- 20 Marks

Question

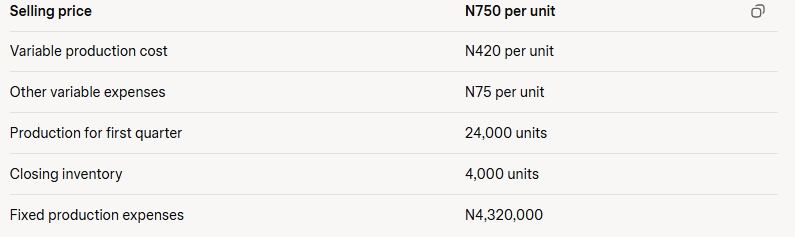

In the first quarter of the year, the following data was given in respect of a product.

Required: i. Prepare the statement of profit or loss using both absorption and marginal costing bases in a columnar format. ii. Reconcile the profits in (i) above.

Answer

i. Statement of Profit or Loss

| Description | Absorption Costing (₦) | Marginal Costing (₦) |

|---|---|---|

| Sales | 15,000,000 | 15,000,000 |

| Variable production cost | 10,080,000 | 10,080,000 |

| Other variable expenses | 1,800,000 | 1,800,000 |

| Fixed production expenses | 4,320,000 | – |

| 16,200,000 | 11,880,000 | |

| Less: closing inventory | (2,700,000) | (1,980,000) |

| Cost of sales / Variable cost | 13,500,000 | 9,900,000 |

| Gross profit / Contribution | 1,500,000 | 5,100,000 |

| Less: Fixed Production Expenses | – | 4,320,000 |

| Net Profit | 1,500,000 | 780,000 |

Workings Closing inventory: Absorption basis 4,000 x (420 + (4,320,000/24,000) +75) = 4,000 x 675 = ₦2,700,000

Marginal basis 4,000 x (420 + 75) = ₦1,980,000

ii. Reconciliation of Profits

| Description | ₦ |

|---|---|

| Profit as per absorption basis | 1,500,000 |

| Fixed cost included in closing inventory (2,700,000 – 1,980,000) | (720,000) |

| Profit as per marginal basis | 780,000 |

- Topic: Costing Techniques

- Series: Nov 2024

- Uploader: Salamat Hamid