- 20 Marks

Question

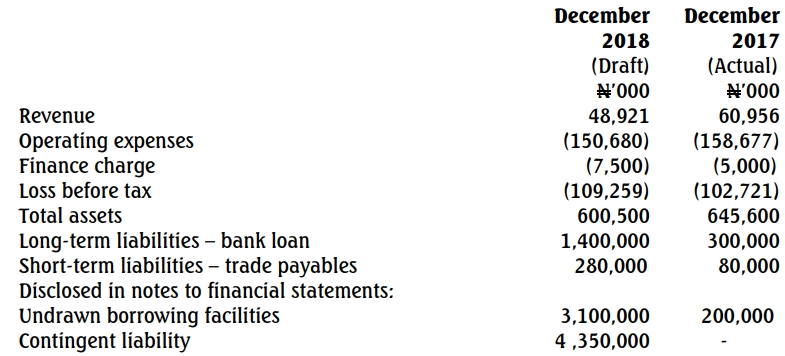

Wazobia Nigeria Limited is a manufacturer of corrugated zinc roofs. Due to the economic recession, revenue continued to decline each year for the past three years. You are aware that the company had only N300,000 in cash at the year end. Extracts from the draft financial statements and other relevant information are given below.

Additional information:

(i) The bank loan was obtained in 2016 when the company started recording losses. The collateral for the loan is a fixed and floating charge on the assets of the company to the tune of the loan balance. The first tranche of repayment of the loan is due in 2019 and the amount repayable is N300 million.

(ii) Wazobia renegotiated its credit line with a major supplier and extended payment terms from 60 days to 90 days in order to improve working capital.

(iii) The terms for accessing the undrawn facilities stipulate that the company must meet certain covenants, including that interest cover is maintained at 2:1 and the ratio of bank loan to total assets does not exceed 1:1.

(iv) The contingent liability relates to litigation against the company by one of its customers for an alleged breach of contract to supply roofing sheets based on agreed specifications.

Required:

(a) Identify and explain the matters which may cast significant doubt on the company’s ability to continue as a going concern in the foreseeable future. (10 Marks)

(b) Recommend the appropriate audit procedures to be performed to adequately address the going concern matters identified. (10 Marks)

Answer

Part (a): Matters That May Cast Significant Doubt on Wazobia’s Ability to Continue as a Going Concern

Several factors raise concerns regarding Wazobia Nigeria Limited’s ability to continue as a going concern:

- Declining Revenue and Losses:

- Revenue has been steadily declining over the past three years, dropping from N60.96 million in 2017 to N48.92 million in 2018. The company has also reported consistent losses before tax (N102.72 million in 2017 and N109.26 million in 2018). Persistent losses are a strong indicator of financial stress and may jeopardize the company’s ability to generate enough cash flow to meet its obligations in the future.

- Insufficient Cash Reserves:

- The company only had N300,000 in cash at year-end, which is insufficient to meet its operational needs or liabilities, especially given the N300 million repayment due on the bank loan in 2019. The company’s liquidity is under significant pressure, which raises concerns about its ability to meet short-term obligations.

- Bank Loan Repayment and Financial Covenants:

- The company has a substantial bank loan of N1.4 billion with a repayment of N300 million due in 2019. Given its financial performance and liquidity challenges, it is uncertain whether Wazobia will be able to make this repayment. The company also faces compliance risks related to covenants tied to the loan, such as the interest cover and the ratio of bank loan to total assets (which must not exceed 1:1). If the company fails to meet these covenants, it could trigger default or penalty provisions.

- Contingent Liability from Litigation:

- Wazobia has a significant contingent liability (N4.35 billion) related to ongoing litigation, which could result in a financial outflow if the company loses the case. This contingency adds further uncertainty to the company’s financial stability and could adversely impact its ability to continue as a going concern.

- Working Capital Issues:

- The company has renegotiated its payment terms with suppliers (from 60 to 90 days), indicating that it is struggling to maintain sufficient working capital. Extending payment terms could be seen as a temporary relief, but it may not be sustainable in the long term, particularly if the company’s cash flow remains weak.

- Undrawn Borrowing Facilities:

- While the company has access to significant undrawn borrowing facilities (N3.1 billion in 2018), these facilities are subject to certain conditions, including meeting the financial covenants. If the company is unable to meet the covenants, it may not be able to access these funds, further limiting its ability to continue operations.

Part (b): Recommended Audit Procedures to Address Going Concern Matters

The following audit procedures are recommended to address the identified going concern issues:

- Assess the Company’s Cash Flow Projections:

- Review and evaluate the company’s cash flow projections for the next 12 months. This includes verifying the assumptions behind the projections (e.g., revenue growth, cost controls, collection of receivables) and determining whether the company will have sufficient liquidity to meet its obligations.

- Evaluate Debt Repayment Plans:

- Review the company’s plans for repaying the N300 million bank loan due in 2019. This includes discussions with management about their ability to restructure or refinance the loan, as well as exploring potential alternatives such as negotiating for more favorable repayment terms.

- Examine the Terms of the Undrawn Borrowing Facilities:

- Investigate the terms and conditions of the undrawn borrowing facilities, including the covenant requirements. Verify whether the company is likely to comply with these covenants, particularly the interest cover and loan-to-assets ratio, and assess the impact of potential breaches on the company’s ability to access these funds.

- Obtain Legal Confirmation Regarding the Contingent Liability:

- Obtain confirmation from the company’s legal advisors regarding the status and potential outcome of the contingent liability (litigation). This will help assess the likelihood of a financial outflow and the potential impact on the company’s financial position.

- Perform a Detailed Review of the Company’s Financial Health:

- Review the company’s financial ratios, including liquidity ratios, profitability, and solvency, to assess its overall financial health. This will provide further insight into the company’s ability to continue operations in the short and long term.

- Evaluate Management’s Plan to Address Financial Difficulties:

- Discuss with management their plans for improving profitability, reducing operating expenses, and generating additional revenue. Determine whether these plans are realistic and achievable in the current economic climate.

- Review Auditor’s Work on Financial Statements:

- Review the previous auditors’ work (if applicable) for any issues related to going concern and assess whether the necessary disclosures have been made in the financial statements regarding the going concern assumption.

- Consider the Adequacy of Going Concern Disclosures:

- Ensure that the financial statements include appropriate disclosures regarding the going concern assumption, including any uncertainties that may cast doubt on the company’s ability to continue operations. If there are significant uncertainties, these should be disclosed in accordance with auditing and accounting standards.

- Engage with Management’s External Advisors:

- Obtain external confirmations from financial advisors or restructuring experts regarding any planned or proposed solutions to address the company’s liquidity or solvency issues, including refinancing or asset sales.

- Monitor Post-Year-End Events:

- Review post-year-end events that may affect the company’s going concern status, including any material changes in financial performance or business operations, to ensure that the going concern assumption remains appropriate.

- Tags: Audit Procedures, Bank Loan, Contingent Liabilities, Financial Stress, Going Concern

- Level: Level 3

- Uploader: Kofi