- 20 Marks

Question

Question:

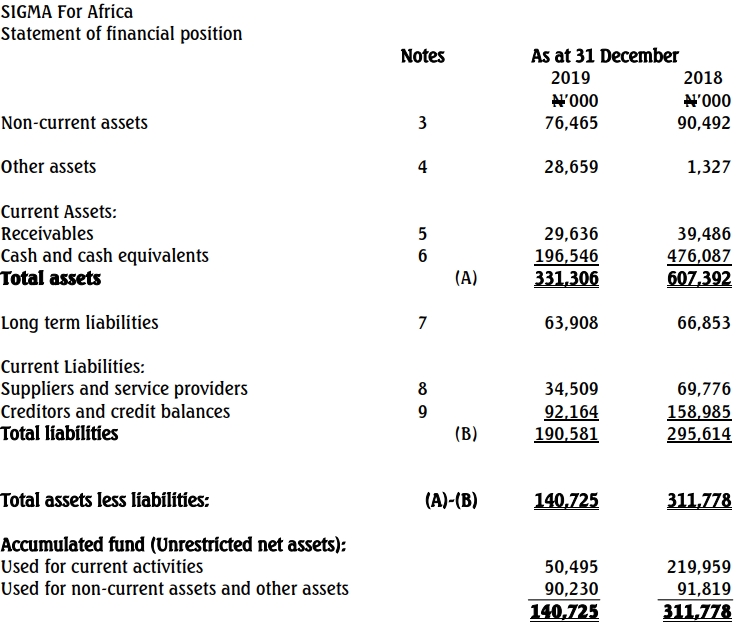

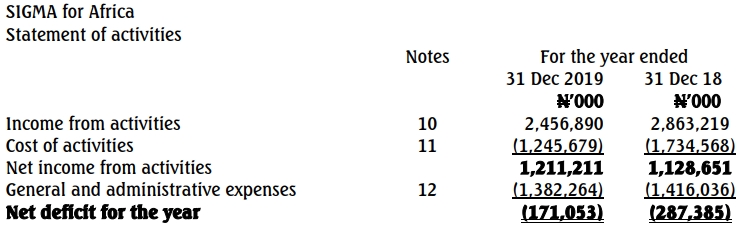

You are the Audit Manager at HWO, an audit firm. HWO has secured the audit of SIGMA For Africa, a not-for-profit organization. You have been assigned the audit of SIGMA For Africa. An extract of the unaudited financial statements is as follows:

SIGMA For Africa Statement of Financial Position

As at 31 December

Furthermore, you were assigned an audit senior. Based on preliminary discussions with your audit senior, you noted that the senior had no prior experience with audits of not-for-profit entities.

Required:

To help your audit senior understand how to audit a not-for-profit organization, prepare a presentation note summarizing the key considerations in the audit for the following areas:

a. Planning (4 Marks)

b. Risk analysis (4 Marks)

c. Internal control (4 Marks)

d. Audit evidence (4 Marks)

e. Reporting (4 Marks)

Answer

1a. Planning: Key considerations for planning the audit of a not-for-profit organization include:

- The objectives and scope of the audit work.

- Any applicable local regulations governing the organization.

- Understanding the organization’s operational environment.

- The form and content requirements for financial statements and the audit opinion.

- Identification of key audit areas and related risks.

1b. Risk Analysis: Important aspects of risk analysis for a not-for-profit organization:

- Inherent risk: Nature of the entity’s activities and the associated environment.

- Control risk: Assessment of internal controls, especially cash handling, as not-for-profits often deal with cash collections and may rely on volunteers.

- Detection risk: Risk that material misstatements may not be identified due to reliance on substantive testing over controls, especially if controls are weak.

1c. Internal Control: Essential internal controls to consider in a not-for-profit audit:

- Segregation of duties, which may be challenging in smaller organizations with limited staff.

- Cash controls for safeguarding funds.

- Controls over income streams (e.g., donations, grants) to ensure completeness.

- Ensuring that funds are used exclusively for authorized purposes.

1d. Audit Evidence: Gathering audit evidence in a not-for-profit organization focuses on:

- Completeness of transaction records, assets, and liabilities.

- Verifying there is no misuse of funds.

- Using analytical procedures to validate reported figures.

- Reviewing final financial statements for appropriate accounting policies and consistency.

1e. Reporting: Key points in reporting for a not-for-profit audit:

- If legally required, use a standard external audit report.

- If the audit is voluntary, customize the report to reflect the audit’s specific objectives.

- Follow ISA 700’s structure, including title, addressee, auditor’s responsibilities, basis for opinion, audit opinion, and if applicable, emphasis of matter on going concern.

- Uploader: Kofi