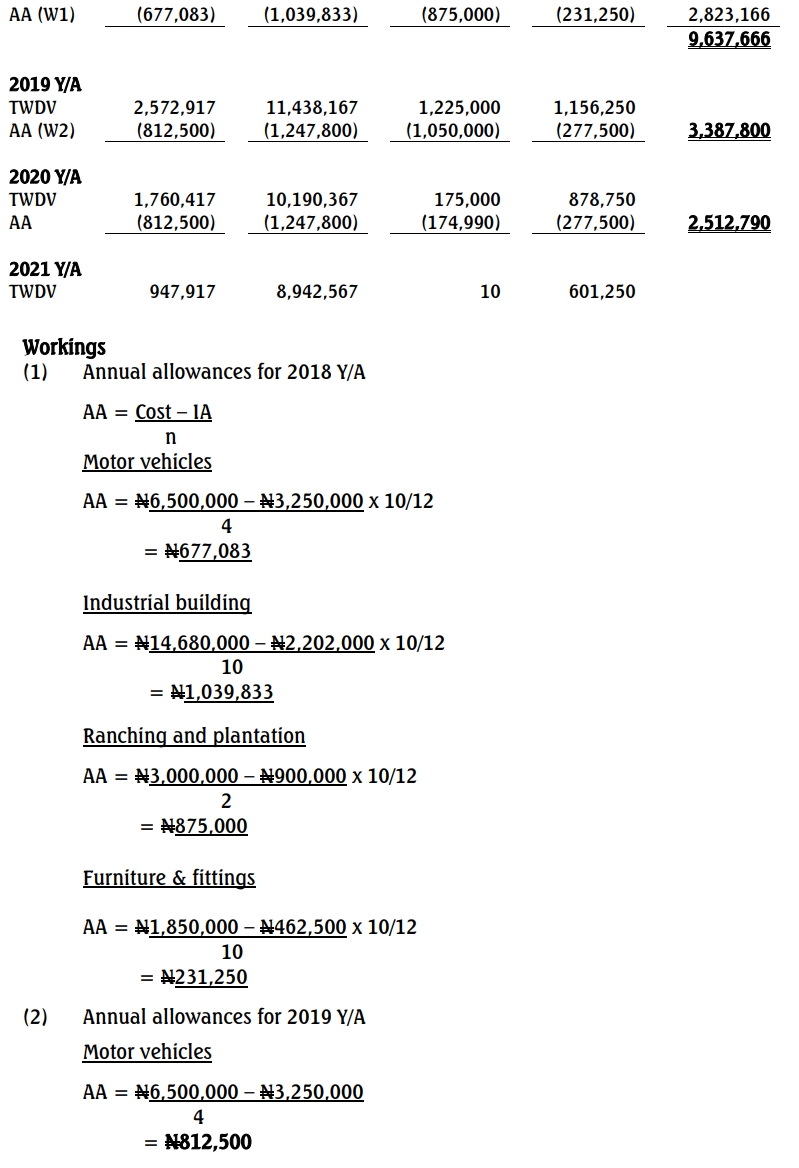

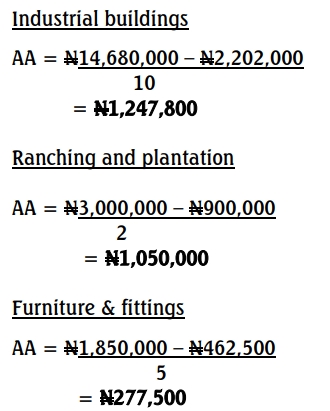

(b) Nature Agricultural Products Limited

Computation of income tax liabilities

For 2018, 2019 and 2020 assessment years

- Tags: Adjusted Profit, Pioneer Companies, Tax computation, Tax Incentives

- Level: Level 3

- Topic: Tax Incentives and Reliefs

- Uploader: Kofi