- 18 Marks

Question

Smaposu Nigeria Limited is based in Ibadan, Oyo State, and is involved in the manufacturing of computer accessories. The company undertook the following transactions during the year ended December 31, 2018:

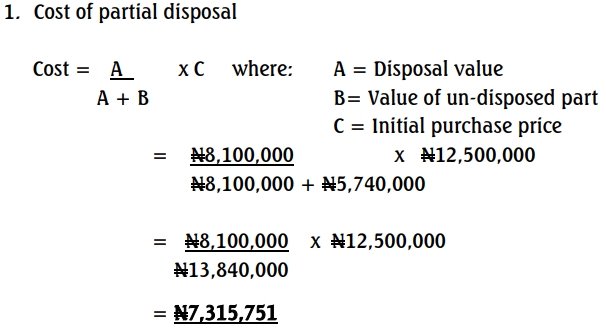

(i) Plant and machinery: Part of the plant and machinery was purchased in the year 2014 at an all-inclusive price of ₦12,500,000. A machinery was sold for ₦8,100,000, and the value of the undisposed part was ₦5,740,000. Selling expenses incurred amounted to ₦150,000.

(ii) Motor vehicle: A motor vehicle, which was acquired in 2016 for ₦3,000,000 for the purpose of the business, was sold to the company’s general manager for ₦2,900,000. The market value of the car as at the point of disposal was ₦3,500,000. The company re-acquired a similar car for ₦3,500,000.

(iii) As a result of an unfavorable business climate in Ibadan, the company relocated to Ikeja, Lagos State. The land and buildings acquired in Ibadan in 2009 for ₦30,000,000 were sold for ₦65,500,000. The cost of valuation and professional fees incurred on disposal was ₦2,000,000. A reinvestment was made in Ikeja through the acquisition of another landed property valued at ₦50,000,000.

Smaposu Nigeria Limited has just appointed your firm as the company’s tax consultant.

You are required to advise the management on:

i. “Deemed” disposal of an asset. (5 Marks)

ii. The capital gains (if any) arising from these transactions. (6 Marks)

iii. The roll-over relief (if any) on re-investment made on the acquisition of new assets by the company. (4 Marks)

iv. Capital gains tax payable. (3 Marks)

Answer

ABC & CO (CHARTERED ACCOUNTANTS)

15, Ojulobun St, Ikeja

P.O. Box 50, Ikeja

Date: ………

The Managing Director

Smaposu Nigeria Limited

Ikeja, Lagos State

Dear Sir,

Re: ADVICE ON CAPITAL GAINS TAX ON VARIOUS ASSETS DISPOSED DURING THE YEAR ENDED DECEMBER 31, 2018

Your letter dated February 15, 2019, in respect of the above subject matter, refers.

We have carefully considered the details provided in the documents, and after reviewing the relevant provisions of the Capital Gains Tax Act Cap C1 LFN 2004 (as amended), we present our findings and advice as follows:

(i) Deemed Disposal of an Asset

A “deemed” disposal of an asset occurs under certain conditions as defined in Section 8 of the Capital Gains Tax Act. Specifically, when there is the death of the original owner of the asset, the asset is deemed to be disposed of by the deceased at the time of death. The asset is then treated as being acquired by the personal representatives or any other person to whom the asset devolves, for a consideration equal to:

- (a) The amount of consideration for which the asset was last disposed of by way of a bargain made at arm’s length (if ascertainable), or

- (b) In any other case, the market value of the asset at the time of death (Section 8(1)).

Gains arising from deemed disposal at market value, as described in (b), shall not be liable to Capital Gains Tax (Section 2 CGT Act).

(ii) Capital Gains from Transactions

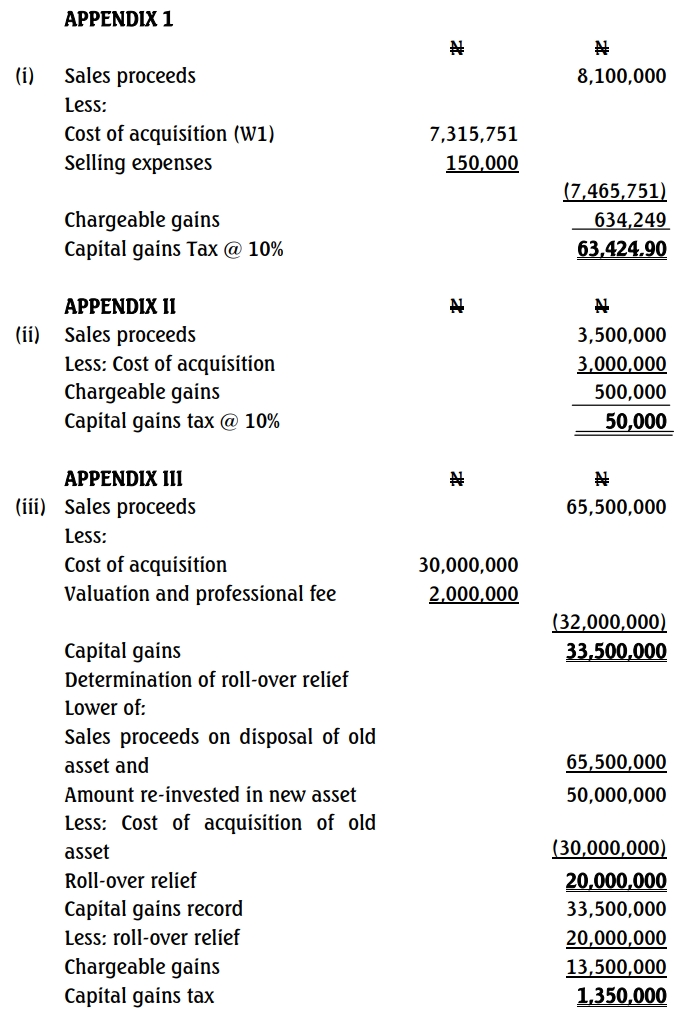

- Plant and Machinery: With respect to the machinery (which forms part of plant and machinery) disposed of, the chargeable gains are ₦634,249, and the Capital Gains Tax payable is ₦63,424.90. There is no roll-over relief to be claimed because a re-investment in new plant was not made. Please see Appendix I for further details of the computation.

- Motor Vehicle: The motor vehicle (Camry 2010 model) was sold to the company’s general manager for ₦2,900,000, while the market value was ₦3,500,000. Since this transaction was made between related parties, it is not considered an arm’s length transaction. According to the tax authority’s practice, the market value is used to calculate the capital gain rather than the actual sale price. Therefore, the capital gain on the motor vehicle is ₦500,000, and the capital gains tax payable is ₦50,000.

Although the company spent ₦3,500,000 to acquire a similar motor vehicle, no roll-over relief is available because motor vehicles are not classified as chargeable assets under the Capital Gains Tax Act Cap C1 LFN 2004 (as amended). Please refer to Appendix II for detailed analysis.

- Land and Building Sale in Ibadan: The company sold land and buildings in Ibadan, originally acquired for ₦30,000,000, for ₦65,500,000, resulting in a capital gain of ₦35,500,000. The cost of valuation and professional fees incurred on the disposal was ₦2,000,000. The company made a re-investment of ₦50,000,000 in a new property in Ikeja.

For this transaction, partial roll-over relief of ₦20,000,000 applies as a result of the acquisition of the new land and buildings in Ikeja. Therefore, the capital gains tax payable is ₦1,350,000, which arises from a capital gain of ₦13,500,000 (after applying the roll-over relief). Please see Appendix III for detailed computations.

(iii) Roll-Over Relief on Re-investment in Motor Vehicle

There is no roll-over relief available on the re-investment made in the motor vehicle because motor vehicles are not considered eligible assets for roll-over relief under the Capital Gains Tax Act Cap C1 LFN 2004 (as amended). Additionally, the amount re-invested (₦2,900,000) is less than the cost of the original motor vehicle (₦3,000,000), which further disqualifies the transaction from roll-over relief.

Conclusion

- Capital Gains Tax is payable on the disposal of the motor vehicle and land and buildings, with specific calculations provided for each asset.

- No roll-over relief is applicable for the motor vehicle transaction, and partial relief is available for the land and building sale.

Should you require further clarification or additional information, we would be happy to assist.

Yours faithfully,

For: ABC & Co.

(Chartered Accountants)

O.B.T.

Workings

- Tags: Asset Disposal, Business Relocation, Capital gains tax, Deemed Disposal, Roll-Over Relief

- Level: Level 3

- Topic: Capital Gains Tax (CGT)

- Uploader: Kofi